Here are three things I’ve written about tax policy. See if you can detect a pattern:

I’ve written that I don’t want a value-added tax because the money would be used to finance bigger government.

I’ve written that I don’t want a value-added tax because the money would be used to finance bigger government.- I’ve also explained I don’t want a carbon tax because the revenue from such a levy would finance bigger government.

- I’ve given thumbs down to financial transactions taxes as well because I don’t want to finance bigger government.

Just in case it’s not obvious, the common theme is that I don’t want to give politicians new sources of revenue that would be used to expand the burden of government spending.

Some of my technocrat friends get upset by these writings. They argue, often correctly, that some of these taxes are not as destructive as the current tax code.

My response is that they’re making an irrelevant argument. Politicians who advocate the above taxes are not proposing to eliminate the income tax and repeal the 16th Amendment. Instead, they simply want to levy a new tax without fully repealing the awful system that already exists.

And now there’s a new tax idea gaining steam.

The Task Force on Fiscal Policy for Health…will examine the evidence on excise tax policy for health, including barriers to implementation, and make recommendations on how countries can best leverage fiscal policies to yield improved health outcomes for their citizens with the added benefit of bringing in additional revenue.

For readers who aren’t familiar with DC bureaucrat-speak, “leverage fiscal policies” means higher taxes. More specifically, advocates want higher “sin taxes” on unhealthy food and drink.

This Task Force is being spearheaded by Larry Summers (yes, that Larry Summers) and Mike Bloomberg (yes, that Mike Bloomberg), so it’s no surprise that this pair of leftists view “additional revenue” as an “added benefit.”

While my focus is on the negative fiscal and economic consequences of higher taxes and more spending, it’s worth pointing out the moral and practical argument against sin taxes.

Bill Wirtz, in a column for CapX, warns that nanny-state policies treat people as infants.

2017 has seen yet another increase in lifestyle regulations and sin taxes… Historically, it was social conservatives pushing for this kind of meddling. …How different is today’s excruciatingly irritating public health lobby…?

Food and non-alcoholic drinks are…under fire, and blamed for a range of health issues. France and Ireland are now cracking down on that scourge on society: fizzy drinks. Ireland introduced a new tax on sugary drinks, while France increased the tax created in 2012 under French president Nicolas Sarkozy. Such policies are highly regressive… When Denmark introduced its controversial tax on fatty foods, consumers simply switched to cheaper – but equally unhealthy – alternatives. The country’s diet did not improve. …We are adults and we sometimes make decisions for ourselves which are unhealthy. The answer is for us to moderate our consumption, not quasi-prohibition. It’s time to stop infantilising the…consumer.

Charles Hughes of the Manhattan Institute reviews what happened with a new sin tax on sweetened beverages in Seattle.

Seattle recently became the latest major city to enact a sweetened beverage tax. …customers are reeling from sticker shock. One local reporter found that the tax added $10.34 to a case of Gatorade, bringing the final price to more than $26.00.

…One of the justifications for beverage taxes is that customers will respond to price changes by reducing consumption of taxed beverages. The mechanism here is straightforward: tax something to get less of it. If people were to substitute diet sodas or other, less-harmful beverages for sugared sodas, they would be healthier.

But will such a policy work?

Many people are likely to avoid the tax by traveling to other untaxed locations to purchase groceries. Costco tells its customers about locations outside the city that are not subject to the beverage tax. …so the tax will have limited success in its health-related goals while also harming local businesses and failing to generate revenue.

Yet the fact the tax will be a failure at generating revenue isn’t stopping the city was squandering the money.

…revenue has already been allocated to a smorgasbord of causes, ranging from $500,000 for displaced worker retraining, to more than $1 million in tax administration costs, to vouchers to purchase fruits and vegetables.

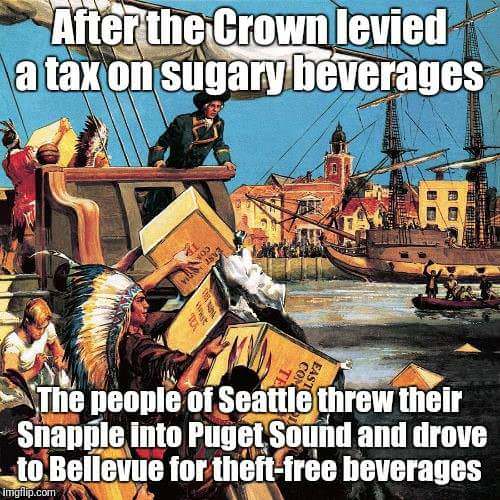

While I’m glad consumers are escaping the tax by buying beverages from outside the city’s borders, in an ideal world, they would react in a bolder fashion.

If nothing else, the pro-tax crowd has a very elastic definition of sin.

They even want to tax meat.

Move over, taxes on carbon and sugar: the global levy that may be next is meat. Some investors are betting governments around the world will find a way to start taxing meat production…

Meat could encounter the same fate as tobacco, carbon and sugar, which are currently taxed in 180, 60, and 25 jurisdictions around the world, respectively, according to a report Monday from investor group the FAIRR (Farm Animal Investment Risk & Return) Initiative. Lawmakers in Denmark, Germany, China and Sweden have discussed creating livestock-related taxes in the past two years.

By the way, the supposed Conservative Party in the United Kingdom is pushing sin taxes to finance bigger government.

The sugar tax was announced by Chancellor Philip Hammond in his budget statement in 2017. He said the money raised as part of the levy would go to the Department for Education.

The former Chancellor said the new levy would be put on drinks companies and they would be taxed according to how much sugar was in their beverages. Two categories of taxation are set to come into force. One on the total sugar content on drinks with more than 5g per 100ml and a higher levy for drinks with 8g per 100ml or more. …The new tax could whack up the cost of a 2 litre bottle of Coca-Cola (10.6g per 100ml) by as much as 48p.

The nanny-state crowd complains that this isn’t enough.

Health campaigners have said the fizzy drinks tax should be extended to cover all chocolate, sweets and other confectionery containing the highest levels of sugar. …Action on Sugar is urging a mandatory levy set at a minimum of 20 per cent on all confectionery products that contain high levels of sugar.

Politicians in other nations also are using this excuse to extract more money from the citizenry.

Other countries have introduced similar measures and have seen some success in reducing the drinking of fizzy drinks. Mexico introduced a 10 per cent tax on sugary drinks in 2014 and saw a 12 per cent reduction over the first year. Hungary brought in a tax on the drinks companies and saw a 40 per cent decrease in the amount of sugar in the products. Brits will be joining some of our European neighbours with the move with similar measures in place on drinks in France and Finland and the Norwegians chocolate tax.

Let’s sum this up. The case against sin taxes is based on two simple principles.

- Politicians want to seize more of our money in order to have greater ability to buy votes.

Saying no to tax increases is a necessary (though sadly not sufficient) condition for good fiscal policy.

Saying no to tax increases is a necessary (though sadly not sufficient) condition for good fiscal policy. - Politicians want to tell us how to live our lives. But that’s not their job, even in cases where I agree with the underlying advice. Coerced good behavior is not a sign of virtue.

The bottom line is that some proponents of sin taxes presumably have their hearts in the right place. But they need their brains in a good place as well. If they want to be taken seriously, at the very least they should match their proposed sin taxes with permanent repeal of an existing tax of similar magnitude.

For example, offer to trade a sugar tax for repeal of the death tax. Or suggest a fat tax accompanied by the elimination of the capital gains tax.

Until we see such offers, advocates of sin taxes should be met with unyielding opposition.

———

Image credit: Marlith | CC BY-SA 3.0.