Proponents of bigger government sometimes make jaw-dropping statements.

I even have collections of bizarre assertions by both Hillary Clinton and Barack Obama.

What’s especially shocking is when statists twist language, such as when they claim all income is the “rightful property” of government and that people who are allowed to keep any of their earnings are getting “government handouts.”

What’s especially shocking is when statists twist language, such as when they claim all income is the “rightful property” of government and that people who are allowed to keep any of their earnings are getting “government handouts.”

A form of “spending in the tax code,” as they sometimes claim.

Maybe we should have an “Orwell Award” for the most perverse misuse of language on tax issues.

And if we do, I have two potential winners.

The governor of Illinois actually asserted that higher income taxes are needed to stop people from leaving the state.

Gov. J.B. Pritzker…blamed the state’s flat income tax for Illinois’ declining population. …“The people who have been leaving the state are actually the people who have had the regressive flat income tax imposed upon them, working-class, middle-class families,”

Pritzker said. Pritzker successfully got the Democrat-controlled state legislature to pass a ballot question asking voters on the November 2020 ballot if Illinois’ flat income tax should be changed to a structure with higher rates for higher earners. …Pritzker said he’s set to sign budget and infrastructure bills that include a variety of tax increases, including a doubling of the state’s gas tax, increased vehicle registration fees, higher tobacco taxes, gambling taxes and other tax increases

I’ve written many times about the fight to replace the flat tax with a discriminatory graduated tax in Illinois, so no need to revisit that issue.

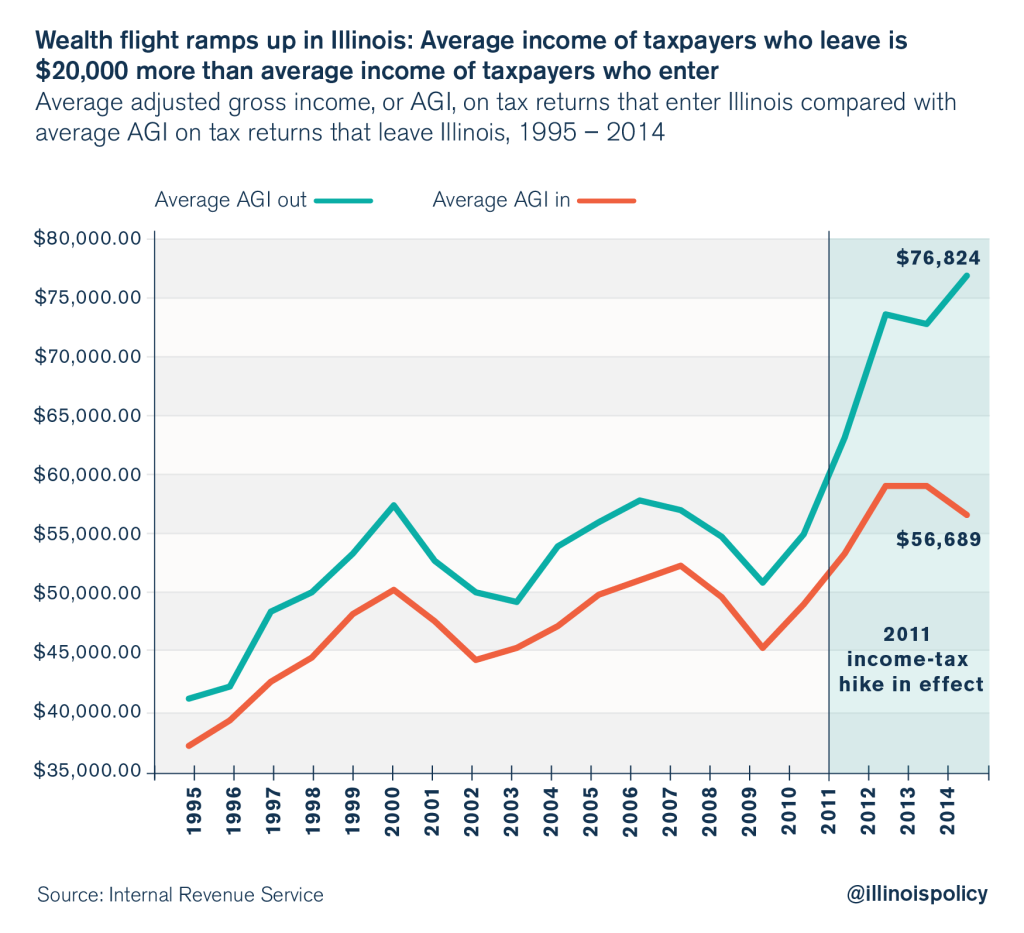

Instead, I’ll simply note that Pritzker’s absurd statement about who is escaping the state not only doesn’t pass the laugh test, but it also is explicitly contradicted by IRS data.

In reality, the geese with the golden eggs already are voting with their feet against Illinois. And the exodus will accelerate if Pritzker succeeds in killing the state’s flat tax.

Another potential winner is Martin Kreienbaum from the German Finance Ministry. As reported by Law360.com, he asserted that jurisdictions have the sovereign right to have low taxes, but only if the rules are rigged so they can’t benefit.

A new global minimum tax from the Organization for Economic Cooperation and Development is not meant to infringe on state sovereignty…, an official from the German Federal Ministry of Finance said Monday. The OECD’s work plan…includes a goal

of establishing a single global rate for taxation… While not mandating that countries match or exceed it in their national tax rates, the new OECD rules would allow countries to tax the foreign income of their home companies if it is taxed below that rate. …”We respect the sovereignty for states to completely, freely set their tax rates,” said Martin Kreienbaum, director general for international taxation at the German Federal Ministry of Finance. “And we restore sovereignty of other countries to react to low-tax situations.” …”we also believe that the race to the bottom is a situation we would not like to accept in the future.”

Tax harmonization is another issue that I’ve addressed on many occasions.

Suffice to say that I find it outrageous and disgusting that bureaucrats at the OECD (who get tax-free salaries!) are tying to create a global tax cartel for the benefit of uncompetitive nations.

What I want to focus on today, however, is how the principle of sovereignty is being turned upside down.

From the perspective of a German tax collector, a low-tax jurisdiction is allowed to have fiscal sovereignty, but only on paper.

So if a place like the Cayman Islands has a zero-income tax, it then gets hit with tax protectionism and financial protectionism.

Sort of like having the right to own a house, but with neighbors who have the right to set it on fire.

P.S. Trump’s Treasury Secretary actually sides with the French and supports this perverse form of tax harmonization.

———

Image credit: Chi Hack Night | Creative Commons Attribution license (reuse allowed).