What’s the worst government statistic, based on whether it distracts from sound thinking and encourages bad policy?

Well, I definitely think gross domestic income is a better measure than gross domestic product if we want insights on growth, so I’m not a big fan of GDP data.

I’m even less enthused about the Gini Coefficient because measures of inequality lead some people to mistakenly think of the economy as a fixed pie, or to falsely think that lots of income for a rich person somehow implies less income for the rest of us. And that then encourages some people to focus on redistribution (i.e., change how the pie is sliced) when it will be far better for the poor if policy makers focus on growth (i.e., expand the size of the pie).

But if you want to know the most unfortunate piece of economic data, I actually gave the answer to this question last year.

…the worst government statistic is the “trade deficit.”This is a very destructive piece of data because people instinctively assume a “deficit” is bad. Yet I have a trade deficit every year with my local grocery store. I’m always buying things from them and they never buy anything from me. Does that mean I’m a “loser”? Of course not. Voluntary exchange, by definition, means that both parties gain from any transaction. And this principle applies when voluntary exchange occurs across national borders.Moreover, people oftentimes don’t realize that the necessary and automatic flip side of a “trade deficit” is a “capital surplus.” In other words, when foreign companies acquire dollars by selling to American consumers, they frequently decide that investing in the American economy is the best use of that money. And the huge amount of investment from overseas is a sign of comparative prosperity and vitality, not a sign of weakness.

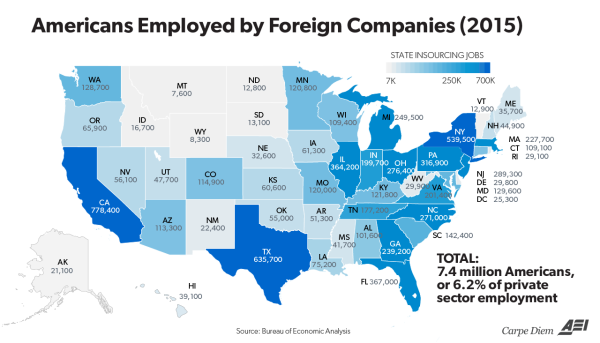

And we’re not talking chump change. Foreigners are “voting with their dollars”  by making huge investments in the American economy.

by making huge investments in the American economy.

According the Commerce Department data, the value of these investments is now well above $10 trillion. Yes, that trillion with a “t.”

That’s something we should celebrate. But you don’t have to believe me.

Let’s see what other have to say, starting with Professor Walter Williams.

There cannot be a trade deficit in a true economic sense. Let’s examine this. I buy more from my grocer than he buys from me. That means I have a trade deficit with my grocer. My grocer buys more from his wholesaler than his wholesaler buys from him.

But there is really no trade imbalance, whether my grocer is down the street, in Canada or, God forbid, in China. Here is what happens: When I purchase $100 worth of groceries, my goods account (groceries) rises, but my capital account (money) falls by $100. For my grocer, it is the opposite. His goods account falls by $100, but his capital account rises by $100. Looking at only the goods account, we would see trade deficits, but if we included the capital accounts, we would see a trade balance. That is true whether we are talking about domestic trade or we are talking about foreign trade.

Of course, it’s not surprising that a scholar like Walter Williams is on the right side and puts forth sound arguments.

But it is a bit of a shock when an elected official does the same thing. So I was very impressed when I saw this column in the Washington Post from Senator James Lankford of Oklahoma.

…the administration has…emphasized its desire to reduce the trade deficit… This is a faulty assumption but one that has unfortunately found its way into mainstream political dialogue. Trade deficits are not always bad for U.S. workers and consumers.

Senator Lankford points out a very important reason why Americans buy more from Mexicans than vice-versa.

For starters, a powerful economy such as ours often runs a trade deficit because of the immense buying power of its people. Mexico’s average net per capita income is roughly $13,000, while the average U.S. household brings in more than $41,000 each year. Americans have a far greater capacity to buy goods than do consumers in Mexico. It should come as no surprise that we do exactly that.

But the Oklahoma lawmakers also echoes what others have said about capital flows.

Because we have the world’s largest economy and the strongest currency, more money comes into the United States than goes out. …this foreign cash…is a positive for our economy.

When a Canadian company decides to invest in a U.S.-based company, it increases our trade deficit. Similarly, when the Mexican government buys U.S. Treasury bonds (as most of the world does), the likelihood of an American trade deficit increases. Investments such as these are indicative of a strong economy. It should be an encouraging sign that we are by far the world’s largest receiver of foreign direct investment. Our trade deficit means, in part, that U.S. companies are considered to be a better investment than companies in other countries. More investment in American businesses means more jobs and higher wages for American workers.

Michael Strain of the American Enterprise Institute adds to the discussion.

Foreigners purchase U.S. stocks, bonds and currency. Foreigners invest directly in the United States… Generally speaking, this is good. It is a vote of confidence in the United States economy and, in some sense, in our nation as a whole. …we should think of foreign investment as increasing wages and economic growth by making workers and firms more productive.

But if President Trump succeeds in limiting the ability of Americans to buy from foreign producers, he will also limit the ability of foreigners to invest in America’s economic future.

…when the president and his administration attack the trade deficit, they are attacking foreign investment in the United States. …when we import capital from abroad, we run a trade deficit. Trade deficits and capital flows from abroad go hand in hand. …If the president wants to significantly reduce the trade deficit, he also wants to significantly reduce inflows of foreign capital. Waging a war on the trade deficit is waging a war on foreign investment.

