After Barack Obama took office (and especially after he was reelected), there was a big uptick in the number of rich people who chose to emigrate from the United States.

There are many reasons wealthy people choose to move from one nation to another, but Obama’s embrace of class-warfare tax policy (including FATCA) was seen as a big factor.

Joe Biden’s tax agenda is significantly more punitive than Obama’s, so we may see something similar happen if he wins the 2020 election.

Given the economic importance of innovators, entrepreneurs, and inventors, this would be not be good news for the American economy.

The New York Times reported late last year that the United States could be shooting itself in the foot by discouraging wealthy residents.

…a different group of Americans say they are considering leaving — people of both parties who would be hit by the wealth tax… Wealthy Americans often leave high-tax states like New York and California for lower-tax ones like Florida and Texas. But renouncing citizenship is a far more permanent, costly and complicated proposition.

…“America’s the most attractive destination for capital, entrepreneurs and people wanting to get a great education,” said Reaz H. Jafri, a partner and head of the immigration practice at Withers, an international law firm. “But in today’s world, when you have other economic centers of excellence — like Singapore, Switzerland and London — people don’t view the U.S. as the only place to be.” …now, the price may be right to leave. While the cost of expatriating varies depending on a person’s assets, the wealthiest are betting that if a Democrat wins…, leaving now means a lower exit tax. …The wealthy who are considering renouncing their citizenship fear a wealth tax less than the possibility that the tax on capital gains could be raised to the ordinary income tax rate, effectively doubling what a wealthy person would pay… When Eduardo Saverin, a founder of Facebook…renounced his United States citizenship shortly before the social network went public, …several estimates said that renouncing his citizenship…saved him $700 million in taxes.

The migratory habits of rich people make a difference in the global economy.

Here are some excerpts from a 2017 Bloomberg story.

Australia is luring increasing numbers of global millionaires, helping make it one of the fastest growing wealthy nations in the world… Over the past decade, total wealth held in Australia

has risen by 85 percent compared to 30 percent in the U.S. and 28 percent in the U.K… As a result, the average Australian is now significantly wealthier than the average American or Briton. …Given its relatively small population, Australia also makes an appearance on a list of average wealth per person. This one is, however, dominated by small tax havens.

Here’s one of the charts from the story.

As you can see, Australia is doing very well, though the small tax havens like Monaco are world leaders.

I’m mystified, however, that the Cayman Islands isn’t listed.

But I’m digressing.

Let’s get back to our main topic. It’s worth noting that even Greece is seeking to attract rich foreigners.

The new tax law is aimed at attracting fresh revenues into the country’s state coffers – mainly from foreigners as well as Greeks who are taxed abroad – by relocating their tax domicile to Greece, as it tries to woo “high-net-worth individuals” to the Greek tax register.

The non-dom model provides for revenues obtained abroad to be taxed at a flat amount… Having these foreigners stay in Greece for at least 183 days a year, as the law requires, will also entail expenditure on accommodation and everyday costs that will be added to the Greek economy. …most eligible foreigners will be able to considerably lighten their tax burden if they relocate to Greece…nevertheless, the amount of 500,000 euros’ worth of investment in Greece required of foreigners and the annual flat tax of 100,000 euros demanded (plus 20,000 euros per family member) may keep many of them away.

The system is too restrictive, but it will make the beleaguered nation an attractive destination for some rich people. After all, they don’t even have to pay a flat tax, just a flat fee.

Italy has enjoyed some success with a similar regime to entice millionaires.

Last but not least, an article published last year has some fascinating details on the where rich people move and why they move.

The world’s wealthiest people are also the most mobile. High net worth individuals (HNWIs) – persons with wealth over US$1 million – may decide to pick up and move for a number of reasons. In some cases they are attracted by jurisdictions with more favorable tax laws…

Unlike the middle class, wealthy citizens have the means to pick up and leave when things start to sideways in their home country. An uptick in HNWI migration from a country can often be a signal of negative economic or societal factors influencing a country. …Time-honored locations – such as Switzerland and the Cayman Islands – continue to attract the world’s wealthy, but no country is experiencing HNWI inflows quite like Australia. …The country has a robust economy, and is perceived as being a safe place to raise a family. Even better, Australia has no inheritance tax

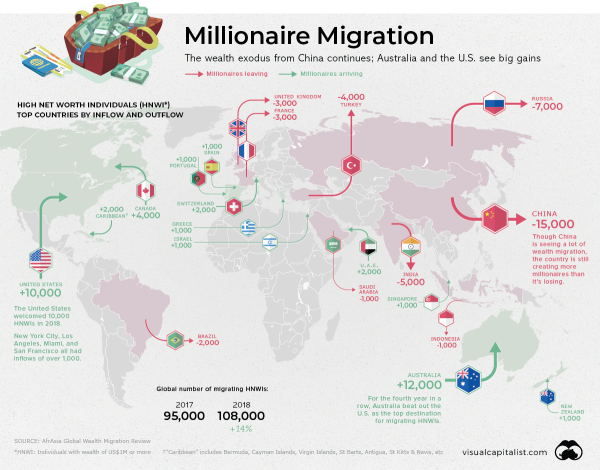

Here’s a map from the article.

The good news is that the United States is attracting more millionaires than it’s losing (perhaps because of the EB-5 program).

The bad news is that this ratio could flip after the election. Indeed, it may already be happening even though recent data on expatriation paints a rosy picture.

The bottom line is that the United States should be competing to attract millionaires, not repel them. Assuming, of course, politicians care about jobs and prosperity for the rest of the population.

P.S. American politicians, copying laws normally imposed by the world’s most loathsome regimes, have imposed an “exit tax” so they can grab extra cash from rich people who choose to become citizens elsewhere.

P.P.S. I’ve argued that Australia is a good place to emigrate even for those of us who aren’t rich.

———

Image credit: Pixnio | Public Domain.