In my humble opinion, Ronald Reagan was the only president in my lifetime who deserves praise for both believing in liberty and delivering good results.

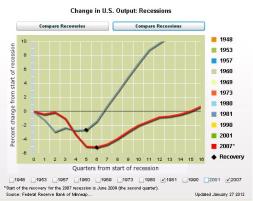

His sound policies help to explain why the economy boomed after his policies were implemented, which is in stark contrast to the economy’s anemic performance during the Obama years.

His sound policies help to explain why the economy boomed after his policies were implemented, which is in stark contrast to the economy’s anemic performance during the Obama years.

There’s really no comparison between the two.

But not everyone appreciates Reagan’s accomplishments.

In his recent newsletter, Paul Krugman of the New York Times asserts that the Gipper’s economic record doesn’t merit praise.

…the legend of the Reagan economy…plays an outsized role in conservative economic doctrine to this day. …the core of modern conservative economic doctrine is the assertion that cutting taxes, especially on the wealthy, does wonderful things for the economy. And they hold up Reagan’s economic record as proof of that doctrine’s truth. …The truth is that Reagan doesn’t deserve blame for the 1981-2 recession — but he doesn’t deserve credit for the subsequent recovery, either. Instead, it was all about the Federal Reserve. …tax-cutting conservatives have been falsely claiming credit for that growth ever since.

I give Krugman credit for realizing that it would be preposterous to blame Reagan for the 1981-82 recession (I don’t know if Krugman understands that the downturn was baked into the cake by the Carter-era inflation, but he probably knows that it began before Reagan’s tax cut was even enacted, much less implemented).

But he then makes two mistakes, neither of which is trivial.

First, Krugman overlooks all of Reagan’s other accomplishments. Not only the impact of the tax cuts and tax reform, but also the spending restraint and deregulation.

First, Krugman overlooks all of Reagan’s other accomplishments. Not only the impact of the tax cuts and tax reform, but also the spending restraint and deregulation.

Second, he wants to give all the credit to the Federal Reserve, yet central banks, while ostensibly independent, don’t operate in a vacuum. One of Reagan’s great accomplishments – as recognized by unbiased establishment types – was to support the temporarily painful shift to a non-inflationary monetary policy.

Krugman raises several additional points in his newsletter.

Since 1990 claims that tax cuts will generate huge booms — and that tax hikes will lead to disaster — have belly-flopped again and again. President Bill Clinton’s tax increases in 1993 didn’t cause the recession just about everyone on the right predicted; President George W. Bush’s tax cuts didn’t produce a “Bush boom.” The Trump tax cut didn’t deliver anything like the promised results. In 2011 Gov. Sam Brownback of Kansas cut taxes sharply, promising that this would lead to a surge in growth. It didn’t. At the same time, California raised taxes; conservatives declared that this would be “economic suicide.” It wasn’t.

I’ll begin by (sort of) agreeing with Krugman that folks on the right can be guilty of acting as if all that matters is tax policy (in other words, the notion that all tax cuts are a guaranteed elixir for growth and that all tax increases lead to economic collapse).

That’s obviously not true. Indeed, fiscal policy only accounts for about 20 percent of a nation’s score in Economic Freedom of the World. And since fiscal policy also includes the burden of government spending, that means tax policy may only explain about 10 percent of economic performance.

And when you understand that, it’s easy to see that Krugman is attacking a straw man.

For instance, nobody should be surprised that the economy didn’t do well under Bush because his one good policy (the 2003 tax cut) was more than offset by all of his bad policies (more spending, more regulation, entitlement expansion, education centralization, TARP, etc).

Likewise, nobody should be surprised that the economy prospered under Clinton because his one bad policy (the 1993 tax hike) was more than offset by all the good policies adopted in the 1990s (spending restraint, welfare reform, deregulation, etc).

The bottom line is that good tax policy is important, but you also have to pay attention to all the other policies that also impact economic performance.

The bottom line is that good tax policy is important, but you also have to pay attention to all the other policies that also impact economic performance.

And when you do, Reagan’s performance looks even more impressive.

P.S. Reagan did engage in some protectionism, unfortunately, which is why America’s score on trade declined during the 1980s. In his defense, I’ll point out that Reagan believed in free trade and he was the one who started the negotiations that led to both NAFTA and the WTO. So I would argue that, in the long run, his tenure was a net plus for trade.

P.P.S. When I write about Reagan’s policies, I can’t resist pointing out that his policies resulted in big increases in tax revenue from upper-income taxpayers (in other words, powerful evidence of the Laffer Curve).

———

Image credit: guvo59 | Pixabay License.