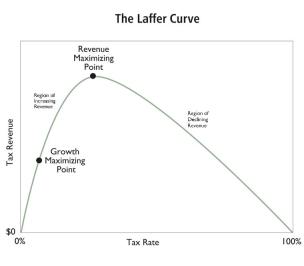

I’m a big fan of the Laffer Curve, which is simply a graphical representation of the common-sense notion that punitively high tax rates can result in less revenue because of reductions in the economy-wide level of work, saving, investment, and entrepreneurship.

This insight of supply-side economics is so obviously true that even Paul Krugman has acknowledged its veracity.

This insight of supply-side economics is so obviously true that even Paul Krugman has acknowledged its veracity.

What’s far more important, though, is that Ronald Reagan grasped the importance of Art’s message. And he dramatically reduced tax rates on productive behavior during his presidency.

And those lower tax rates, combined with similar reforms by Margaret Thatcher in the United Kingdom, triggered a global reduction in tax rates that has helped boost growth and reduce poverty all around the world.

In other words, Art Laffer was a consequential man.

So it was great news that President Trump awarded Art with the Presidential Medal of Freedom.

Let’s look at some commentary on this development, starting with a column in the Washington Examiner by Fred Barnes.

When President Trump announced he was awarding the Presidential Medal of Freedom to economist Arthur Laffer, there were groans of dismay in Washington… Their reaction was hardly a surprise. Laffer is everything they don’t like in an economist. He’s an evangelist for tax cuts.

He believes slashing tax rates is the key to economic growth and prosperity. And more often than not, he’s been right about this. Laffer emerged as an influential figure in the 1970s as the champion of reducing income tax rates. He was a key player in the Reagan cuts of 1981 that touched off an economic boom lasting two decades. …Laffer, 78, is not a favorite of conventional, predominantly liberal economists. Tax cuts leave the job of economic growth to the private sector. Liberal economists prefer to give government that job. Tax cuts are not on their agenda. Tax hikes are. …His critics would never admit to Laffer envy. But they show it by paying attention to what he says and to whom he’s affiliated. They rush to criticize him at any opportunity. …Laffer was right…about tax cuts and prosperity.

And here are some excerpts from a Bloomberg column by Professor Karl Smith of the University of North Carolina.

Most important, he highlights how supply-side economics provided a misery-minimizing way of escaping the inflation of the 1970s.

President Donald Trump’s decision to award Arthur Laffer the Presidential Medal of Freedom has met with no shortage of criticism… Laffer was a policy entrepreneur, and his..boldness was crucial in the development of what came to be known as the “Supply Side Revolution,” which even today is grossly underappreciated. In the 1980s, the U.S. economy avoided the malaise that afflicted Japan and much of Western Europe.

The primary reason was supply-side economics. …Reducing inflation with minimal damage to the economy was the central goal of supply-side economics. …most economists agreed that inflation could be brought down with a severe enough recession. …Conservative economists argued that the long-term gain was worth that level of pain. Liberal economists argued that inflation was better contained with price and income controls. Robert Mundell, a future Nobel Laureate, argued that there was third way. Restricting the money supply, he said, would cause demand in the economy to contract, but making large tax cuts would cause demand to expand. If done together, these two strategies would cancel each other out, leaving room for supply-side factors to do their work. …Laffer suggested that permanent reductions in taxes and regulations would increase long-term economic growth. A faster-growing economy would increase foreign demand for U.S. financial assets, further raising the value of the dollar and reducing the price of foreign imports. These effects would speed the fall in inflation by increasing the supply of goods for sale. In the early 1980s, the so-called Mundell-Laffer hypothesis was put to the test — and it was, by and large, successful.

I’ve already written about how taming inflation was one of Reagan’s great accomplishments, and this column adds some meat to the bones of my argument.

And it’s worth noting that left-leaning economists thought it couldn’t be done. Professor Bryan Caplan shared this quote from Paul Samuelson.

Today’s inflation is chronic. Its roots are deep in the very nature of the welfare state. [Establishment of price stability through monetary policy

would require] abolishing the humane society [and would] reimpose inequality and suffering not tolerated under democracy. A fascist political state would be required to impose such a regime and preserve it. Short of a military junta that imprisons trade union activists and terrorizes intellectuals, this solution to inflation is unrealistic–and, to most of us, undesirable.

It’s laughable to read that today, but during the Keynesian era of the 1970s, this kind of nonsense was very common (in addition to the Samuelson’s equally foolish observations on the supposed strength of the Soviet economy).

The bottom line is that Art Laffer and supply-side economics deserve credit for insights on monetary policy in addition to tax policy.

But since Art is most famous for the Laffer Curve, let’s close with a few additional observations on that part of supply-side economics.

Many folks on the left today criticize Art for being too aggressive about the location of the revenue-maximizing point of the Laffer Curve. In other words, they disagree with him on whether certain tax cuts will raise revenue or lose revenue.

While I think there’s very strong evidence that lower tax rates can increase revenue, I also think it doesn’t happen very often.

But I also think that debate doesn’t matter. Simply stated, I don’t want politicians to have more revenue,  which means that I don’t want to be at the revenue-maximizing point of the Laffer Curve.

which means that I don’t want to be at the revenue-maximizing point of the Laffer Curve.

Moreover, there’s a lot of economic damage that occurs as tax rates approach that point, which is why I often cite academic research confirming that one additional dollar of tax revenue is associated with several dollars (or more!) of lost economic output.

Call me crazy, but I’m not willing to destroy $5 or $10 of private-sector income in order to increase Washington’s income by $1.

The bottom line is that the key insight of the Laffer Curve is that there’s a cost to raising tax rates, regardless of whether a nation is on the left side of the curve or the right side of the curve.

P.S. While I’m a huge fan of Art Laffer, that doesn’t mean universal agreement. I think he’s wrong in his analysis of destination-based state sales taxes. And I think he has a blind spot about the danger of a value-added tax.

———

Image credit: Gage Skidmore | CC BY-SA 2.0.