Compared to most of the world, Japan is a rich country. But it’s important to understand that Japan became rich when the burden of government was very small and there was no welfare state.

Indeed, as recently as 1970, Japan’s fiscal policy was rated by Economic Freedom of the World as being better than what exists today in Hong Kong.

Indeed, as recently as 1970, Japan’s fiscal policy was rated by Economic Freedom of the World as being better than what exists today in Hong Kong.

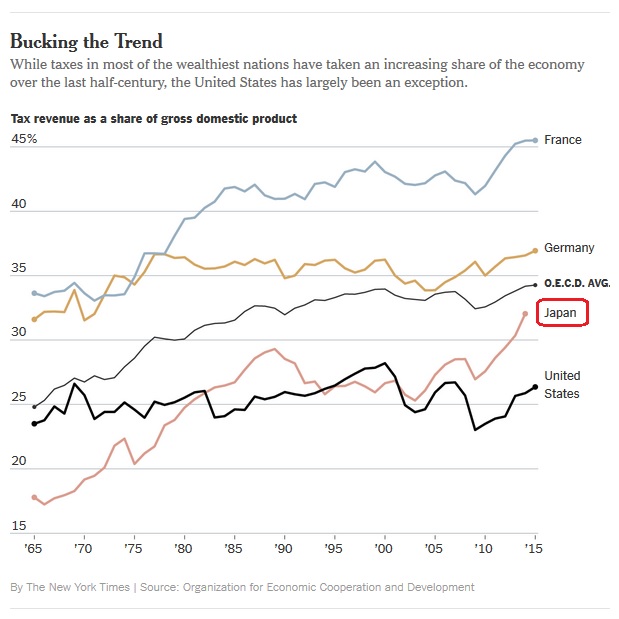

Unfortunately, the country has since moved in the wrong direction. Back in 2016, I shared the “most depressing chart about Japan” because it showed that the overall tax burden doubled in just 45 years.

As you might expect, that rising tax burden was accompanied by a rising burden of government spending (fueled in part by enactment of a value-added tax).

And that has not been a good combination for the Japanese economy, as Douglas Carr explains in an article for National Review.

From 1993 to 2019, the U.S. averaged 2.6 percent growth, …far ahead of Japan’s meager 0.9 percent. …What happened? Big government happened…

Japanese government spending was just 17.5 percent of the country’s GDP in 1960 but has grown, as illustrated below, to 38.8 percent of GDP today. …the island nation’s growth never recovered. The theory that government spending boosts long-term growth has failed… What government spending does is crowd out investment.

Amen. Japan has become a parody of Keynesian spending.

Here’s a chart from Mr. Carr’s article, which could be entitled “the other most depressing chart about Japan.”

As you can see, the burden of government spending began to climb about 1970 and is now represents a bigger drag on their economy than what we’re enduring in the United States.

Unfortunately, the United States is soon going to follow Japan in that wrong direction according to fiscal projections from the Congressional Budget Office.

Carr warns that bigger government in America won’t work any better than big government in Japan.

Rather than a problem confined to the other side of the world, Japan’s death spiral is a pointed warning to the U.S. The U.S. and Japanese economies are on the same trajectory; Japan is simply further along the big-government, low-growth path. …The United States is at risk of entering a Japanese death spiral.

Here’s another chart from the article showing the inverse relationship between government spending and economic growth.

Moreover, the U.S. numbers may be even worse because of coronavirus-related spending and whatever new handouts that might be created after the election.

The negative relationship of government spending with growth and investment holds with adjustments for cyclical influences such as using ten-year averages or the Congressional Budget Office’s estimates of cyclically adjusted U.S. government spending. CBO data highlight how close the U.S. is to a Japanese-style death spiral. …Of course, CBO’s recent forecast was prepared before the coronavirus shock and does not incorporate spending by a new Democratic government, so this dismal outlook is likely to worsen.

So what’s the solution? Can the United States avoid a Greek-style future?

The author explains how America can be saved.

Boosting growth means restraining government. Restraining government means reengineering entitlements… Economically, it shouldn’t be too difficult to do better. We have an insolvent, low-return government-retirement program along with an insolvent retiree-health program — part of a Rube Goldberg health-care system.

He’s right. To avoid stagnation and decline, we desperately need spending restraint and genuine entitlement reform in the United States.

Sadly, Trump is on the wrong side on that issue and Biden wants to add fuel to the fire by making the programs even bigger.

P.S. Here’s another depressing chart about Japan.

P.P.S. Unsurprisingly, the OECD and IMF have been cheerleading for Japan’s fiscal decline.

P.P.P.S. Japan’s government may win the prize for the strangest regulation and the prize for the most useless government giveaway.

———

Image credit: victorpalmer | Pixabay License.