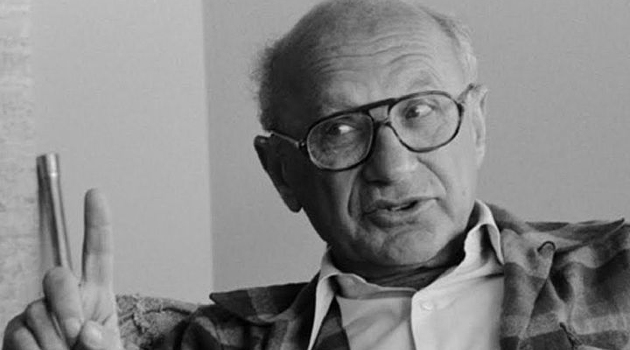

Yesterday’s column featured some of Milton Friedman’s wisdom from 50 years ago on how a high level of societal capital (work ethic, spirit of self-reliance, etc) is needed if we want to limit government.

Today, let’s look at what he said back then about that era’s high tax rates.

His core argument is that high marginal tax rates are self-defeating because the affected taxpayers (like Trump and Biden) will change their behavior to protect themselves from being pillaged.

This was in the pre-Reagan era, when the top federal tax rate was 70 percent, and notice that Friedman made a Laffer Curve-type prediction that a flat tax of 19 percent would collect more revenue than the so-called progressive system.

We actually don’t know if that specific prediction would have been accurate, but we do know that Reagan successfully lowered the top tax rate on the rich from 70 percent in 1980 to 28 percent in 1988.

So, by looking at what happened to tax revenues from these taxpayers, we can get a pretty good idea whether Friedman’s prediction was correct.

Well, here’s the IRS data from 1980 and 1988 for taxpayers impacted by the highest tax rate. I’ve circled (in red) the relevant data showing how we got more rich people, more taxable income, and more tax revenue.

The bottom line is that Friedman was right.

Good tax policy (i.e., lower rates on productive behavior) can be a win-win situation. Taxpayers earn more and keep more, while politicians also wind up with more because the economic pie expands.

Something to keep in mind since some politicians in Washington want a return to confiscatory taxes on work, saving, investment, and entrepreneurship.