I strongly applauded the tax reform plan that was enacted in December, especially the lower corporate tax rate and the limit on the deduction for state and local taxes.

But I’m not satisfied. Our long-run goal should be fundamental tax reform. And that means replacing the current system with a simple and fair flat tax.

And the recent tax plan only took a small step in that direction. How small? Well, the Tax Foundation just calculated that it only improved the United States from #30 to #25 in their International Tax Competitiveness Ranking. In other words, we have a long way to go before we catch up to Estonia.

It’s possible, of course, to apply different weights and come up with a different list. I think the Tax Foundation’s numbers could be improved, for instance, by including a measure of the aggregate tax burden. And that presumably would boost the U.S. score.

But the fact would remain that the U.S. score would be depressingly low. In other words, the internal revenue code is still a self-imposed wound and huge improvements are still necessary.

That’s why we need another round of tax reform, based on the three core principles of good tax policy.

- Lower tax rates

- Less double taxation

- Fewer loopholes

But how is tax reform possible in a fiscal environment of big government and rising deficits?

This is a challenge. In an ideal world, there would be accompanying budget reforms to save money, thus creating leeway for tax reform to be a net tax cut.

But even in the current fiscal environment, tax reform is possible if policymakers finance pro-growth reforms by closing undesirable loopholes.

Indeed, that’s basically what happened in the recent tax plan. The lower corporate rate was financed by restricting the state and local tax deduction and a few other changes. The budget rules did allow for a modest short-run tax cut, but the overall package was revenue neutral in the long run (i.e., starting in 2027).

Indeed, that’s basically what happened in the recent tax plan. The lower corporate rate was financed by restricting the state and local tax deduction and a few other changes. The budget rules did allow for a modest short-run tax cut, but the overall package was revenue neutral in the long run (i.e., starting in 2027).

It’s now time to repeat this exercise.

The Congressional Budget Office periodically issues a report on Budget Options, which lists all sort of spending reforms and tax increases, along with numbers showing what those changes would mean to the budget over the next 10 years.

I’ve never been a huge fan of this report because it is too limited on the spending side. You won’t find fleshed-out options to shut down departments, for instance, which is unfortunate given the target-rich environment (including Transportation, Housing and Urban Development, Education, Energy, and Agriculture).

And on the tax side, it has a lengthy list of tax hikes, generally presented as ways to finance an ever-expanding burden of government spending. The list must be akin to porn for statists like Bernie Sanders.

It includes new taxes.

And it includes increases in existing taxes.

- Higher gas taxes

- More onerous depreciation rules

- Busting the cap on taxable earnings for Social Security

- Expanded death tax

- Higher capital gains taxes on “carried interest“

- Higher capital gains taxes on everything else

- More double taxation of investment

- More double taxation of savings

- Increasing top tax rates

But the CBO report also includes some tax preferences that could be used to finance good tax reforms.

Here are four provisions of the tax code that should be the “pay-fors” in a new tax reform plan.

We’ll start with two that are described in the CBO document.

