The theory of “economic convergence” is based on the notion that poor nations should grow faster than rich nations and eventually achieve the same level of development.

This theory is quite reasonable, but I’ve pointed out that decent public policy (i.e., free markets and small government) is a necessary condition for convergence to occur.

This theory is quite reasonable, but I’ve pointed out that decent public policy (i.e., free markets and small government) is a necessary condition for convergence to occur.

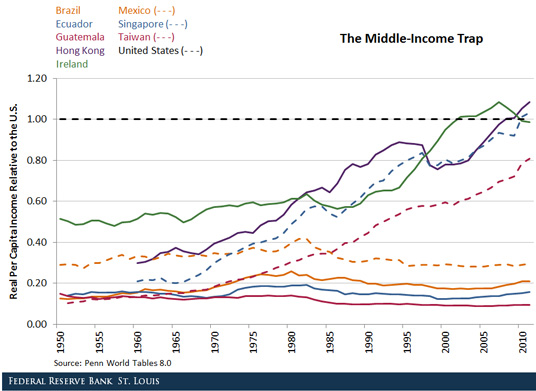

The link between good policy and convergence explains why Hong Kong and Singapore, for instance, have caught up to the United States.

And the adverse effect of bad policy is a big reason why Europe continues to lag.

Moreover, it also explains why some nations with awful policy are de-converging.

Today, let’s look at convergence between Western Europe and Eastern Europe.

Here are some excerpts from a new study published by the European Central Bank.

This paper analyses real income convergence in central, eastern and south-eastern Europe (CESEE) to the most advanced EU economies between 2000 and 2016. …The paper establishes stylised facts of convergence, analyses the drivers of economic growth

and identifies factors that might explain the differences between fast- and slow-converging economies in the region. The results show that the most successful CESEE economies in terms of the pace of convergence share common characteristics such as, inter alia, a strong improvement in institutional quality and human capital, more outward-oriented economic policies, favourable demographic developments and the quick reallocation of labour from agriculture into other sectors. Looking ahead, accelerating and sustaining convergence in the region will require further efforts to enhance institutional quality and innovation, reinvigorate investment, and address the adverse impact of population ageing.

The study is filled with fascinating data (at least if you’re a policy wonk).

This chart, for example, shows how many nations are converging (the dots above the diagonal line) and how many nations are falling behind (the dots below the diagonal line).

The yellow dots are Eastern European nations, so it’s good news that all of them are experiencing some degree of convergence.

But the above graphic doesn’t provide any details.

So let’s look at another chart from the study. The blue bar shows per-capita GDP in selected Eastern European nations as a share of the EU average. The yellow dot shows where the countries were in 2008 and the orange dot shows where they were in 2000.

The good news, at least relatively speaking, is that all nations are catching up to Western Europe.

But the report notes that some are catching up faster than others.

The developments were…heterogeneous within CESEE countries that are EU Member States. Some of them (the Baltic States, Bulgaria, Poland, Romania and Slovakia) experienced particularly fast convergence in the period analysed. At the same time, other CESEE EU Member States found it hard to converge… In fact, GDP per capita in Croatia and Slovenia diverged from the EU average after 2008… Given these heterogeneous developments, it appears that while in some CESEE countries the middle-income trap hypothesis could be dismissed (at least given their experience so far), in others the signs of a slowdown in convergence after reaching a certain level of economic development are visible.

My one gripe with the ECB study is that there’s a missing piece of analysis.

The report does a great job of documenting relative levels of prosperity over time. And it also has a thorough discussion of the characteristics that are found in fast-converging countries.

But there’s not nearly enough attention paid to the policies that promote and enable convergence. Why, for instance, has there been so much convergence in Estonia and so little convergence in Slovenia?

So I’ve tinkered with the above chart by adding each nation’s ranking for Economic Freedom of the World.

Lo and behold, a quick glance shows that higher-ranked nations (blue numbers indicate a nation is in the “most free” category) have enjoyed the greatest degree of convergence.

Here are some specific observations.

- The Baltic nations are the biggest success stories of the post-communist world. Thanks to pro-market reforms, they have enjoyed the most convergence.

- Romania and Slovakia also experienced big income gains. Romania is in the “most free” group of nations and Slovakia was in the “most free” group until a few years ago.

- Poland has enjoyed the most convergence since 2008. Not coincidentally, that’s a period during which Poland’s economic freedom score climbed from 7.00 to 7.27.

- Bulgaria also merits a positive mention for a big improvement, doubtlessly driven by a huge improvement (from 5.55 to 7.41) in economic freedom since 2000,.

- Sadly, Slovenia and Croatia have not experienced much convergence, which presumably is caused in part by their comparatively low rankings for economic liberty.

To be sure, there’s not an ironclad relationship between a nation’s annual score and yearly growth rates.

But, over time, poor nations that want convergence almost certainly won’t get the necessary levels of sustained strong growth without high scores for economic liberty.

P.S. Here’s some related research on this topic from 2017. And here’s a column on the evolution of economic liberty (or lack thereof) in Europe.