I wrote five years ago about the growing threat of a wealth tax.

Some friends at the time told me I was being paranoid. The crowd in Washington, they assured me, would never be foolish enough to impose such a levy, especially when other nations such as Sweden have repealed wealth taxes because of their harmful impact.

to impose such a levy, especially when other nations such as Sweden have repealed wealth taxes because of their harmful impact.

But, to paraphrase H.L. Mencken, nobody ever went broke underestimating the foolishness of politicians.

I already wrote this year about how folks on the left are demonizing wealth in hopes of creating a receptive environment for this extra layer of tax.

And some masochistic rich people are peddling the same message. Here’s some of what the Washington Post reported.

A group of ultrarich Americans wants to pay more in taxes, saying the nation has a “moral, ethical and economic responsibility” to ensure that they do. In an open letter addressed to the 2020 presidential candidates

and published Monday on Medium, the 18 signatories urged political leaders to support a wealth tax on the richest one-tenth of the richest 1 percent of Americans. “On us,” they wrote. …The letter, which emphasized that it was nonpartisan and not to be interpreted as an endorsement of anyone in 2020, noted that several presidential candidates, including Sen. Elizabeth Warren (D-Mass.), Pete Buttigieg and Beto O’Rourke, have already signaled interest in addressing the nation’s staggering wealth inequality through taxation.

I’m not sure a please-tax-us letter from a small handful of rich leftists merits so much news coverage.

Though, to be fair, they’re not the only masochistic rich people.

Another guilt-ridden rich guy wrote for the New York Times that he wants the government to have more of his money.

My parents watched me build two Fortune 500 companies and become one of the wealthiest people in the country. …It’s time to start talking seriously about a wealth tax. …Don’t get me wrong: I am not advocating an end to the capitalist system that’s yielded some of the

greatest gains in prosperity and innovation in human history. I simply believe it’s time for those of us with great wealth to commit to reducing income inequality, starting with the demand to be taxed at a higher rate than everyone else. …let’s end this tired argument that we must delay fixing structural inequities until our government is running as efficiently as the most profitable companies. …we can’t waste any more time tinkering around the edges. …A wealth tax can start to address the economic inequality eroding the soul of our country’s strength. I can afford to pay more, and I know others can too.

When reading this kind of nonsense, my initial instinct is to tell this kind of person to go ahead and write a big check to the IRS (or, better yet, send the money to me as a personal form of redistribution to the less fortunate). After all, if he really thinks he shouldn’t have so much wealth, he should put his money where his mouth is.

But rich leftists like Elizabeth Warren don’t do this, and I’m guessing the author of the NYT column won’t, either. At least if the actions of other rich leftists are any guide.

But I don’t want to focus on hypocrisy.

Today’s column is about the destructive economics of wealth taxation.

A report from the Mercatus Center makes a very important point about how a wealth tax is really a tax on the creation of new wealth.

Wealth taxes have been historically plagued by “ultra-millionaire” mobility. …The Ultra-Millionaire Tax, therefore, contains “strong anti-evasion measures” like a 40 percent exit tax on any targeted household that attempts to emigrate, minimum audit rates, and increased funding for IRS enforcement.

…Sen. Warren’s wealth tax would target the…households that met the threshold—around 75,000—would be required to value all of their assets, which would then be subject to a two or three percent tax every year. Sen. Warren’s team estimates that all of this would bring $2.75 trillion to the federal treasury over ten years… a wealth tax would almost certainly be anti-growth. …A wealth tax might not cause economic indicators to tumble immediately, but the American economy would eventually become less dynamic and competitive… If a household’s wealth grows at a normal rate—say, five percent—then the three percent annual tax on wealth would amount to a 60 percent tax on net wealth added.

Alan Viard of the American Enterprise Institute makes the same point in a column for the Hill.

Wealth taxes operate differently from income taxes because the same stock of money is taxed repeatedly year after year. …Under a 2 percent wealth tax, an investor pays taxes each year equal to 2 percent of his or her net worth, but in the end pays taxes each decade equal to a full 20 percent of his or her net worth.

…Consider a taxpayer who holds a long term bond with a fixed interest rate of 3 percent each year. Because a 2 percent wealth tax captures 67 percent of the interest income of the bondholder makes each year, it is essentially identical to a 67 percent income tax. The proposed tax raises the same revenue and has the same economic effects, whether it is called a 2 percent wealth tax or a 67 percent income tax. …The 3 percent wealth tax that Warren has proposed for billionaires is still higher, equivalent to a 100 percent income tax rate in this example. The total tax burden is even greater because the wealth tax would be imposed on top of the 37 percent income tax rate. …Although the wealth tax would be less burdensome in years with high returns, it would be more burdensome in years with low or negative returns. …high rates make the tax a drain on the pool of American savings. That effect is troubling because savings finance the business investment that in turn drives future growth of the economy and living standards of workers.

Alan is absolutely correct (I made the same point back in 2012).

Taxing wealth is the same as taxing saving and investment (actually, it’s the same as triple- or quadruple-taxing saving and investment). And that’s bad for competitiveness, growth, and wages.

And the implicit marginal tax rate on saving and investment can be extremely punitive. Between 67 percent and 100 percent in Alan’s examples. And that’s in addition to regular income tax rates.

You don’t have to be a wild-eyed supply-side economist to recognize that this is crazy.

Which is one of the reasons why other nations have been repealing this class-warfare levy.

Here’s a chart from the Tax Foundation showing the number of developed nations with wealth taxes from1965-present.

And here’s a tweet with a chart making the same point.

A reminder that most of the OECD has moved away from wealth taxes. 12 countries had them in 1990, while only 4 levy them today. Most countries found that the tax has high administrative and compliance costs, and didn’t meet the goal of redistribution. pic.twitter.com/pHs7Q5ehjL

— Garrett Watson (@GS_Watson) January 24, 2019

P.S. I’ve tried to figure out why so many rich leftists support higher taxes. For non-rich leftists, I cite IRS data in hopes of convincing them they should be happy there are rich people.

P.P.S. I’ve had two TV debates with rich, pro-tax leftists (see here and here). Very strange experiences.

P.P.P.S. There are also pro-tax rich leftists in Germany.

———

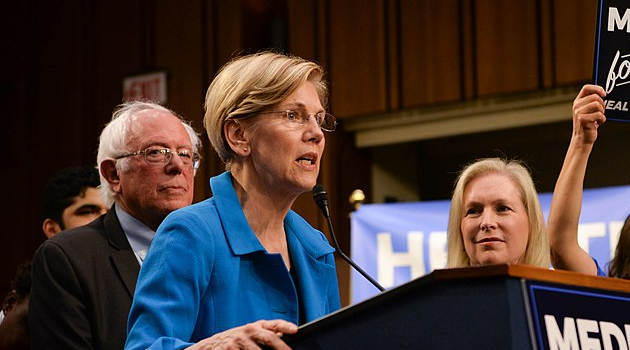

Image credit: Senate Democrats | CC BY 2.0.