The hard part about being a libertarian is that there are endless opportunities to be frustrated. Especially if you’re job is trying to convince politicians to restrain the size and scope of government when that’s not in their self interest.

One of my special frustrations, though, is that many people don’t understand economic history.

- They blame the Great Depression on capitalism when it was largely the result of bad government policy.

- They blame the financial crisis on capitalism when it was largely the result of bad government policy.

Today, let’s talk about another example of bad economic history. Many people think corporations are rapacious entities that – in the absence of wise government – will create monopolies that screw workers with sweatshop conditions and screw consumers with ever-higher prices.

Much of this mythology goes back to the era of supposed “Robber Barons” in the late 1800s.

Fortunately, in a column for FEE, Professor Burton Folsom shared an excerpt from his book on the topic. He notes that there was considerable economic liberty – and considerable economic progress – during that era.

The years…from 1865 to the early 1900s, saw the U.S. encourage entrepreneurs indirectly by limiting government. Slavery was abolished and so was the income tax. Federal spending was slashed… American politicians learned from the past.

They had dabbled in federal subsidies from steamships to transcontinental railroads, and those experiments dismally failed. Politicians then turned to free markets as a better strategy for economic development. The world-dominating achievements of Cornelius Vanderbilt, James J. Hill, John D. Rockefeller, and Charles Schwab validated America’s unprecedented limited government.

Yet that’s not the story you find in most history books.

Professor Folsom explores why there’s such a poor understanding and finds bias in the academy, as well as an inability to understand the difference between honest wealth and politically connected wealth.

Why is it, then, that for so many years, most historians have been teaching the opposite lesson? …most historians have preached that many, if not all, entrepreneurs were “robber barons.” They did not enrich the U.S. with their investments; instead, they bilked the public and corrupted political and economic life in America. The catalyst for this negative view of American entrepreneurs was historian Matthew Josephson, who wrote a landmark book, The Robber Barons. …Josephson began research for his book in 1932, the nadir of the Great Depression. Businessmen were a handy scapegoat for that crisis, and Josephson embraced a Marxist view that the Great Depression was perhaps the last phase in the fall of capitalism and the triumph of communism. …“I am not a complete Marxist,” Josephson insisted, “But what I took to heart for my own project was his theory of the process of industrial concentration… Josephson missed the distinction between market entrepreneurs like Vanderbilt, Hill, and Rockefeller and political entrepreneurs like Collins, Villard, and Gould. …Most of Josephson’s ire is directed toward political entrepreneurs. The subsidized Henry Villard of the Northern Pacific Railroad, with his “bad grades and high interest charges”… But it never occurs to Josephson that the subsidies government gave these railroads created the incentives. …If Josephson’s research was so sloppy, and his interpretation so biased, how did his Robber Baron view come to prevail in the writing of U.S. history? …Progressive historians had begun to dominate the writing of history and they were eager to blame a new generation of robber barons for the collapse of the American economy.

Now let’s take a closer look at two infamous companies.

We’ll begin with Standard Oil, which has a modern-day reputation of being a greedy monopolist.

Yet as David Weinberger explained for FEE, that’s an odd way of describing a company that continuously lowered prices.

In 1870, when it was in its early years, Standard Oil owned just 4 percent of the petroleum market. John D. Rockefeller, however, obsessed over improving efficiency and cutting costs. Through economies of scale and vertical integration,

he vastly improved oil-refining efficiency. His business grew as a result. By 1874, his share of the petroleum market jumped to 25 percent, and by 1880 it skyrocketed to about 85 percent. Meanwhile, the price of oil plummeted from 30 cents per gallon in 1869 to eight cents in 1885. …His business was a model of free-market efficiency.

The government ultimately used antitrust laws to dismantle the company, but it’s worth noting that the courts never found any evidence of actual monopolistic behavior.

In 1911, the court declared Standard Oil a monopoly and ordered its breakup. …economist John S. McGee reviewed over 11,000 pages of trial testimony, including the charges brought by Standard Oil’s competitors. Publishing his findings in the Journal of Law and Economics, he concluded that there was “little to no evidence” of wrongdoing, adding that “Standard Oil did not use predatory price cutting to acquire or keep monopoly power.” Furthermore, and also in contradiction to monopoly theory, Standard Oil’s share of the market had declined from close to 90 percent in the late 1800s to about 65 percent at the time of the court’s ruling. …In other words, Standard Oil did precisely the opposite of what monopoly theory maintains—it reduced rather than raised prices, it increased rather than cut production, it lost rather than “controlled” market share, and it paid its employees more rather than less than its competitors—yet the theory that Standard Oil engaged in “predatory practices” and “exploited” consumers has prevailed in our history books.

