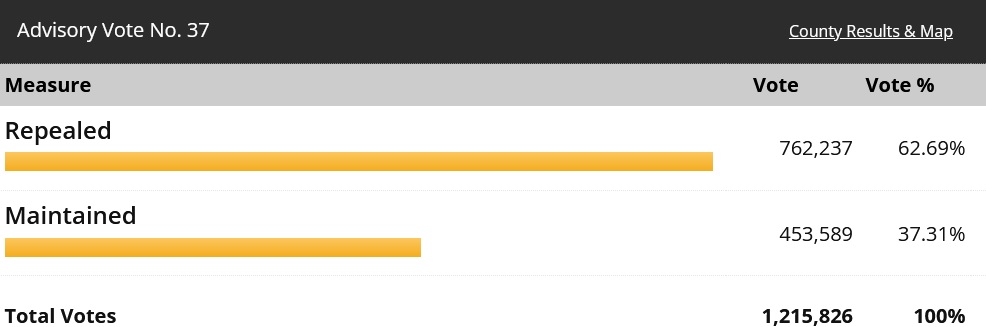

Immediately after election day in early November, I applauded voters in the (very blue) state of Washington. They wisely expressed their opposition to a plan by state politicians to impose a capital gains tax.

And it wasn’t even close. Voters said no by a landslide margin in a state that went heavily for Biden.

Today, we’re going to look at more good news from a statewide initiative.

Voters in Louisiana last Saturday had a chance to vote for some pro-growth tax reform. And, as reported by KPVI, they made a wise choice.

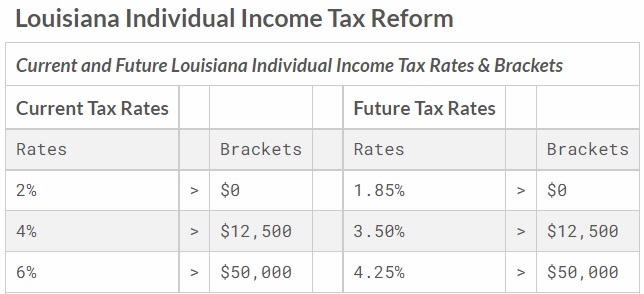

Louisiana voters approved a constitutional amendment that decreases the maximum individual income tax rate from 6% to 4.75% beginning next year. …fifty-four percent of voters agreed to Amendment 2, which affects taxpayers making more than $50,000 and couples making more than $100,000 annually. …The free market Pelican Institute also supported Amendment 2. “For too long Louisiana has been lagging behind our neighbors, but the people of Louisiana voted to start our comeback story by passing amendment 2 to simplify our tax code and lower our income tax rates to the lowest in the Southeast of states that levy the tax,” Pelican Institute CEO Daniel Erspamer said in a statement.

The good news gets even better.

Voters imposed a cap on income tax rates, with a maximum of 4.75 percent.

But the legislature is putting the rate down to 4.25, as noted by the Tax Foundation.

Let’s close by looking at some excerpts from an editorial by the Wall Street Journal.

…voters on Saturday approved a constitutional amendment that will reduce corporate and individual income tax rates while simplifying the code. …The tax reform, approved with 54% of the vote, eliminates the deductibility for federal taxes while reducing the top income tax rate on individuals making more than $50,000 to 4.25% from 6%. Rates will also decline for lower earners. The current five corporate tax brackets would be consolidated into three with the top rate falling to 7.5% from 8%. Most Louisianans will get a small net tax cut, and the implementing legislation includes triggers that would reduce rates more if revenues meet growth goals.

For what it’s worth, allowing state deductibility of federal taxes is almost as misguided as federal deductibility of state and local taxes.

So Louisiana voters opted for a win-win situation of lower rates and getting rid of a loophole.

P.S. In a payoff to their wealthy constituents (and to make life easier for profligate governors, state lawmakers, and local officials), Democrats in Congress are pushing to re-create a big deduction for state and local tax payments.

———

Image credit: Kārlis Dambrāns | CC BY 2.0.