On the one-year anniversary of his inauguration, I graded Trump’s overall record on economic policy and specifically observed that his trade rhetoric was worse than his trade policy. But I added a caveat about the North American Free Trade Agreement.

…he’s been doing a lot of saber-rattling, but fortunately not drawing too much blood. That being said, he is threatening to pull the United States out of NAFTA, which would be a very big mistake.

Unfortunately, this is not an idle threat. So let’s look at what some experts have said about the value of NAFTA to the American economy.

We’ll start with a column from today’s Washington Post by the CEO of Union Pacific. He worries that the good news on taxes will be offset by bad news on trade.

Freight railroads are the bloodstream of U.S. business, supporting the livelihoods of employees in nearly every sector of the economy. …From my vantage point, it is clear that the recently adopted tax-reform law will provide meaningful stimulus for the U.S. economy. …our economy is on the rise, and tax reform will help generate even more momentum.

But America’s potential exit from the North American Free Trade Agreement threatens to undo much of that progress. …About 60 percent of U.S. imports are intermediate goods for U.S. production, so raising costs through what will be functionally higher taxes on production would make U.S. businesses less competitive — thwarting tax reform’s goal of allowing people and businesses to invest their money as they see fit. …executives who are excited about the economic benefits of the tax cuts are facing equal, if not greater, economic losses if NAFTA is eliminated. …At Union Pacific, …nearly 40 percent of our shipments now have an international component — coming from or headed to Canada, Mexico, Asia, Europe and beyond. …it will be critical for the United States to strengthen its most important trade partnerships, not abandon them. …the recent tax legislation is clearly a strong tail wind for future growth and expansion. Let’s not ruin the momentum by abandoning NAFTA.

I fully agree. It’s worth noting that trade policy is just as important as fiscal policy according to Economic Freedom of the World.

Which is why it makes no sense for Trump to undermine his achievement on tax reform.

Here are some excerpts from a study by a Dartmouth professor. He starts by outlining some of the benefits that have been produced by NAFTA.

U.S. trade in goods and services with Canada and Mexico has nearly quadrupled under NAFTA—from $337 billion in 1994 to about $1.4 trillion in 2016. …NAFTA partners have become the largest destination for U.S. small-business exporters. In 2014, more than 125,000 small and medium-sized businesses (SME) exported to Canada and/or Mexico: this was over 95 percent of all U.S. exporters into the NAFTA market.

For these small U.S. exporters that year, Canada and Mexico were the top two export destinations. The total value of these 2014 exports was $136 billion, fully 25 percent of all U.S. SME exports. Under NAFTA, cross-border investment among the three member countries has surged as well: from $126.8 billion in 1993 to $731.3 billion in 2016. …A reasonable conclusion from…studies is that NAFTA in its entirety has elevated U.S. GDP by somewhere between 0.2 percent and 0.3 percent of GDP. …boosting U.S. GDP by between 0.2 percent and 0.3 percent means U.S. output and income is somewhere between about $40 billion to nearly $60 billion higher than it would be without NAFTA. …representative studies calculated that NAFTA raised average U.S. wages by somewhere between 0.2 and 0.3 percent–a boost to workers’ wages that, like the boost to national GDP, recurs every year.

Needless to say, wrecking NAFTA would unwind all these benefits.

…studies that have carefully modeled the United States withdrawing from NAFTA share a central estimate of withdrawal damages of about 0.3 percent of GDP. In 2017, a loss of national output approaching 0.3 percent of GDP would have been a loss of about $50 billion. …Withdrawing would reduce trade, lower national output and income, and destroy U.S. jobs and lower average U.S. real wages. In an increasingly competitive global economy, many U.S. companies and their workers would suffer, not win.

Another study had a similarly grim assessment.

…termination of the North American Free Trade Agreement (NAFTA) would have significant net negative impacts on the U.S. economy and U.S. employment, particularly over the immediate years after termination.

Termination would re-impose high costs of tariffs on U.S. exports and imports, which would reduce the competitiveness of U.S. businesses both domestically and abroad. U.S. exports would drop, both to Canada and Mexico and globally, as U.S. output becomes more expensive and therefore U.S. businesses would be less competitive in these markets. Foreign purchasers would shift away from U.S. goods and services in favor of lower-cost goods and services made in other international markets, particularly those made in Asia.

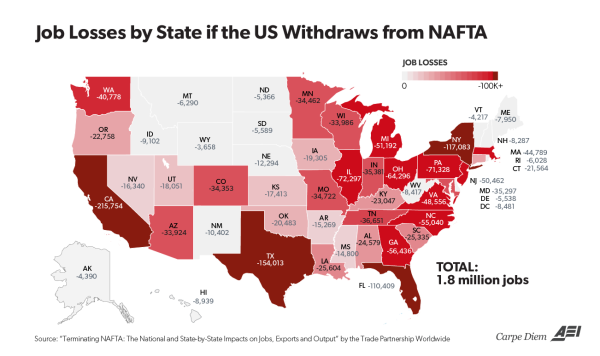

This study calculated the economic damage in each state, including estimated job losses.

Mark Perry of the American Enterprise Institute put that data into a map.

Let’s close with Veronique de Rugy of the Mercatus Center, who echoes the observation that Trump may be about to sabotage the benefits of tax reform by throwing sand in the gears of international trade.

…for the first time in decades. U.S.-based businesses can now compete against their foreign counterparts without starting from an immediate disadvantage… The change should result in faster growth, higher wages and more jobs. Unfortunately, those gains may be undone this year with a wrong step on trade.

…NAFTA has benefited American business. …But ramping up economic protectionism would undermine these gains and harm the economy. Many U.S. manufacturers have global supply chains, meaning they import materials and other inputs, even if the final product might then be exported. Raising the prices of these goods with tariffs makes it harder for U.S.-based businesses to compete. …Canada and Mexico are our top trading partners. If they were to increase foreign tariffs on U.S.-manufactured goods — absent a free trade pact or as retaliation for new tariffs imposed by Trump — that would significantly harm U.S. exporters.

So why is Trump threatening to do something so foolish?

Based on his public statements, he simply doesn’t understand trade. He thinks it is a contest between countries and whichever one has a trade surplus is the winner. And to fix this supposed problem, he wants to wreck NAFTA unless politicians and bureaucrats somehow have the power to dictate equal levels of trade (sort of like the way class-warfare advocates want to dictate equal levels of income).

This is wrong on many levels.

- There is zero evidence that a trade deficit is an indication of economic weakness. Indeed, since wealthier people can afford to buy more goods and services than poor people, a trade deficit oftentimes is a sign that a nation has a prosperous economy.

- Moreover, the flip side of a trade deficit is a capital surplus. In other words, foreigners who earn dollars by selling to consumers in the United States sometimes decide that investing in America is the best use of those dollars. That’s a positive indicator.

- Last but not least, it’s worth noting that countries don’t trade. Instead, trade is between consumers and businesses and those transaction are – by definition – mutually beneficial. Interfering with those transactions is pernicious government intervention.

The bottom line is that I’m still waiting for someone to successfully answer my eight questions for protectionists.

P.S. Unlike the current president, Reagan had the right approach.