In Part I of this series, I expressed some optimism that Joe Biden would not aggressively push his class-warfare tax plan, particularly since Republicans almost certainly will wind up controlling the Senate.

But the main goal of that column was to explain that the internal revenue code already is heavily weighted against investors, entrepreneurs, business owners and other upper-income taxpayers.

And to underscore that point, I shared two charts from Brian Riedl’s chartbook to show that the “rich” are now paying a much larger share of the tax burden – notwithstanding the Reagan tax cuts, Bush tax cuts, and Trump tax cuts – than they were 40 years ago.

Not only that, but the United States has a tax system that is more “progressive” than all other developed nations (all of whom also impose heavy tax burdens on upper-income taxpayers, but differ from the United States in that they also pillage lower-income and middle-class residents).

In other words, Biden’s class-warfare tax plan is bad policy.

Today’s column, by contrast, will point out that his tax increases are impractical. Simply stated, they won’t collect much revenue because people change their behavior when incentives to earn and report income are altered.

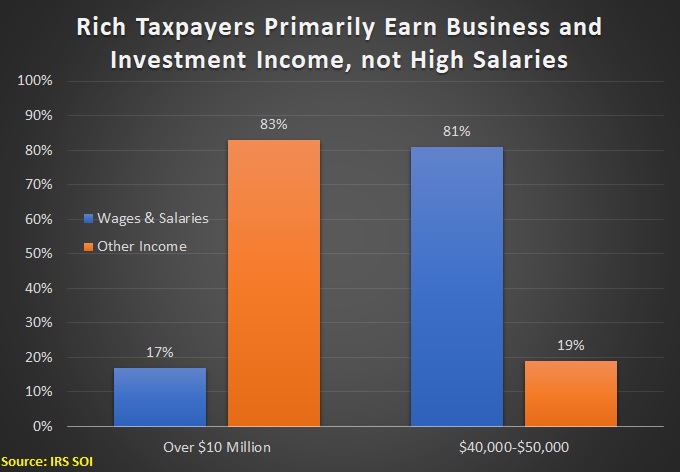

This is especially true when looking at upper-income taxpayers who – compared to the rest of us – have much greater ability to change the timing, level, and composition of their income.

This is especially true when looking at upper-income taxpayers who – compared to the rest of us – have much greater ability to change the timing, level, and composition of their income.

This helps to explain why rich people paid five times as much tax to the IRS during the 1980s when Reagan slashed the top tax rate from 70 percent to 28 percent.

When writing about this topic, I normally use the Laffer Curve to help people understand why simplistic assumptions about tax policy are wrong (that you can double tax revenue by doubling tax rates, for instance). And I point out that even folks way on the left, such as Paul Krugman, agree with this common-sense view (though it’s also worth noting that some people on the right discredit the concept by making silly assertions that “all tax cuts pay for themselves”).

But instead of showing the curve again, I want to go back to Brian Riedl’s chartbook and review his data on of revenue changes during the eight years of the Obama Administration.

It shows that Obama technically cut taxes by $822 billion (as further explained in the postscript, most of that occurred when some of the Bush tax cuts were made permanent by the “fiscal cliff” deal in 2012) and raised taxes by $1.32 trillion (most of that occurred as a result of the Obamacare legislation).

If we do the math, that means Obama imposed a cumulative net tax increase of about $510 billion during his eight years in office

But, if you look at the red bar on the chart, you’ll see that the government didn’t wind up with more money because of what the number crunchers refer to as “economic and technical reestimates.”

Indeed, those reestimates resulted in more than $3.1 trillion of lost revenue during the Obama years.

I don’t want the politicians and bureaucrats in Washington to have more tax revenue, but I obviously don’t like it when tax revenues shrink simply because the economy is stagnant and people have less taxable income.

Yet that’s precisely what we got during the Obama years.

To be sure, it would be inaccurate to assert that revenues declined solely because of Obama’s tax increase. There were many other bad policies that also contributed to taxable income falling short of projections.

Heck, maybe there was simply some bad luck as well.

But even if we add lots of caveats, the inescapable conclusion is that it’s not a good idea to adopt policies – such as class-warfare tax rates – that discourage people from earning and reporting taxable income.

The bottom line is that we should hope Biden’s proposed tax increases die a quick death.

P.S. The “fiscal cliff” was the term used to describe the scheduled expiration of the 2001 and 2003 Bush tax cuts. According to the way budget data is measured in Washington, extending some of those provisions counted as a tax cut even though the practical impact was to protect people from a tax increase.

P.P.S. Even though Biden absurdly asserted that paying higher taxes is “patriotic,” it’s worth pointing out that he engaged in very aggressive tax avoidance to protect his family’s money.