I’ve written many times about people and businesses escaping high-tax states and moving to low-tax states.

This tax-driven migration rewards states with good policy and punishes those with bad policy.

And now we have some new data.

The Wall Street Journal recently opined on the updated numbers.

…some states are booming while others are suffering a European-style sclerosis of population loss and slow economic growth. …The eight fastest-growing states by population last year…also experienced rapid employment and GDP growth spurred by low tax rates and policies generally friendly to business and job creation.

Nevada, Arizona, Texas, Washington, Utah, Florida and Colorado ranked among the eight states with the fastest job growth this past year, according to the Bureau of Labor Statistics. Nevada, Texas, Washington and Florida have no income tax. …Then there’s California. Despite its balmy weather and thriving tech industry, the Golden State last year lost more people to other states than it gained from foreign immigration. Since 2010, a net 710,000 people have left California for other states. …New York Gov. Andrew Cuomo recently blamed cold weather for the state’s population exodus, but last year frigid New Hampshire with no income tax attracted 3,900 newcomers from other states. …Illinois’s population has declined by 157,000 over the past five years… Cold weather? While Illinois’s population has declined by 0.8% since 2010, Indiana’s has grown 3.1% and Wisconsin’s by 2.2%.

Here’s my favorite part of the editorial.

America as a whole can thank the Founders for creating a federalist system that allows the economic and political safety valve of interstate policy competition.

Amen. Federalism is great for a wide range of reasons, but I especially like that people have the freedom to escape when policy is decentralized.

Companies escape high taxes.

Honeywell International Inc. is snubbing New Jersey and heading south. …Honeywell’s move follows other companies that have moved corporate offices

out of states with elevated costs of living and high taxes, including General Electric Co.’s relocation of its headquarter to Boston from Connecticut. Those costs were exacerbated by a new law last year that removed state income-tax deductions on federal taxes. North Carolina has a lower state income tax than New Jersey for higher-paid employees.

Former governors escape high taxes.

Gov. Paul LePage said Monday that he plans to move to Florida for tax reasons… LePage and his wife, Ann, already own a house in Florida and often vacation there.

He said he would be in Maine from April to September. Asked where he would maintain his legal residency, LePage replied Florida. …”I have a house in Florida. I will pay no income tax and the house in Florida’s property taxes are $2,000 less than we were paying in Boothbay. … At my age, why wouldn’t you conserve your resources and spend it on your family instead of on taxes?” …LePage often has cited Maine’s income tax – currently topping out at 7.15 percent, down from a high of 8.5 percent when he took office – as an impediment to economic growth and attracting/retaining residents.

Even sports stars avoid class-warfare tax regimes.

Bryce Harper and Manny Machado…will “take home” significantly higher or lower pay depending on which teams sign them and the applicable income tax rates in the states where those teams are based. This impact could be worth tens of millions of dollars.

…For example, assume the Cubs and Dodgers offer identical eight-year, $300 million contracts to Machado. Lozano would warn the Dodgers that their offer is decidedly inferior. As a Dodger, Machado’s million-dollar wages would be subject to the top bracket of California’s state income tax rate. At 13.3%, it is the highest rate in the land. In contrast, as a Cub, Machado would be subject to the comparatively modest 4.95% Illinois income tax rate. …the difference in after-tax value of these two $300 million contracts would be $14 million.

Though Lozano needs to warn Machado that the recent election resultssignificantly increase the danger that Illinois politicians will finally achieve their long-held goal of changing the state constitution and replacing the flat tax with a class-warfare system.

Since we’re talking about the Land of Lincoln, it’s worth noting that the editors at the Chicago Tribune understand the issue.

Every time a worker departs, the tax burden on those of us who remain grows. The release on Wednesday of new census data about Illinois was alarming: Not only has the flight of citizens continued for a fifth straight year, but the population loss is intensifying.

