As an economist, I strongly oppose the wealth tax (as well as other forms of double taxation) because it’s foolish to impose additional layers of tax that penalize saving and investment.

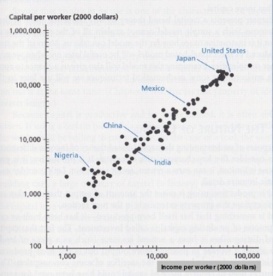

Especially since there’s such a strong relationship between investment and worker compensation.

The politicians may tell us they’re going to “soak the rich,” but the rest of us wind up getting wet.

That being said, there are also administrative reasons why wealth taxation is a fool’s game. One of them, which I mentioned as part of a recent tax debate, is the immense headache of trying to measure wealth every single year.

Yes, that’s not difficult if someone has assets such as stock in General Motors or Amazon. Bureaucrats from the IRS can simply go to a financial website and check the value for any given day.

But the value of many assets is very subjective (patents, royalties, art, heirlooms, etc), and that will create a never-ending source of conflict between taxpayers and the IRS if that awful levy is ever imposed.

Let’s look at a recent dispute involving another form of destructive double taxation. The New York Times has an interesting story about a costly dispute involving the death tax to be imposed on Michael Jackson’s family.

Michael Jackson died in 2009… But there was another matter that has taken more than seven years to litigate: Jackson’s tax bill with the Internal Revenue Service, in which the government and the estate held vastly different views about what Jackson’s name and likeness were worth when he died. The I.R.S. thought they were worth $161 million. …Judge Mark V. Holmes of United States Tax Court ruled that Jackson’s name and likeness were worth $4.2 million, rejecting many of the I.R.S.’s arguments. The decision will significantly lower the estate’s tax burden… In a statement, John Branca and John McClain, co-executors of the Jackson estate, called the decision “a huge, unambiguous victory for Michael Jackson’s children.”

I’m glad the kids won this battle.

Michael Jackson paid tax when he first earned his money. Those earnings shouldn’t be taxed again simply because he died.

But the point I want to focus on today is that a wealth tax would require these kinds of fights every single year.

Given all the lawyers and accountants this will require, that goes well beyond adding insult to injury. Lots of time and money will need to be spent in order to (hopefully) protect households from a confiscatory tax that should never exist.

P.S. The potential administrative nightmare of wealth taxation, along with Biden’s proposal to tax unrealized capital gains at death, help to explain why the White House is proposing to turbo-charge the IRS’s budget with an additional $80 billion.