I’ve previously written that Keynesian economics is like Freddy Kreuger. No matter how many times it is killed off by real-world evidence, it comes back to life whenever a politician wants to justify a vote-buying orgy of new spending.

And there will always be Keynesian economists who will then crank up their simplistic models that churn out results  predicting that a bigger burden of government spending somehow will produce additional growth.

predicting that a bigger burden of government spending somehow will produce additional growth.

They never bother to explain why they think draining funds from the private sector is good for growth, of course, or why they think politicians supposedly spend money more wisely than households and businesses.

Nonetheless, there are some journalists who are willing to act as stenographers for their assertions.

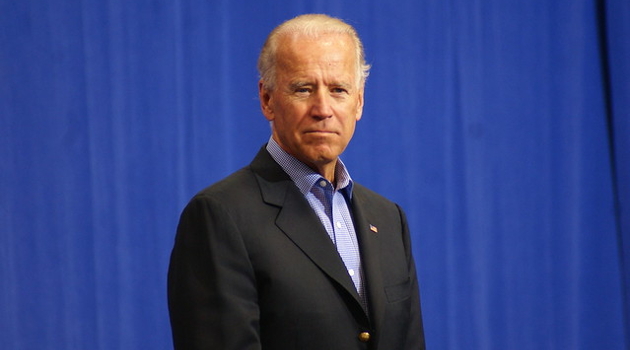

In a September 25 story for the Washington Post, Tory Newmyer gives free publicity to Keynesian predictions that the economy will grow faster if Biden wins and then imposes his profligate agenda – which they underestimate to include $7.3 trillion of new spending and $4.1 trillion of new taxes over the next 10 years.

A Democratic sweep that puts Joe Biden in the White House and the party back in the Senate majority would produce 7.4 million more jobs and a faster economic recovery than if President Trump retains power.

…Moody’s Analytics economists Mark Zandi and Bernard Yaros…see the higher government spending a Biden administration would approve — for emergency relief programs, infrastructure, and an expanded social safety net — giving the economy a potent injection of stimulus. …while a Biden administration would seek to offset some of his proposed $7.3 trillion in new spending over the next decade with $4.1 trillion in higher taxes on corporations and the wealthy, “the net of these crosscurrents is to boost economic activity,” the economists write.

Here’s one of the charts that was included in the story, which purports to show how bigger government leads to faster growth.

If there was a contest for the world’s most inaccurate economist, Zandi almost surely would win a gold medal.

But his laughable track record is hardly worth mentioning. What matters more is that we have decades of real-world experience with Keynesian economics. And it never works.

- It didn’t work for Hoover.

- It didn’t work for Roosevelt.

- It didn’t work for Japan.

- It didn’t work for Europe.

- It didn’t work for Obama.

It’s also worth pointing out that Keynesians have been consistently wrong with predicting economic damage during periods of spending restraint.

- They were wrong about growth after World War II (and would have been wrong, if they were around at the time, about growth when Harding slashed spending in the early 1920s).

- They were wrong about Thatcher in the 1980s.

- They were wrong about Reagan in the 1980s.

- They were wrong about Canada in the 1990s.

- They were wrong after the sequester.

Now let’s look at another example of how Keynesian predictions are wrong.

Professor Casey Mulligan from the University of Chicago analyzed what happened when turbo-charged unemployment benefits recently ended.

July was the final month of the historically disproportionate unemployment bonus of $600 per week. The termination or reduction of benefits will undoubtably make a difference in the lives of the people who were receiving them, but old-style Keynesians insist that the rest of us will be harmed too.

…Paul Krugman explained in August that “I’ve been doing the math, and it’s terrifying. . . . Their spending will fall by a lot . . . [and there is] a substantial ‘multiplier’ effect, as spending cuts lead to falling incomes, leading to further spending cuts.” GDP could fall 4 to 5 percent, and perhaps as much as ten percent… Wednesday the Census Bureau’s advance retail-sales report provided our first extensive look at consumer spending in August, which is the first month with reduced benefits (reduced roughly $50 billion for the month). Did consumer spending drop by tens of billions, starting our economy on the promised path toward recession?

Not exactly. As shown in this accompanying chart, “…retail sales increased $3 billion above July.”

Professor Mulligan explains why Keynesian economics doesn’t work in the real world.

Two critical elements are missing from the old-style Keynesian approach. The first piece is that employment, which depends on benefits and opportunity costs to employer and employee, is a bigger driver of spending than government benefits are. For every person kept out of work by benefits, that is less aggregate spending that is not made up elsewhere in the economy. The second missing piece is that taxpayers and lenders to our government finance these benefits and therefore have less to spend and save on other things. Even a foreign lender who decides to lend that extra $1 million to our government may well be lending less to U.S. households and companies. At best, redistribution from workers to the unemployed reallocates demand rather than increasing its total.

Amen.

At best, Keynesian policy enables a transitory boost in consumption, but there’s no increase in production. At the risk of stating the obvious, a nation’s gross domestic income does not increase when the government borrows money from one group of people and redistributes it to another group of people.

P.S. Since today’s topic is Keynesian economics here’s the famous video showing the Keynes v. Hayek rap contest, followed by the equally entertaining sequel, which features a boxing match between Keynes and Hayek. And even though it’s not the right time of year, here’s the satirical commercial for Keynesian Christmas carols.

———

Image credit: Marc Nozell | CC BY 2.0.