This year’s estimated net reduction of 45,116 residents is the worst of these five losing years. …Residents fed up with the economic climate here are heading for less taxaholic, jobs-friendlier states. …Many of them left because they believed Illinois is headed in the wrong direction. Because Illinois politicians have raised taxes, milked employers and created enormous public indebtedness that the pols want to address with … still more taxation. …How bad does the Illinois Exodus have to get before its dominant politicians understand that their debt-be-damned, tax-and-spend policies are ravaging this state?

Wow, no wonder Illinois is perceived to be the first state to suffer a fiscal collapse.

Let’s now zoom out and consider some national implications.

Chris Edwards took a close look at the data and crunched some numbers.

The new Census data confirms that people are moving from tax-punishing places such as California, Connecticut, Illinois, New York, and New Jersey to tax-friendly places such as Florida, Idaho, Nevada, Tennessee, and South Carolina.

In the chart, each blue dot is a state. The vertical axis shows the one-year Census net interstate migration figure as a percentage of 2017 state population. The horizontal axis shows state and local household taxes as a percentage of personal income in 2015. …On the right, most of the high-tax states have net out-migration. …On the left, nearly all the net in-migration states have tax loads of less than 8.5 percent. …The red line is fitted from a simple regression that was highly statistically significant.

Here’s the chart.

Professor Glenn Reynolds wrote a column on tax migration for USA Today.

He starts by warning states that it’s a very bad recipe to repel taxpayers and attract tax consumers.

IRS data show that taxpayers are migrating from high-tax states like New York, Illinois, and California to low-tax states like Texas and Florida. …In time, if taxpayers tend to migrate from high-tax states to low-tax states, and if people receiving government benefits tend to stay in place

or migrate from lower-benefit states to higher-benefit states, then over time lower-tax states will tend to accumulate more people with high earnings, while higher-benefit states will tend to accumulate more people who live on the dole. …if high-benefits states are also high-tax states (as is often the case) since then states with high benefits will accumulate more people who draw on them, while shedding the taxpayers they need to support them. The problem is that the result isn’t stable: High-tax, high-benefit states will eventually go bankrupt because they won’t retain enough taxpayers to support their welfare spending.

He then makes a very interesting observation about the risk that people who leave states such as New York, Illinois, California, and New Jersey may bring their bad voting habits to their new states.

…migrants from high tax states might bring their political attitudes with them, moving to new, low-tax states for the economic opportunity but then supporting the same policies that ruined the states they left. This seems quite plausible, alas, and I’ve heard Coloradans lament that the flow of Californians to their state involved a lot of people doing just that. …If I were one of those conservative billionaires…I might try spending some of the money on some…sort of welcome wagon for blue state migrants to red states. Something that would explain to them why the place they’re moving to is doing better than the place they left, and suggesting that they might not want to vote for the same policies that are driving their old home states into bankruptcy.

Glenn makes a very good point.

As part of my work on defending TABOR in Colorado, I often run into people who fret that the state has moved in the wrong direction because of migration from left-leaning states.

Though Chuck DeVore shared some data on how migrants to Texas are more conservative than people born in the state.

Fascinating @CNN #Texas exit poll: those who moved to Texas favored Cruz over O’Rourke by 57-42 – https://t.co/RvFkMujXic This finding agrees w/ a @TexasTribune poll showing California expats in Texas were 2:1 conservative – https://t.co/OC5JVsg67s @TPPF pic.twitter.com/XAqgs4QFae

