Earlier this month, I commented on a Wall Street Journal report that expressed puzzlement about some sub-par economic numbers in America  even though politicians were spending a lot more money.

even though politicians were spending a lot more money.

I used the opportunity to explain that this shouldn’t be a mystery. Keynesian economics never worked in the past, so it shouldn’t be a surprise that it’s not working today.

This is true in the United States, and it’s true in other nations.

Speaking of which, here are some excerpts from a story in the Wall Street Journal about China’s sagging economy.

A strategy by Chinese policy makers to stimulate the economy…hasn’t stopped growth from slowing, stoking expectations that Beijing will roll out more incentives such as easier credit conditions to get businesses and consumers spending. …The breakdown of second-quarter figures shows how roughly 2 trillion yuan ($291 billion) of stimulus,

introduced by Premier Li Keqiang in March, is failing to make business owners less risk-averse. …While Beijing has repeatedly said it wouldn’t resort to flooding the economy with credit, economists say it is growing more likely that policy makers will use broad-based measures to ensure economic stability. That would include fiscal and monetary stimulus that risks inflating debt levels. Policy makers could lower interest rates, relax borrowing restrictions on local governments and ease limits on home purchases in big cities, economists say. Measures they could use to stimulate consumption include subsidies to boost purchases of cars, home appliances and other big-ticket items.

This is very worrisome.

China doesn’t need more so-called stimulus policies. Whether it’s Keynesian fiscal policy or Keynesian monetary policy, trying to artificially goose consumption is a dead-end approach.

is a dead-end approach.

At best, temporary over-consumption produces a very transitory blip in the economic data.

But it leaves a permanent pile of debt.

This is why, as I wrote just a couple of days ago, China instead needs free-market reforms to liberalize the economy.

A period of reform beginning in the late 1970s produced great results. Another burst of liberalization today would be similarly beneficial.

P.S. Free-market reforms in China also would help cool trade tensions. That’s because a richer China would buy more from America, thus appeasing folks like Trump who mistakenly fixate on the trade deficit. More important, economic liberalization presumably would mean less central planning and cronyism, thus mitigating the concern that Chinese companies are using subsidies to gain an unfair advantage.

———

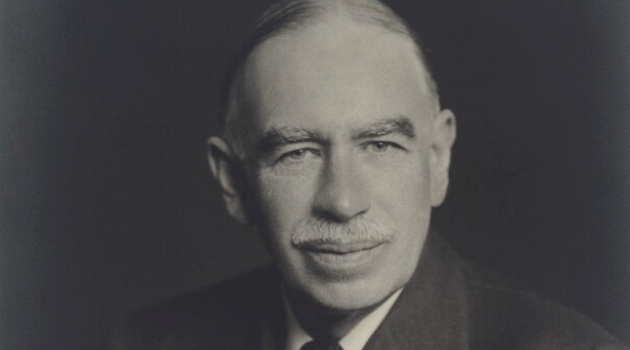

Image credit: National Portrait Gallery | CC BY-NC-ND 3.0.