It’s simple to mock Democrats like Joe Biden, Alexandria Ocasio-Cortez, and Bernie Sanders. One reason they’re easy targets is they want people to believe that America can finance a European-style welfare state with higher taxes on the rich.

That’s nonsensical. Simply stated, there are not enough rich people and they don’t earn enough money (and they have relatively easy ways of protecting themselves if their tax rates are increased).

Some folks on the left admit this is true. I’ve shared many examples of big-government proponents who openly acknowledge that lower-income and middle-class people will need to be pillaged as well.

- The editors at the New York Times endorsed higher taxes on the middle class in 2010.

- The then-House Majority Leader Steny Hoyer also gave a green light that year to higher taxes on the middle class.

- In 2012, MIT professor and former IMF official Simon Johnson argued that the middle class should pay more tax.

- The Washington Post also called for higher taxes on the middle class a few years ago, as did Vice President Joe Biden’s former economist.

- A New York Times columnist also called for broad-based tax hikes on the middle class in 2012.

- A Senior Fellow from Demos also argued for higher taxes on all Americans that year, specifically targeting the middle class.

- In 2013, the New York Times again editorialized in favor of higher tax burdens on the middle class.

- In 2017, two UCLA law professors endorsed big tax increases on ordinary people.

- Also that year, a columnist for US News & World Report urged higher taxes on middle-income people.

- In 2019, an out-of-the-closet socialist admitted a big welfare state requires big tax hikes on lower-income and middle-class people.

- Last year, two leftists opined in the Washington Post that ordinary people need to pay much higher taxes to finance bigger government.

I disagree with these people on policy, but I applaud them for being straight shooters. They get membership in my “Honest Leftists” club.

And we have a new member of that group.

Catherine Rampell opines in the Washington Post that President Biden should openly embrace tax increases on everybody.

President Biden is trying to address…big, thorny problems…with one hand tied behind his back. Yet he’s the one who tied it, with a pledge to bankroll every solution solely by soaking the rich. …Some have compared Biden’s efforts to Franklin D. Roosevelt’s New Deal, Lyndon B. Johnson’s Great Society or other ambitious endeavors of the pre-Reagan era — when government was more commonly seen as a solution rather than the problem. …Like many Democrats before him, Biden has promised to pay for government expansions by raising taxes only on corporations and the “rich,” everyone else spared. Exactly who counts as “rich” is an ever-shrinking sliver of the population. Barack Obama defined it as households making $250,000 or more a year; now, Biden says it’s anyone making $400,000 or more. …more than 95 percent of Americans are excluded from helping to foot the bill… But…there aren’t enough ultrarich people and megacorporations out there to fund the massive new economic investments and social services Democrats say they want… Democrats sometimes point to Sweden or Denmark as examples of generous, successful welfare states. But in those countries, taxes are higher and broader-based. Here, the middle class pays much lower taxes… Here’s the argument I wish Biden would make: These new spending projects are worth doing. …we should all be financially invested in their success, at least a little. Taxation is the price we pay for a civilized society, as Supreme Court Justice Oliver Wendell Holmes Jr. put it. …If Biden wants to permanently transform the role of government, that may need to be his trajectory.

Needless to say, I fundamentally disagree with Ms. Rampell’s support for an even bigger welfare state, regardless of which taxpayers are being pillaged.

But at least she wants to pay for it and knows that means the IRS reaching into all of our pockets. And kudos to her for acknowledging the high tax burdens on lower-income and middle-class people in nations such as Sweden and Denmark.

Though I can’t resist commenting on the quote (“Taxation is the price we pay for a civilized society”) from Oliver Wendell Holmes.

People on the left love to cite that sentence, but they conveniently never explain that Holmes reportedly made that statement in 1904, nine years before there was an income tax, and then again in 1927, when federal taxes amounted to only $4 billion and the federal government consumed only about 5 percent of economic output.

As I wrote in 2013, “I’ll gladly pay for that amount of civilization.”

Let’s close with a couple of tweets that underscore how Democrats are pushing for giant spending increases, well beyond what can be financed by confiscating more money from the rich.

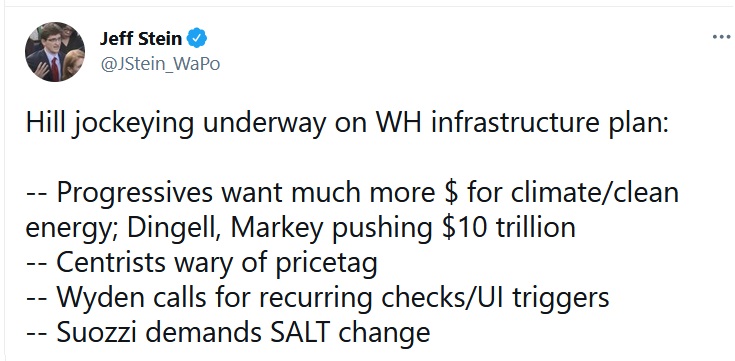

First, a reporter from the Washington Post lists some of the insanely expensive spending schemes being pushed on Capitol Hill.

I assume the “recurring checks” is a reference to the new per-child handouts in Biden’s so-called American Rescue Plan.

And “SALT change” refers to restoring the state and local tax deduction, which is supported by many Democrats from high-tax states even though (or perhaps because) it is a huge tax break for the rich.

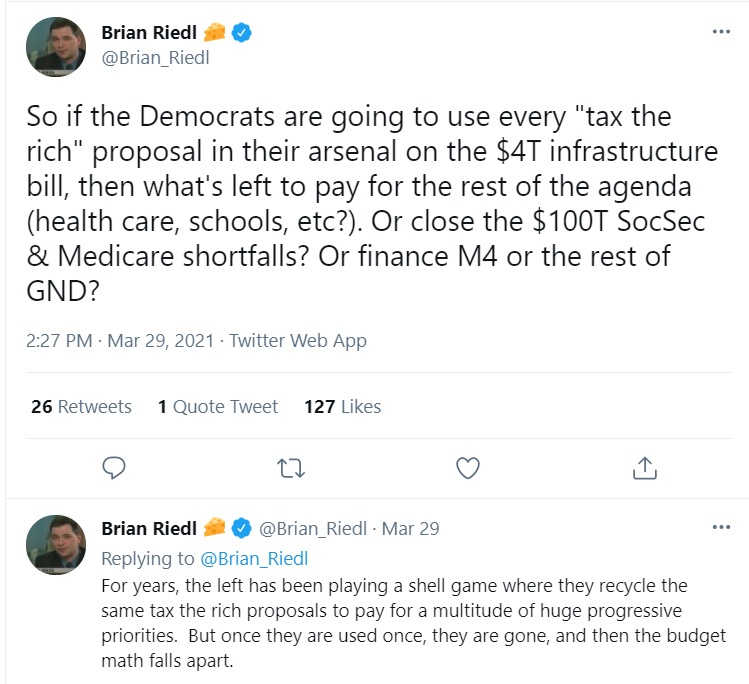

Next we have a couple of tweets from Brian Riedl of the Manhattan Institute. He correctly points out that Democrats are using just about every available class-warfare tax scheme, yet that money will only finance a fraction of their spending wish list.

Brian is right.

What tax increases (on the rich) will be left when the left want to push their “green new deal“? Or the “public option” for Medicare? Or any of the other spending schemes circulating in Washington.

The bottom line is that – sooner or later – politicians will follow Ms. Rampell’s advice and squeeze you and me.

P.S. It’s not a good idea to turn America into a European-style welfare state – unless the goal is much lower living standards.