— Chuck DeVore (@ChuckDeVore) November 8, 2018

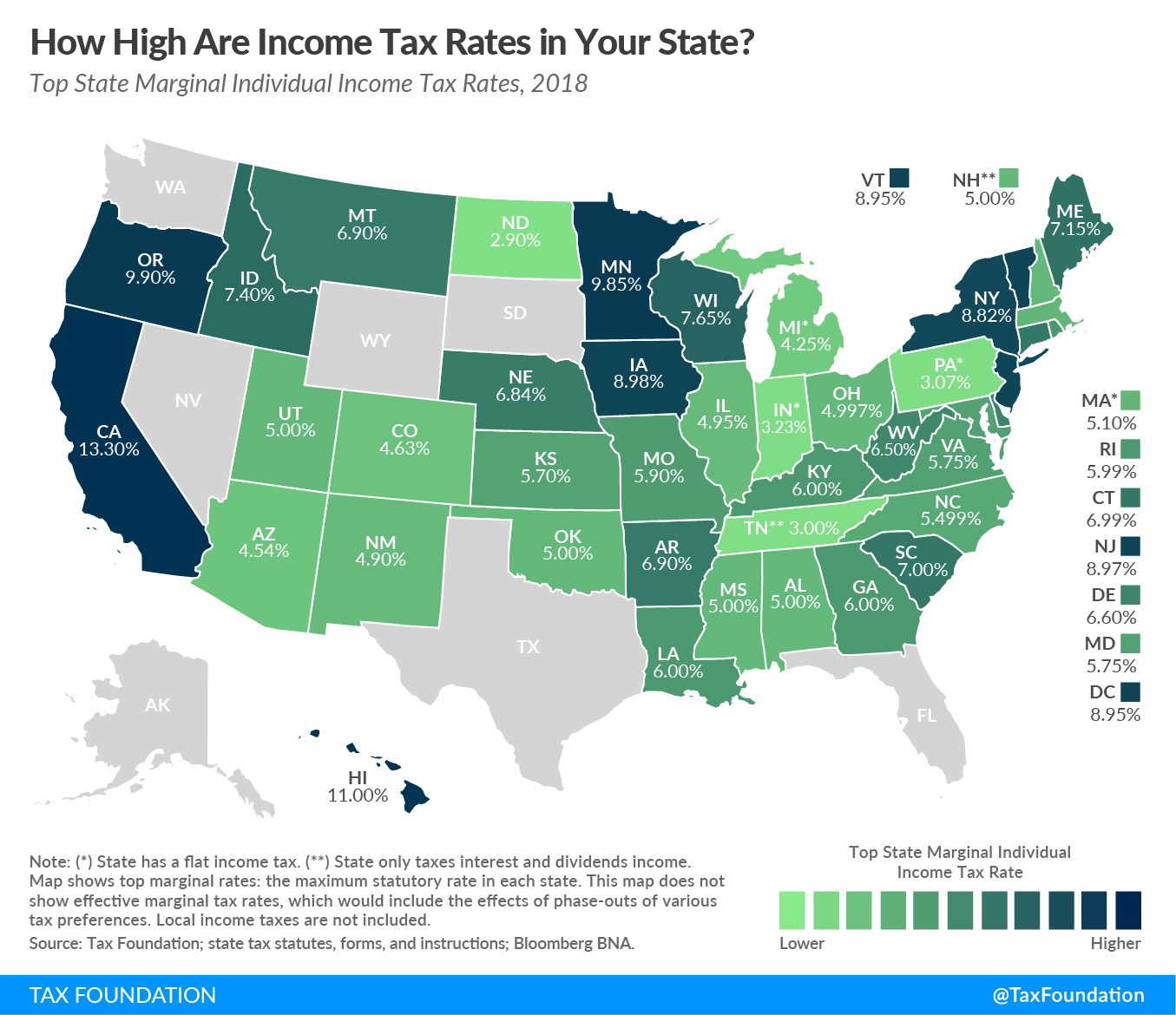

I’ll close today’s column with a helpful map from the Tax Foundation.

All you really need to know is that you should move if you live in a blue state and you should erect a no-leftists-allowed sign if you live in a gray state.

P.S. Everything I wrote about the benefits of tax migration between states also applies to tax migration between nations.

I will never stop defending the right of labor and capital to escape high-tax regimes. I especially enjoy the hysterical reactions of folks on the left, who think that my support of fiscal sovereignty means that I’m “trading with the enemy,” being disloyal to my government, or that I should be tossed in jail.