I’ve warned many times that Italy is the next Greece.

Simply stated, there’s a perfect storm of bad news. Government is far too big, debt is too high, and the economy is too sclerotic.

I’ve always assumed that the country would suffer a full-blown fiscal crisis when the next recession occurs. At that point, tax receipts will fall because of the weak economy and investors will realize that the nation no longer is able to pay its bills.

I’ve always assumed that the country would suffer a full-blown fiscal crisis when the next recession occurs. At that point, tax receipts will fall because of the weak economy and investors will realize that the nation no longer is able to pay its bills.

But it may happen even sooner thanks to a spat between Italy’s left-populist government and the apparatchiks at the European Commission.

Here’s what you need to know. There are (poorly designed) European budget rules, known as the Maastricht Criteria, that supposedly require that nations limit deficits to 3 percent of GDP and debt to 60 percent of GDP.

With cumulative red ink totaling more than 130 percent of GDP, Italy obviously fails the latter requirement. And this means the bureaucrats at the European Commission can veto a budget that doesn’t strive to lower debt levels.

At least that’s the theory.

In reality, the European Commission doesn’t have much direct enforcement power. So if the Italian government tells the bureaucrats in Brussels to go jump in a lake, you wind up with a standoff. As the New York Times reports, that’s exactly what’s happened.

In what is becoming a dangerous game of chicken for the global economy, Italy’s populist government refused to budge on Tuesday after the European Union for the first time sent back a member state’s proposed budget

because it violated the bloc’s fiscal laws and posed unacceptable risks. …the commission rejected the plan, saying that it included irresponsible deficit levels that would “suffocate” Italy, the third-largest economy in the eurozone. Investors fear that the collapse of the Italian economy under its enormous debt could sink the entire eurozone and hasten a global economic crisis unseen since 2008, or worse. But Italy’s populists are not scared. They have repeatedly compared their budget, fat with unemployment welfare, pension increases and other benefits, to the New Deal measures of Franklin D. Roosevelt.

Repeating the failures of the New Deal?!? That doesn’t sound like a smart plan.

That seems well understood, at least outside of Italy.

The question for Italy, and all of Europe, is how far Italy’s government is willing to go. Will it be forced into submission by the gravity of economic reality? Or will Italian leaders convince their voters that the country’s financial health is worth risking in order to blow up a political and economic establishment that they say is stripping Italians of their sovereignty? And Brussels must decide how strict it will be. …the major pressure on Italy’s budget has come from outside Italy. Fitch Ratings issued a negative evaluation of the budget, and Moody’s dropped its rating for Italian bonds to one level above “junk” last week.

So now that Brussels has rejected the Italian budget plan, where do things go from here?

According to CNBC, the European Commission will launch an “Excessive Deficit Procedure” against Italy.

…a three-week negotiation period follows in which a potential agreement could be found on how to lower the deficit (essentially, Italy would have to re-submit an amended draft budget). If that’s not reached, punitive action could be taken against Italy. Lorenzo Codogno, founder and chief economist at LC Macro Advisors, told CNBC…

“it’s very likely that the Commission will, without making a big fuss, will move towards making an ‘Excessive Deficit Procedure’…to put additional pressure on Italy…” Although it has the power to sanction governments whose budgets don’t comply with the EU’s fiscal rules (and has threatened to do so in the past), it has stopped short of issuing fines to other member states before. …launching one could increase the already significant antipathy between Brussels and a vociferously euroskeptic government in Italy. Against a backdrop of Brexit and rising populism, the Commission could be wary of antagonizing Italy, the third largest euro zone economy. It could also be wary of financial market nerves surrounding Italy from spreading to its neighbors… Financial markets continue to be rattled over Italy’s political plans. …This essentially means that investors grew more cautious over lending money to the Italian government.

For those who read carefully, you probably noticed that the European Commission doesn’t have any real power. As such, there’s no reason to think this standoff will end.