…investing in the United States…is a very attractive proposition, which is…the main reason why we have trade deficits. Trade deficits are partly a question of consumer preference…but they are not mainly a question of consumer preference. They are mainly a question of investor preference — and investors prefer the United States,

which is why there is almost twice as much foreign direct investment in the United States as in China, even though China’s economy has grown at a much faster rate over the past 20 years. …When Walmart orders $1 million worth of flip-flops from a Chinese concern, those Chinese gentlemen receive 1 million delicious U.S. dollars, which they are very happy and grateful to have. But what can you do with U.S. dollars? You can buy stuff from U.S. companies or you can buy assets from sellers who take U.S. dollars, which ultimately means U.S.-based investments. …But it isn’t only the Chinese. The Japanese, the British, the Germans and the other Europeans, the Canadians, the Mexicans, and practically everybody else in the world with a little bit of coin to invest likes to buy American assets. And why wouldn’t they? The American economy is the most wondrous thing human beings have ever managed to do… Trade deficits don’t happen because the wily Japanese juke us on trade policy. They happen because intelligent people holding a fistful of dollars very often decide to forgo the consumption of American consumer goods in order to invest in American assets. In economics terms, what this means is that the trade deficit is a mirror image of the capital surplus.

By the way, there are two ways that foreigners invest in the American economy.

Most of their money is for “passive” or “indirect” investments, which is simply a way of saying that they buy lots of stocks and bonds.

Those investments are very important for our economy. As I wrote just a few days ago, investment is what leads to productivity growth, and that’s how we earn higher wages and get higher living standards.

But foreigners also engage in “direct” investments, such as BMW building a factory in South Carolina. Mark Perry of the American Enterprise Institute points out that this also is a recipe for lots of job creation.

Since I’ve shared a lot of information on why a capital surplus is good, I supposed I should share some information explaining why protectionism is bad.

We’ll start with a column from the Wall Street Journal that looks at the impact of protectionist policies in Brazil and Argentina.

For decades, South America’s two largest economies have tried to shield their workers from global trade, largely through high tariffs and regulations that promote domestic production over imports. The World Bank ranks Argentina and Brazil among the world’s most closed big economies.

…These protectionist policies have…come at a huge cost to consumers, who now pay higher prices, and to taxpayers, who underwrite the subsidies. …air conditioners and other products are…sold for two to three times the market price of other countries. The cost to Argentina’s taxpayers of these jobs is steep: up to $72,000 per factory worker a year… But for ordinary Argentines, the products’ price tag can be hefty. An unlocked Samsung J7 smartphone sells for $240 in the U.S. but costs nearly $500 in Buenos Aires. …Brazil’s long history of protectionism bred complacency… Consider Brazil’s auto industry, until recently one of the world’s 10 largest. Shielded for decades by high tariffs, it has devolved into a peddler of rinky-dink hatchbacks… And for Brazilian consumers, cars are far pricier: A new Volkswagen Gol Comfortline lists in Brazil at $15,231—nearly twice as much as in Mexico, which has low tariffs and an efficient car industry.

George Will looks at the cost of similar (but thankfully mostly in the past) policies in the United States.

…there are more than 45 million Americans in poverty, “stretching every dollar they have.” The apparel industry employs 135,000 Americans. Can one really justify tariffs that increase the price of clothing for the 45 million in order to save some of the 135,000 low-wage jobs? …A three-year, 15 percent tariff enabled domestic producers to raise their prices,

thereby raising the costs of many American manufacturers. By one estimate, each U.S. job “saved” cost $550,000 as the average bolt-nut-screw worker was earning $23,000 annually. …Ronald Reagan imposed “voluntary restraints” on Japanese automobile exports, thereby creating 44,100 U.S. jobs. But the cost to consumers was $8.5 billion in higher prices, or $193,000 per job created, six times the average annual pay of a U.S. autoworker. And there were job losses in sectors of the economy into which the $8.5 billion of consumer spending could not flow. …In 2012, Barack Obama boasted that “over a thousand Americans are working today because we stopped a surge in Chinese tires.” But this cost about $900,000 per job, paid by American purchasers of vehicles and tires. And the Peterson Institute for International Economics says that this money taken from consumers reduced their spending on other retail goods, bringing the net job loss from the job-saving tire tariffs to around 2,500.

Let’s close with some good news.

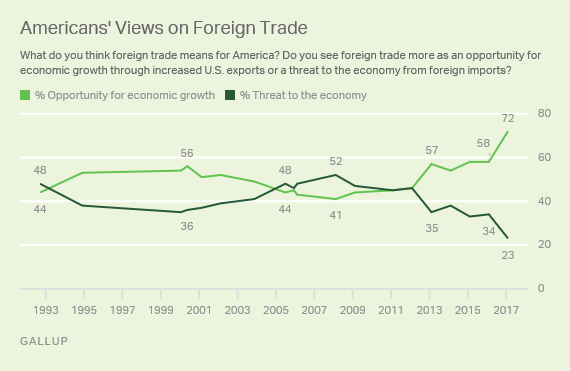

Here’s a poll showing that Americans are increasingly supportive of trade.

I don’t know why the numbers have improved so much since 2008, but I’m happy with the outcome.

And one of the big reasons I’m happy is that the global shift to more open trade has been very beneficial to the global economy.

Indeed, expanded openness to trade in the post-World War II era has helped offset the damage caused by a bigger fiscal burden.

And more trade has been very good for the poor, as Deirdre McCloskey explains in this video.

I’ll close by recycling my column that challenges protectionists with eight questions. I wrote that column also six years ago and I still haven’t received any good answers.