I’m not a fan of President Bush. The first one or the second one.

Both adopted policies that, on net, reduced economic liberty.

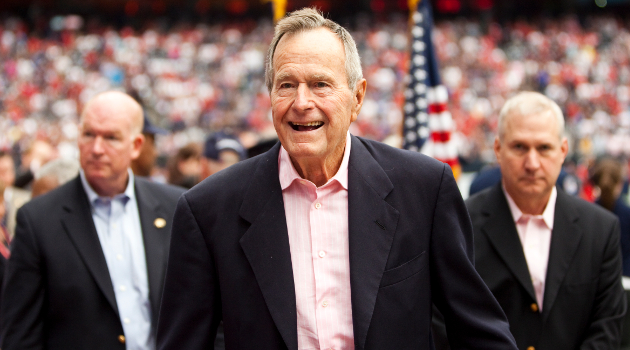

Today, let’s focus on the recently deceased George H.W. Bush (a.k.a., Bush 41). By all accounts, he was a very good man, but that doesn’t mean he was a very good president. Or even a mildly good one.

Steve Moore’s column in the Washington Times is a damning indictment of his infamous read-my-lips tax betrayal.

Liberals love George H.W. Bush for the very tax increase betrayal that destroyed his presidency. …This was not just the political blunder of the half-century, it was a fiscal policy catastrophe. …What the history books are writing is that Mr. Bush showed political “courage” in breaking his “Read my lips: No new taxes” pledge, and he was thrown out of office for doing the right thing.

Wrong. The quick story is that the Reagan expansion — in no small part due to the reduction of the highest tax rates from 70 percent to 28 percent — was shrinking deficit spending dramatically by the end of Ronald Reagan’s presidency. The budget deficit had fallen in half down to 2.9 percent of GDP by 1988. It was headed to below 2 percent if Mr. Bush simply had did nothing. …the 1990 budget deal became a license for Democrats to spend and spend. …Government expenditures accelerated at a faster pace than at any time in 30 years. In two years time, the domestic budget grew by almost 20 percent above inflation. …The tax increases either caused the recession or exacerbated it — ending the Reagan expansion. The economy lost 100,000 jobs and the unemployment rate rose and the unemployment rate rose from 5.5 percent to 7.4 percent. Real disposable income fell from 1990 to the eve of the 1992 election. If this tax hike was a success, so was the Hindenburg.

There’s a lot of good analysis in Steve’s column.

But I want to emphasize the part about the budget deficit being on a downward trajectory when Reagan left the White House.  That’s absolutely accurate, as confirmed by both OMB and CBO projections.

That’s absolutely accurate, as confirmed by both OMB and CBO projections.

All Bush needed to do was maintain the Gipper’s pro-market policies.

Unfortunately, he decided that “kinder and gentler” meant putting Washington first and giving politicians and bureaucrats more power over the economy.

And not just on fiscal policy.

Jim Bovard points out in USA Today that Bush 41 also had some very unseemly bouts of protectionism.

Bush was the most protectionist president since Herbert Hoover. Like Trump, he spoke of the need for level playing fields and fair trade. But Bush-style fairness gave federal bureaucrats practically endless vetoes over Americans’ freedom to choose foreign goods. Bush’s Commerce Department ravaged importers

with one bureaucratic scam after another, using the dumping law to convict 97 percent of imports investigated, claiming that their prices were unfairly low to American producers (not consumers). Bush also ordered the U.S. International Trade Commission to investigate after ice cream imports threatened to exceed one percent of the U.S. market. And he perpetuated import quotas on steel and machine tools. …he slapped new textile import quotas on Nigeria, Indonesia, Egypt, the Philippines, Burma (now Myanmar), Costa Rica, Panama, Pakistan and many other nations. Mexico was allowed to sell Americans only 35,292 bras in 1989 — part of a byzantine regime that also restricted imports of tampons, typing ribbons, tarps, twine, table linen, tapestries, ties and thousands of other products.

To be fair, George H.W. Bush played a key role in moving forward NAFTA and the WTO/GATT, so his record on trade is mixed rather than bad.

Let’s return to the tax issue. Alan Reynolds explains that the Bush 41 tax hike was a painful example of the Laffer Curve in action.

The late President G.H.W. Bush famously reneged on his “no new taxes” pledge… The new law was intended to raise more revenue from high-income households and unincorporated businesses. It was supposed to raise revenue partly by raising the top tax rate from 28% to 31% but more importantly by phasing-out deductions and personal exemptions…

Treasury estimates expected revenues after the 1990 budget deal to be higher by a half-percent of GDP. What happened instead is that revenues fell from 17.8% of GDP in 1989 to 17.3% in 1991, and then to 17% in 1992 and 1993. Instead of rising from 17.8% of GDP to 18.3% as initial estimates assumed, revenues fell to 17%. …A recession began in October 1990, just as the intended tax increase was being enacted. To blame the weak revenues of 1991-93 entirely on that brief recession begs the obvious question: To what extent was a recession that began with a tax increase caused or at least worsened by that tax increase? …When discussing tax increases (or tax cuts), journalists and economists must take care to distinguish between intended effects on revenue and actual effects.

We’ll never know, of course, how the 1990 tax increase impacted the economy. As a general rule, I think monetary policy is the first place to look when assigning blame for downturns.

But there’s no question that the tax increase wasn’t helpful.

wasn’t helpful.

That being said, my biggest complaint about Bush 41 was not his tax increase. It was all the new spending.

Not just new spending in general. What’s especially galling is that he allowed domestic spending to skyrocket. Almost twice as fast as it increased under Obama and more than twice the rate of increase we endured under Clinton and Carter.

The opposite of Reaganomics, to put it mildly.