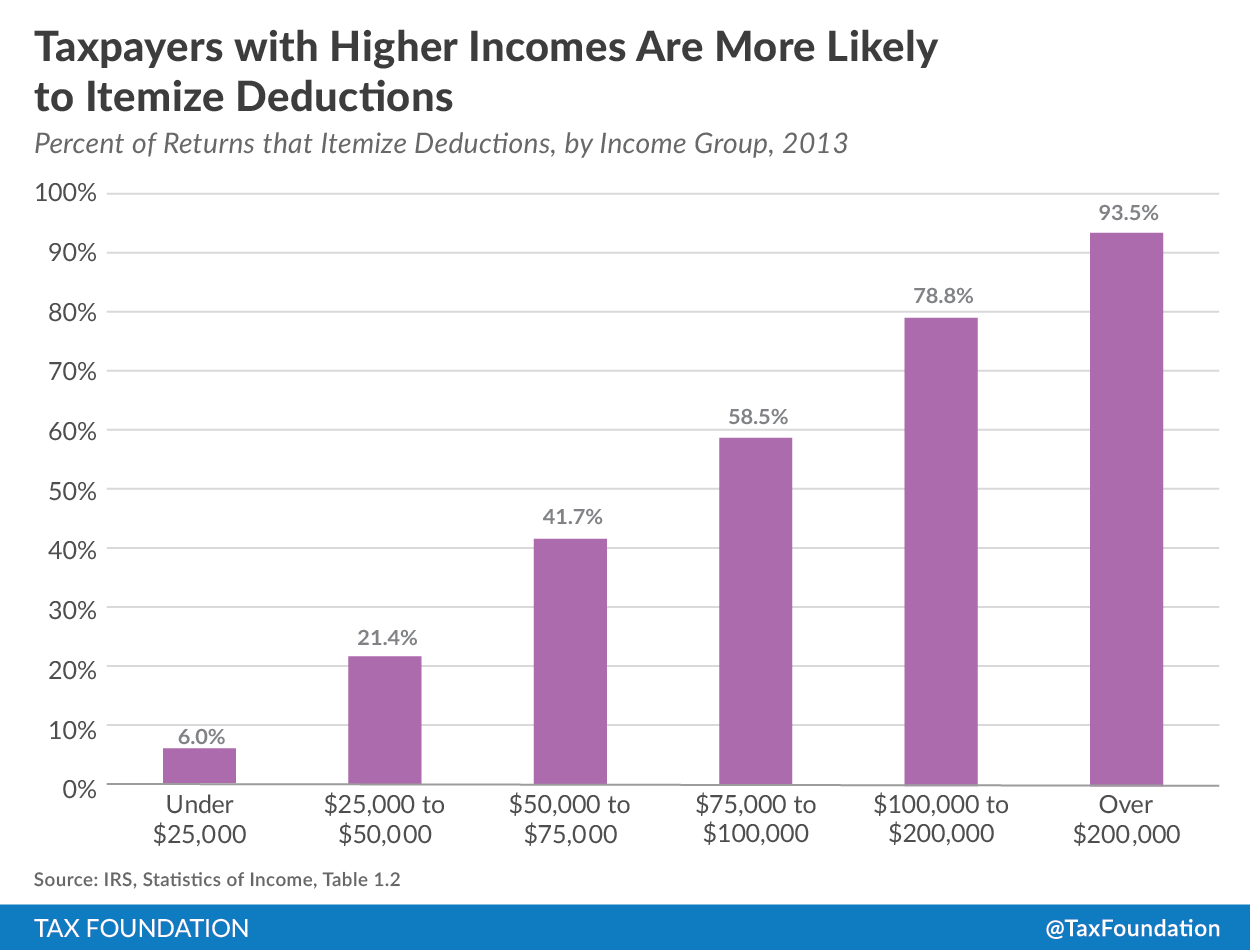

Further reductions in itemized deductions– The limit on the state and local tax deduction should be the first step. The entire deduction could be repealed as part of a second wave of tax reform. And the same is true for the home mortgage interest deduction and the charitable contributions deduction.

Further reductions in itemized deductions– The limit on the state and local tax deduction should be the first step. The entire deduction could be repealed as part of a second wave of tax reform. And the same is true for the home mortgage interest deduction and the charitable contributions deduction.

Green-energy pork – The House version of tax reform gutted many of the corrupt tax preferences for green energy. Unfortunately, those changes were not included in the final bill. But the silver lining to that bad decision is that those provisions can be used to finance good reforms in a new bill.

Surprisingly, the CBO report overlooks or only gives cursory treatment to a couple of major tax preferences that each could finance $1 trillion or more of pro-growth changes over the next 10 years.

Municipal bond interest – Under current law, there is no federal tax on the interest paid to owners of bonds issued by state and local governments. This “muni-bond” loophole is very bad tax policy since it creates an incentive that diverts capital from private business investment to subsidizing the profligacy of cities like Chicago and states like California.

Healthcare exclusion – Current law also allows a giant tax break for fringe benefits. When companies purchase health insurance plans for employees, that compensation escapes both payroll taxes and income taxes. Repealing – or at least capping – this exclusion could raise a lot of money for pro-growth reforms (and it would be good healthcare policy as well).

What’s potentially interesting about the four loopholes listed above is that they all disproportionately benefit rich people. This means that if they are curtailed or repealed and the money as part of tax reform, the left won’t be able to argue that upper-income taxpayers are getting unfair benefits.

Actually, they’ll probably still make their usual class-warfare arguments, but they will be laughably wrong.

The bottom line is that we should have smaller government and less taxation. But even if that’s not immediately possible, we can at least figure out revenue-neutral reforms that will produce a tax system that does less damage to growth, jobs, and competitiveness.