Yesterday, I shared some research showing how misguided redistribution policies lead to high implicit marginal tax rates that discourage work.

Then I was interviewed about a very tangible example of this phenomenon – jobless benefits that give people more money than they could earn by working.

I wrote about this specific issue in late April and shared the nearby chart to show how many people can get a lot more money if they simply choose not to work. Which is the economic equivalent of a marginal tax rate of more than 100 percent.

As I noted in yesterday’s interview, creating this kind of upside-down incentive system is crazy even by the bizarre standards of Washington policy.

The federal government is – for all intents and purposes – bribing people not to work. This will be especially harmful for low-income workers since steady employment is their best route for upward mobility.

Part of the interview focused on the Keynesian argument that unemployment benefits are “stimulus” because recipients will have more money to spend. This is not satire. I mentioned that Nancy Pelosi actually asserted the economy becomes stronger when people are paid not to work.

Needless to say, this simplistic argument overlooks the fact that government can’t give people goodies without taking the money out of the private economy in the first place.

Sadly, the perpetual motion machine of Keynesian economics is still part of the Congressional Budget Office’s methodology. Here are some excerpts from the CBO’s report on the issue of super-charged benefits.

CBO has examined the economic effects of extending the temporary increase of $600 per week in the benefit amount provided by unemployment programs. …CBO estimates that extending that increase for six months through January 31, 2021, would have the following effects:

…Roughly five of every six recipients would receive benefits that exceeded the weekly amounts they could expect to earn from work during those six months. …The estimated effects on output and employment are the net results of two opposing factors. An extension of the additional benefits would boost the overall demand for goods and services, which would tend to increase output and employment. That extension would also weaken incentives to work as people compared the benefits available during unemployment to their potential earnings, and those weakened incentives would in turn tend to decrease output and employment.

Since I’ve already written many times about the flaws of Keynesian theory, let’s focus on the deleterious effect of government-subsidized unemployment.

In a column two days ago for the Wall Street Journal, Congressman James Comer of Kentucky explained how super-charged benefits have hurt his state’s economy.

Employers in Kentucky are finding it difficult to persuade employees to return to work, as nearly 40% of the state’s labor force has filed for unemployment benefits… It is clear that a system of excessive unemployment benefits has run its course.

More than 60 of my colleagues in Congress plan to join me in sending a letter to House and Senate leadership to express our concerns and demand that these payments expire July 31, as the Cares Act intended. …It defies logic to extend disincentives to work when businesses are beginning to reopen. …efforts to spend the nation into oblivion and discourage Americans from working…are fundamentally opposed to the American spirit of the dignity of work. …to get back on the right track, we cannot extend the $600-a-week incentive not to return to work.

I applaud Rep. Comer.

It’s not popular to remove goodies from voters. Indeed, that’s the message of my Second Theorem of Government.

But it’s necessary if we want to restore incentives to work.

I’ll close by elaborating on the point I made in the interview about this battle being a repeat of the Obama-era fight about extended unemployment benefits.

Obama and other folks on the left said extended benefits were necessary because the unemployment rate was still high, while people like me argued that the jobless rate was still high precisely because the government was paying people not to work.

Extended benefits were finally halted in 2014, meaning we had a real-world test to see who was right. So what happened? Lo and behold, the jobless rate fell as more people went back to work.

The moral of the story, as illustrated by this satirical cartoon strip, is that people are more likely to work when the benefits of having a job and greater than the benefits of not having a job.

P.S. Here are a couple of anecdotes, one from Ohio and one from Michigan, about the perverse impact of excessive unemployment benefits during the last recession.

———

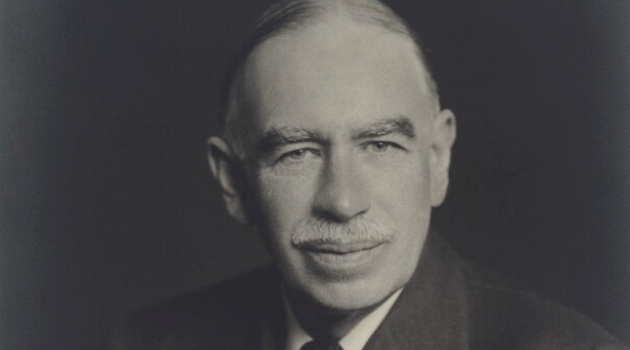

Image credit: National Portrait Gallery | CC BY-NC-ND 3.0.