The Republican tax plan is based on some very attractive principles.

- Lowering the corporate tax rate.

- Ending the tax bias against new investment.

- Eliminating harmful loopholes.

- Reducing double taxation.

Unfortunately, the GOP isn’t planning to completely fix these policies, largely because there’s no commitment to control government spending. But any shift toward better tax policy will be good for the nation.

Another goal to add to the above list is that Republicans want to create a level playing field for American-based firms by replacing “worldwide taxation” of business income with “territorial taxation” of business income.

for American-based firms by replacing “worldwide taxation” of business income with “territorial taxation” of business income.

For those who have wisely avoided the topic of international business taxation, here’s all you need to know: Worldwide taxation means a company that earns income in another country is taxed both by the government where the income is earned and by the government back home. Territorial taxation, by contrast, is simply the common-sense notion that income is taxed only by the government where the income is earned.

In a column for the Wall Street Journal, two authors explain how America’s anti-competitive system of worldwide taxation undermines U.S.-domiciled companies.

…earlier this month Iconix , the U.S.-based company that owns the rights to Charles Schulz’s comic characters, announced it will sell them to Canada’s DHX Media. That makes Charlie Brown America’s latest expatriate. It’s a clear signal that U.S. corporate taxes are nudging business elsewhere. …why? In part because the U.S. corporate tax system hampers U.S.-based businesses by subjecting them to world-wide taxation. Canada’s aggregate corporate taxes are about 10 percentage points lower. …America’s high corporate tax rate and its practice of taxing international income is out of step with the rest of the world. The solution is so clear even a cartoon character should grasp it: Cut tax rates and adopt a system for taxing international income that more closely resembles those used by the country’s international competitors.

Indeed, it’s worth noting that the entire “inversion” controversy only exists because of America’s worldwide tax regime.

Simply stated, American-domiciled multinationals have a big competitive disadvantage compared to their foreign rivals. So it’s understandable that many of them try to protect shareholders, workers, and consumers by arranging (usually through a merger) to become foreign companies.

Simply stated, American-domiciled multinationals have a big competitive disadvantage compared to their foreign rivals. So it’s understandable that many of them try to protect shareholders, workers, and consumers by arranging (usually through a merger) to become foreign companies.

That’s the bad news.

The good news is that the Republican tax reform plan ostensibly will shift America to a territorial tax system. As explained above, this is the sensible notion of letting other nations tax income earned inside their borders while the IRS would tax the income earned by companies in the United States.

This would be good for competitiveness, particularly since the United States is one of only a handful of nations that impose a worldwide tax burden on domestic firms.

This would be good for competitiveness, particularly since the United States is one of only a handful of nations that impose a worldwide tax burden on domestic firms.

But not everybody likes the idea of territorial taxation.

One reason for opposition is that some people see corporations primarily as sources of tax revenue. So when there are discussions of international tax, their mindset is nations should compete on grabbing the most money. I’m not joking.

European Union regulators’ tax crackdown on Amazon.com Inc. — like the EU’s case against Apple Inc. — should spur U.S. policy makers to address companies’ aggressive offshore tax-avoidance strategies before it’s too late, experts said.

…“Really, what we are seeing is a race by the different taxing jurisdictions to claim a share of the tax prize represented by the largely untaxed streams of income that U.S. multinationals have engineered for themselves,’’ said Ed Kleinbard, a professor at the University of Southern California and the former chief of staff for Congress’s Joint Committee on Taxation. “If the United States doesn’t join the race, it will just lose tax revenue to more aggressive host countries around the world.’’ The EU rulings “do make it clear that if we are not interested in protecting our corporate tax base, other countries will be more than happy to tax the income,’’ said Kimberly Clausing, a professor of economics at Reed College in Portland, Oregon.

Call me crazy, but I think American policymakers should be in a race to create jobs, boost investment, and increase wages. And that means doing the opposite of what these supposed experts want.

Unsurprisingly, left-wing groups also are opposed to territorial taxation. Here are some passages from a report published by the Hill.

One hundred organizations, including a number of progressive groups and labor unions, are urging Congress to reject a major international tax change proposed in Republicans’ framework for a tax overhaul. In a letter dated Monday, the groups speak out against the framework’s move toward a “territorial” tax system that would largely exempt American companies’ foreign profits from U.S. tax. …”Ending taxation of offshore profits would give multinational corporations an incentive to send jobs offshore, thereby lowering U.S. wages,” they wrote.

Both assertions in that excerpt are wrong and/or misleading.

First, territorial taxation doesn’t mean that profits are exempt from tax.  It simply means that the IRS doesn’t impose an additional layer of tax on income that already has been subject to the tax system of another country.

It simply means that the IRS doesn’t impose an additional layer of tax on income that already has been subject to the tax system of another country.

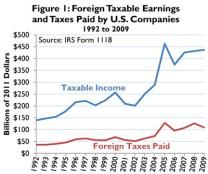

And other countries impose plenty of tax on American firms operating overseas.

Second, the incentive to shift job overseas is caused by America’s high corporate tax rate. That’s what makes it attractive for firms to operate in other nations.

Worldwide taxation is not the way to fix that bias since foreign-domiciled companies wouldn’t be impacted and they easily can sell into the American market.

By the way, the Republican tax plan doesn’t even create a real territorial tax system. Returning to the Bloomberg story cited above, the GOP proposal basically copies a very bad idea that was being pushed a few years ago by the Obama Administration.

…the GOP tax framework contemplates a so-called “minimum foreign tax’’ on multinationals’ future earnings that would apply in cases where a company’s effective tax rate fell below a pre-determined threshold.

To be fair, the Republican approach is less punitive that what Obama wanted.

Nonetheless, I worry that if Republicans adopt some sort of global minimum tax, it will just be a matter of time before that rate increases. In which case a shift toward territoriality actually plants a seed for a more onerous worldwide system!

Without knowing what will happen in the future, there’s no right or wrong answer, but I’m wondering whether the smart approach is to simply leave the current system in place. Yet, it’s based on worldwide taxation, but at least companies have deferral, which creates de facto territoriality for firms that manage their affairs astutely.

Such a shame that the GOP isn’t capable of simply doing the right thing.