Largely because of my support for jurisdictional competition, I’m a big fan of federalism.

Simply stated, our liberties are better protected when there’s decentralization since politicians are less like to over-tax and over-spend when they know  potential victims of plunder have the option of moving across a border.

potential victims of plunder have the option of moving across a border.

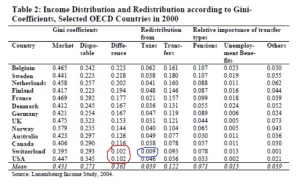

Indeed, I cited some academic research back in 2012 which showed that there as less economy-weakening redistribution in nations with genuine federalism (see, for instance, how Vermont politicians were forced to backtrack when they try to impose government-run healthcare).

Now let’s look at some additional scholarly evidence. A study published by the OECD, authored by Hansjörg Blöchliger, Balázs Égert and Kaja Fredriksen, investigates the impact of federalism on outcomes in developed nations.

Here are the key findings from the abstract.

This paper presents empirical research on the potential effects of fiscal decentralisation on a set of outcomes such as GDP, productivity, public investment and school performance. The results can be summarised as follows: decentralisation, as measured by revenue or spending shares, is positively associated with GDP per capita levels.

The impact seems to be stronger for revenue decentralisation than for spending decentralisation. Decentralisation is strongly and positively associated with educational outcomes as measured by international student assessments (PISA). While educational functions can be delegated either to sub-central governments (SCG) or to schools, the results suggest that both strategies appear to be equally beneficial for educational performance. Finally, investment in physical and – especially – human capital as a share of general government spending is significantly higher in more decentralised countries.

Here’s some detail from the body of the paper about the pro-growth impact of decentralization (especially when sub-national governments are responsible for raising their own funds).

Across countries, sub-central fiscal power, as measured by revenue or spending shares, is positively associated with economic activity. Doubling sub-central tax or spending shares (e.g. increasing the ratio of sub-central to general government tax revenue from 6 to 12%) is associated with a GDP per capita increase of around 3%. …Revenue decentralisation appears to be more strongly related with income gains than spending decentralisation. This empirical finding may reflect that “true” fiscal autonomy is better captured by the sub-central revenue share, as a large part of sub-central spending may be mandated or regulated by central government. … the estimated relationship never becomes negative and is not hump-shaped, i.e. “more decentralisation always tends to be better”.

The part of “more decentralisation always tends to be better” is a good result.

But it’s also a sad result since the United States has moved in the wrong direction in recent decades.

Though we’re still less centralized than most nations, as you can see from this chart from the OECD study.

Kudos to Canada and Switzerland for leading the world in federalism.

Here are some additional details from the study. I’m especially interested to see that the authors acknowledge how jurisdictional competition helps to explain why nations with federalism perform better.

Decentralised fiscal frameworks can raise TFP through an increase in the efficiency and productivity of the public sector… Public sector productivity is influenced by competition between SCGs and inter-jurisdictional mobility. Most SCGs aim at attracting and retaining mobile production factors, in order to promote investment and economic activity. They can do so by using fiscal policy, among other instruments. Since firms are choosing their location based on where they expect the highest returns on investment, and since returns depend (partly) on public inputs, SCGs have an incentive to raise the productivity of their public sector. SCGs may also try to improve the relationship between taxation and public service levels, by lowering taxes… The more decentralised a country, the stronger these competitive forces could be. Competition and inter-jurisdictional mobility could be weakened by large intergovernmental transfer systems, in particular fiscal equalisation.

As a aside, it’s rather ironic that that the professional economists at the OECD produce rigorous studies (here’s another one) showing the benefits of jurisdictional competition while the political appointees push for anti-growth policies such as tax harmonization.

Let’s close by looking at the study’s estimates of how nations would enjoy more prosperity by shifting in the direction of decentralization.

…an assessment of what a country might gain in terms of higher GDP if it moved to the benchmark of the most decentralised country. To be more specific, the gains were calculated for each federal country if it moved tax decentralisation to the level of Canada, and for each unitary country if it moved tax decentralisation to the level of Sweden (Figure 6). Further decentralisation could potentially be associated with an average increase of GDP of around 1% to 2% for federal countries and 3% to 4% for unitary countries, with values for more centralised countries being larger.

Here’s the accompanying chart.

Since the U.S. still has some federalism, our gain isn’t very large, but nations such as Austria, Belgium, Slovakia, Ireland, Luxembourg, and the United Kingdom could get big boosts.

P.S. I didn’t focus on the findings about better educational outcomes in decentralized nations. But I can’t resist pointing out that this is an additional reason to abolish the Department of Education.

P.P.S. Here’s a video discussing how Switzerland benefits from federalism.

P.P.P.S. And here’s what scholars from the Austrian school of economics wrote about federalism.