I’ve been in China this week, giving lectures about economic policy at Northeastern University in Shenyang.

I’ve explained that China has enjoyed reasonably impressive growth in recent decades thanks to pro-market reforms. But I’ve also pointed out that further economic liberalization is needed if China wants to avoid the middle-income trap.

That won’t be easy. Simply stated, I don’t think it’s possible to become a rich nation without free markets and small government.

The good news is that China’s economic freedom score has increased dramatically since reforms began, rising from 3.64 in 1980 to 6.40 in the latest edition of Economic Freedom of the World. And there’s been a dramatic increase in prosperity and a dramatic reduction in poverty.

The good news is that China’s economic freedom score has increased dramatically since reforms began, rising from 3.64 in 1980 to 6.40 in the latest edition of Economic Freedom of the World. And there’s been a dramatic increase in prosperity and a dramatic reduction in poverty.

The bad news is that a score of 6.40 means that China is only ranked #112 in the world. That’s way too low. The country needs a new burst of pro-market reform (especially since it also faces serious demographic challenges in the not-too-distant future).

In other words, China should strive to be more like #1 Hong Kong, which has a score of 8.97, or #4 Switzerland, with a score of 8.44.

Or even the #11 United States, which has a score of 7.94, or also #19 Netherlands, with a score of 7.74.

Or even the #11 United States, which has a score of 7.94, or also #19 Netherlands, with a score of 7.74.

The bottom line is that China won’t become a rich nation so long as it has a score of 6.40 and a ranking of #112.

Fortunately, there is a pre-existing recipe for growth and prosperity. China needs to change the various policies that undermine competitiveness.

Since I’m a public finance economist, I told the students how China’s fiscal score (“size of government”) could be improved.

I recommended a spending cap, of course, but I also said the tax system needed reform to enable more prosperity.

Part of tax reform is low marginal tax rates on productive behavior.

Chinese academic experts agree. As reported by the South China Morning Post, they’re urging the government to significantly reduce the top rate of the personal income tax.

China needs to slash its highest tax levy on the nation’s top income earners in its upcoming individual tax code review, or risk seeing an unprecedented

talent exodus, argued eight academics… They called for authorities to scrap the top two tax brackets of 35 per cent and 45 per cent in the current seven brackets progressive tax system on individuals, granting high income earners more leeway with a five tax brackets system that will be capped at 30 per cent.

The scholars pointed out that high tax rates are especially harmful in a world where high-skilled people have considerable labor mobility.

The academics from esteemed mainland universities called for further revision of the code, as the current draft failed…high income earners, a group that is often highly skilled professionals China wants to attract and retain in the global fight for talent. …For the “highly intelligent groups”, remunerations and royalties were likely to surpass the monthly salary, meaning that the combination can add up to a higher taxable income base and “seriously restrain them from” pursuing innovation, the academics argued. “In a global environment [when tax cuts become mainstream], if China maintains its high individual income tax rates … it will push the high-income, high-intelligent group overseas,” they said.

Needless to say, I’ll be very curious to see what happens. I’ve now been to China several times and I think the country has huge potential.

But achieving that potential requires reforms that will reduce the size and scope of government.

Here’s a chart I shared with the students, which shows that Taiwan has much more economic freedom and is much richer (basically an updated version of some numbers I put together in 2014).

The bottom line is that the country can become a genuine “Chinese Tiger” rather than a “paper tiger” with the right policies.

P.S. Some people actually think China should become more statist. Both the Organization for Economic Cooperation and Development and the International Monetary Fund have urged staggering tax increases in China.

———

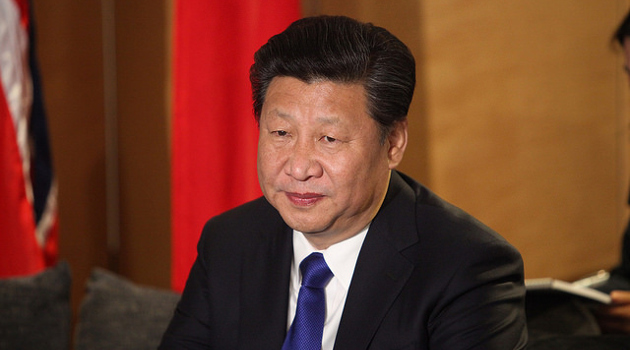

Image credit: Foreign and Commonwealth Office | CC BY 2.0.