Ten days ago, I shared an interview in which I pointed out that President George W. Bush acquiesced to a flawed narrative about the 2008 financial crisis.

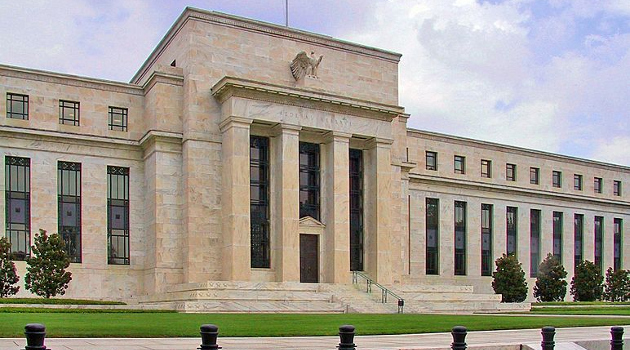

Bush and his team basically accepted the assertion of interventionists that it was the fault of “Wall Street greed,” when the crisis actually was caused by bad monetary policy from the Federal Reserve and corrupt housing subsidies from Fannie Mae and Freddie Mac.

(For what it’s worth, I don’t disagree that folks on Wall Street were greedy, but they were also greedy in the 1990s, 1980s, and other decades. The crisis was caused because foolish government policies made bad decisions profitable in the 2000s.)

The reason I’m raising this issue is because the Washington Post editorialized this morning in favor of the TARP bailout.

…support for TARP should be considered a basic demonstration of political maturity and pragmatism… Some relevant historical context: The outgoing Bush administration and the Democrats who controlled both houses of Congress had few good options

for dealing with a once-in-a-century global financial collapse. As experts from the Federal Reserve and Treasury Department told the politicians, however, one sure way to turn the worst recession since the Great Depression into, well, another Great Depression, would have been to let the banking sector collapse and take millions of American households down with it. …TARP…was actually a major policy success.

Nope, that’s not true.

Tim Carney of the Washington Examiner wisely wrote about this issue a couple of years ago.

Under the guise of saving the U.S. economy, a bipartisan gang of powerful men decided to save a few failed or faltering banks. They posited a false dichotomy between “doing nothing” about the credit crisis rollicking markets, and saving the big banks.

…The stated reasons for government intervention were…to prevent a disorderly fire sale of financial assets, which could cause a total market collapse… There are ways that government can do that without making it a point to save the banks. Bankruptcy often involves winding down failed firms in a manner that minimizes the losses taken by creditors and counterparties. It can be structured so as to prevent a disorderly liquidation.

Amen.

Tim hit the nail on the head when he pointed out that it wasn’t a TARP-or-nothing choice.

Lawmakers could have recapitalized the financial system using the “FDIC-resolution” approach, which basically means putting bankrupt financial institutions into receivership.

Depositors and investors are protected with this approach, even if it means taxpayers are picking up the tab.

What really matters, though, it that the poorly run institutions get shut down. The senior executives lose their jobs, and shareholders and bondholders are subject to losses. Which is exactly what should happen. After all, capitalism without bankruptcy is like religion without hell.

So why didn’t lawmakers adopt the FDIC-resolution approach?

They don’t have ignorance as an excuse. I spent a lot of time talking to policy makers at the time, both in the Bush Administration and on Capitol Hill. I begged and pleaded for them to reject a bailout and instead go with FDIC-resolution.

Sadly, I was ignored, and I think the reason was corruption. Tim elaborated on this hypothesis in his column.

You could call it cronyism if you want. After all, Ben Bernanke and Tim Geithner have both cashed out to financial institutions. Barack Obama fundraiser Warren Buffett made billions off his investment in Goldman Sachs based on his informed assumption the taxpayers would bail Goldman out. …Geithner and crew could have reduced the moral hazard and moral outrage of TARP had they wound down Citigroup. But Geithner wanted Citigroup to keep existing. It was pinstripe protectionism. …At nearly every turn, the bailout barons acted mostly to save the failed or wounded banks rather than to focus narrowly on preserving economic stability. …An economic system where the big guys are never allowed to fail precisely because they are big is not a just system. When you look at the revolving door actions of these guys—Rubin, Geithner, Bernanke, Orszag, and all the others—the unfairness is more obvious.

Kevin Williamson also wrote about how corruption was the dominant factor.

The bottom line is that narratives are important. Unfortunately, too many people accept the establishment’s flawed narrative about TARP – and plenty of Republicans have aided and abetted this false view.

The right lesson is that bailouts are bad economic policy and immoral as well.

P.S. I wrote about this issue for USA Today in both 2010 and 2012.

P.P.S. The only silver lining to the dark cloud of TARP (and the related European fiscal crisis) is that we got this humorous glossary.

———

Image credit: Rdsmith4 | CC BY-SA 2.5.