I’ve been in Prague the past few days for a meeting of the European Resource Bank. I spoke today about a relatively unknown international bureaucracy called the European Bank for Reconstruction and Development and I warned that it is going through a process of OECD-ization, which is simply my way of saying it is pursuing bad policy.

I’ll write about that issue in the near future, but today’s topic is based on a presentation from Michael Jäger of the Barvarian Taxpayers Association. He shared some depressing data on how the German government imposed a surtax for the ostensibly limited purpose of helping the finance the reunification of West Germany and East Germany.

But limited apparently means forever.

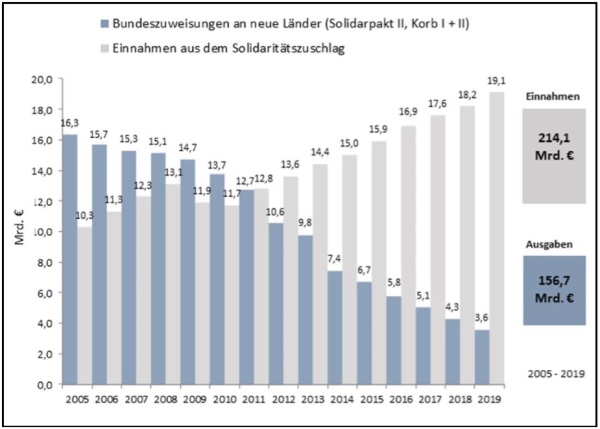

You’ll notice two things in the chart he shared.

- First, the German government has been the big winner from this new levy, collecting €214 billion euros over the past 15 years and spending less than €157 billion euros. In other words, the politicians now have a lot of extra loot to spend elsewhere.

- Second, revenues continue to rise even though the ostensible purpose of the tax is disappearing. Herr Jäger is pressuring the German government to eliminate the tax, but Frau Merkel apparently has little interest in reducing the nation’s tax burden.

To save non-German speakers from having to translate, the dark blue bars are “federal allocations to new states” and the light blue bars are “revenues from the solidarity surcharge.”

The big lesson to learn from this data is that temporary taxes are like temporary programs. They will last forever unless politicians somehow can be pressured to reduce their grip on the economy.

And that’s not easy, though I told some participants in the conference that it could be done. The United States government actually repealed a temporary telephone tax that was imposed to help finance the Spanish-American War.

That’s the good news.

The bad news is that the tax wasn’t repealed until last decade, more than 100 years after that war ended. I’m not joking.

Another painful lesson is that taxes on the rich often wind up penalizing other people. The Spanish-American War telephone tax was supposed to hit rich people since they were the ones who first utilized telephone technology.

But then the rest of us eventually got telephones as well, and we also had to pay the tax.

Just as the income tax was first imposed on just a tiny handful of very wealthy people, but it eventually morphed into a malignant tax code that now bedevils tens of millions of households with modest incomes.

Something to keep in mind when the crowd in Washington says we should have a value-added tax. Based on what’s happened in Europe, I guarantee it would just be a matter of time before that tax became more onerous to finance an ever-expanding burden of government spending.