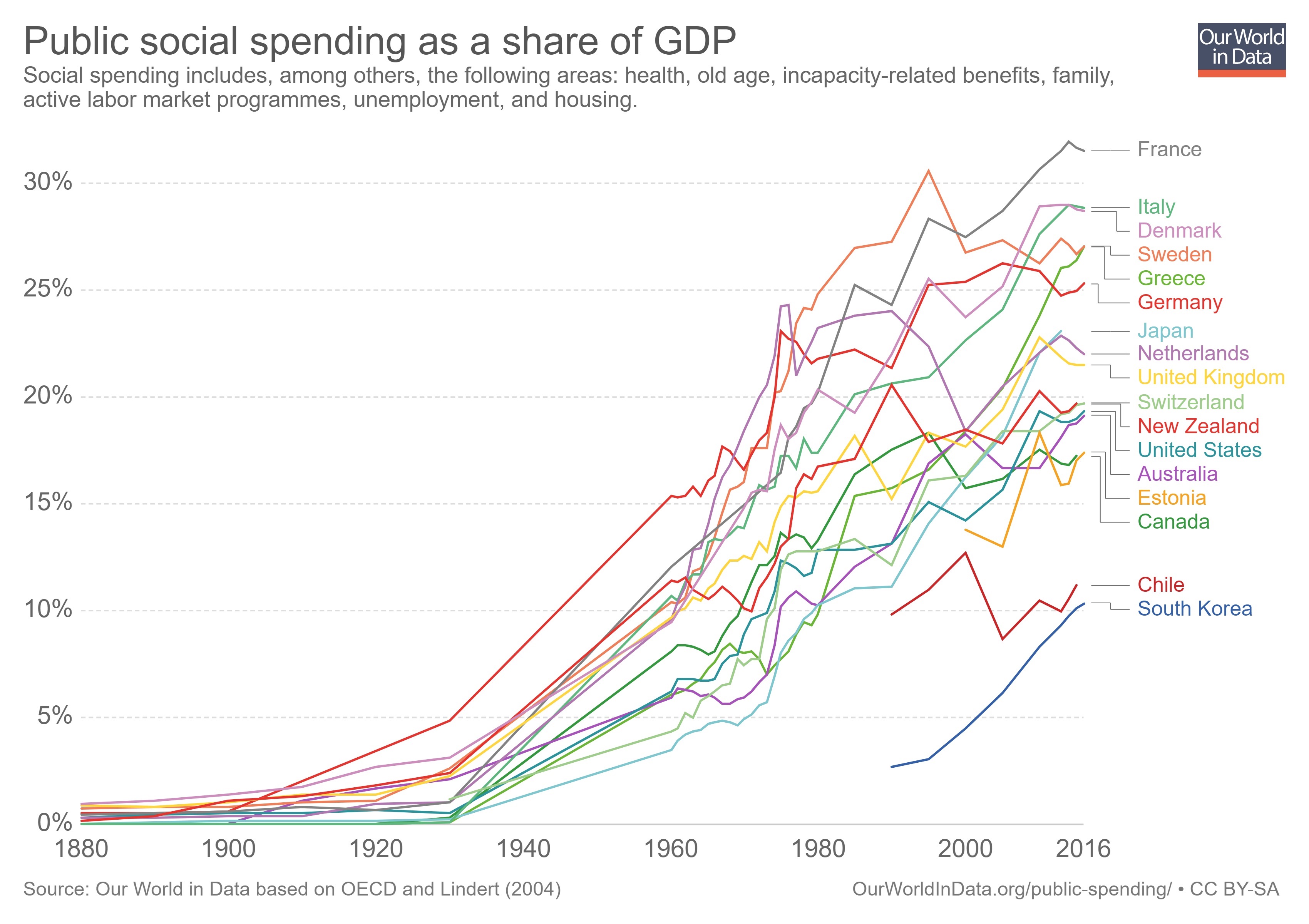

Last week, I shared very grim data, going all the way back to 1880, on the growth of the welfare state.

I even claimed that the accompanying graph was the “western world’s most depressing chart” because it showed the dramatic increase in the burden of government spending for redistribution programs.

I even claimed that the accompanying graph was the “western world’s most depressing chart” because it showed the dramatic increase in the burden of government spending for redistribution programs.

And I didn’t even mention that the numbers likely will get even worsebecause of changing demographics.

Now it’s time for the western world’s second-most depressing chart. Like the first chart, the data for this second chart comes from “Our world in data,” only this time it shows the relentless and astounding (in a depressing way) expansion in tax burdens starting in 1868. It only shows four countries, but other western nations would show the same pattern.

What isn’t shown in this chart is that the tax burden used to be reasonable because governments generally did not have income taxes.

The United Kingdom was an early adopter, but France, Sweden, and the United States didn’t impose that onerous levy until the 1900s. And it’s no coincidence that the tax burden exploded once politicians learned to exploit that source of revenue.

An obvious lesson is that it is never a good idea to give politicians a new source of revenue. We see in the above chart what happened once nations imposed income taxes. We’ve also seen increases in fiscal burdens in nations that imposed value-added taxes (which is why Americans should fight to their dying breaths before allowing that levy in the United States).

From the perspective of politicians, they like new sources of revenue because that increases “tax capacity,” which is an Orwellian term that describes their ability to grab more money from the economy’s productive sector.

And here’s another chart from “Our world in data” showing how income taxes and VATs (along with income-tax withholding) have become ubiquitous.

Very depressing trends. Reminds me of the biased grading of tax regimes from the World Bank.

Let’s close with the tiny bit of good news from the website. Here’s a chart showing how top rates for the personal income tax dropped substantially between 1979 and 2002.

This happened, needless to say, because of tax competition. As globalization expanded, it became easier and easier for taxpayers to move themselves and/or their money from high-tax nations to low-tax jurisdictions.

Politicians thus were forced to lower tax rates so the geese with the golden eggs didn’t fly away.

Sadly, updated versions of this chart now show top tax rates heading in the wrong direction, in large part because tax havens have been weakened and politicians no longer feel as much competitive pressure.