Now let’s look at the United Fruit Corporation, which history tells us was a master of brutal exploitation.

Yet a new academic study by Esteban Mendez-Chacon and Diana Van Patten discovered that the workers of Costa Rica were beneficiaries (h/t: Alex Tabarrok).

These excerpts from the abstract provide a very good summary of what really happened.

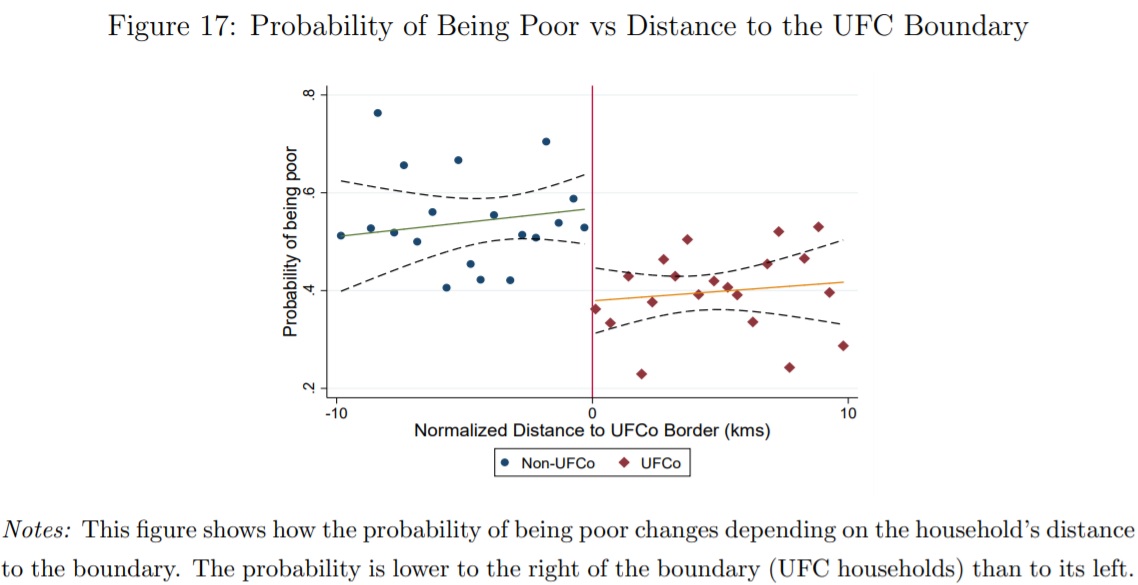

The United Fruit Company (UFC)…was given a large land concession in Costa Rica — one of the so-called “Banana Republics”— from 1889 to 1984. Using administrative census data with census-block geo-references from 1973 to 2011, we implement a geographic regression discontinuity (RD) design that exploits a quasi-random assignment of land.

We find that the firm had a positive and persistent effect on living standards. Regions within the UFC were 26% less likely to be poor in 1973 than nearby counterfactual locations, with only 63% of the gap closing over the following 3 decades. Company documents explain that a key concern at the time was to attract and maintain a sizable workforce, which induced the firm to invest heavily in local amenities that likely account for our result. We then build a dynamic spatial model in which a firm’s labor market power within a region depends on how mobile workers are across locations and run couterfactual exercises. The model is consistent with observable spatial frictions and the RD estimates, and shows that the firm increases aggregate welfare

by 2.9%.

Here’s a look at the data showing lower poverty rates based on proximity to company lands.

And here are other measures of well-being for populations on either side of those boundaries.

What’s especially interesting is that the benefits have remained even several decades after the company’s concession ended.

By the way, I’m not saying that the United Fruit Company was motivated by anything other than profits.

Nor am I saying that Standard Oil was guided by anything beyond making money.

What I am saying, however, is that Adam Smith was right. The pursuit of self interest (whether by companies, workers, entrepreneurs, etc) is what creates mass prosperity. And what enabled an end to child labor.

Here are two videos for those who want further background. Here’s Professor Brian Domitrovic analyzing the “Gilded Age.”

And here’s an excerpt of the great Milton Friedman discussing the so-called Robber Barons.

P.S. By today’s standards, workers didn’t have great lives in the 1800s. But it’s important to understand that what we perceive today as “sweatshop conditions” were actually a big improvement over the grinding poverty of subsistence agriculture. Similarly, working conditions in modern-era third world sweatshops seem awful, but they are an avenue of upward mobility for people who otherwise would suffer unimaginable material deprivation.