The populists in Rome almost certainly will move forward with their profligate budget. Bureaucrats in Brussels will complain, but to no avail.

Since I’m a nice guy, I’m going to give the bureaucrats in Brussels a much better approach. Here’s the three-sentence announcement they should make.

- The European Commission recognizes that it was a mistake to centralize power in Brussels and henceforth will play no role is overseeing fiscal policy in member nations.

- The European Commission (and, more importantly, the European Central Bank) henceforth will have a no-bailout policy for national governments, or for those who lend to national governments.

- The European Commission henceforth advises investors to be appropriately prudent when deciding whether to lend money to any government, including the Italian government.

From an economic perspective, this is a far superior approach, mostly because it begins to unwind the “moral hazard“that undermines sound financial decision making in Europe.

To elaborate, investors can be tempted to make unwise choices if they think potential losses can be shifted to taxpayers. They see what happened with the various bailouts in Greece and that tells them it’s probably okay to continue lending money to Italy. To be sure, investors aren’t totally blind. They know there’s some risk, so the Italian government has to promise higher interest payments

But it’s highly likely that the Italian government would have to pay even higher rates if investors were convinced there would be no bailouts. Incidentally that would be a very good outcome since it would make it more costly for Italy’s politicians to continue over-spending.

In other words, a win-win situation, with less debt and more prudence (and maybe even a smaller burden of government!).

My advice seems so sensible that you’re probably wondering if there’s a catch.

There is, sort of.

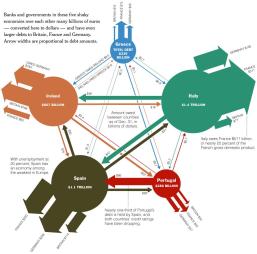

When I talk to policy makers, they generally agree with everything I say, but then say my advice is impractical because Italy’s debt is so massive.  They fret that a default would wipe out Italy’s banks (which imprudently have bought lots of government debt), and might even cause massive problems for banks in other nations (which, as was the case with Greece, also have foolishly purchased lots of Italian government debt).

They fret that a default would wipe out Italy’s banks (which imprudently have bought lots of government debt), and might even cause massive problems for banks in other nations (which, as was the case with Greece, also have foolishly purchased lots of Italian government debt).

And if banks are collapsing, that could produce major macroeconomic damage and even lead/force some nations to abandon the euro and go back to their old national currencies.

For all intents and purposes, the Greek bailout was a bank bailout. And the same would be true for an Italian bailout.

In any event, Europeans fear that bursting the “debt bubble” would be potentially catastrophic. Better to somehow browbeat the Italian government in hopes that somehow the air can slowly be released from the bubble.

With this in mind, it’s easy to understand why the bureaucrats in Brussels are pursuing their current approach.

So where do we stand?

- In an ideal world, the problem will be solved because the Italian government decides to abandon its big-spending agenda and instead caps the growth of spending (as I recommended when speaking in Milan way back in 2011).

- In an imperfect world, the problem is mitigated (or at least postponed) because the European Commission successfully pressures the Italian government to curtail its profligacy.

- In the real world, though, I have zero faith in the first option and very little hope for the second option. Consider, for instance, the mess in Greece. For all intents and purposes, the European Commission took control of that nation’s fiscal policy almost 10 years ago. The results have not been pretty.

So this brings me back to my three-sentence prescription. Yes, it almost certainly would be messy. But it’s better to let the air out of bubbles sooner rather than later.

P.S. The so-called Basel Rules contribute to the mess in Europe by directing banks to invest in supposedly safe government debt.

P.P.S. If the European Union is going to impose fiscal rules on member nations, the Maastricht criteria should be jettisoned and replaced with a Swiss-style spending cap.

P.P.P.S. Some of the people in Sardinia have the right approach. They want to secede from Italy and become part of Switzerland. The Sicilians, by contrast, have the wrong mentality.