I expressed pessimism yesterday about Trump’s tax plan. Simply stated, I don’t think Congress is willing to enact a large tax cut given the nation’s grim fiscal outlook.

In this Fox Business interview, I elaborated on my concerns while also pointing out that the plan would be very good if it somehow got enacted.

We now have some preliminary numbers that illustrate why I’m concerned.

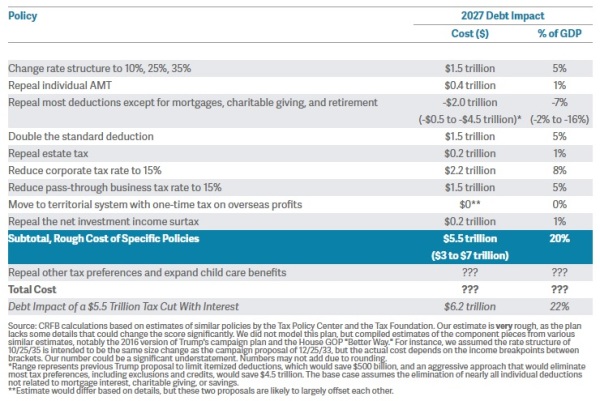

The Committee for a Responsible Federal Budget put together a quick guess about the revenue implications of Trump’s new plan. Their admittedly rough estimate is that federal revenues would be reduced by close to $6 trillion over 10 years.

Incidentally, these revenue estimates are very inaccurate because they are based on “static scoring,” which is the antiquated notion that major changes in tax policy have no impact on economic performance.

But these numbers nonetheless are useful since the Joint Committee on Taxation basically uses that approach when producing official revenue estimates that guide congressional action.

In other words, it doesn’t matter, at least for purposes of enacting legislation, that there would be substantial revenue feedback in the real world (the rich actually paid more, for instance, when Reagan dropped the top tax rate from 70 percent to 28 percent). Politicians on Capitol Hill will point to the JCT’s static numbers, gasp with feigned horror, and use higher deficits as an excuse to vote no (even though those same lawmakers generally have no problem with red ink when voting to expand the burden of government spending).

That being said, they wouldn’t necessarily have that excuse if the Trump Administration was more aggressive about trying to shrink the size and scope of the federal government. So there’s plenty of blame to go around.

Until something changes, however, I don’t think Trump’s tax cut is very realistic. So if you want my prediction on what will happen, I’m sticking to the three options I shared yesterday.

- Congress and the White House decide to restrain spending, which easily would create room for a very large tax cut (what I prefer, but I won’t hold my breath for this option).

- Congress decides to adopt Trump’s tax cuts, but they balance the cuts with dangerous new sources of tax revenue, such as a border-adjustment tax, a carbon tax, or a value-added tax (the option I fear).

- Congress and the White House decide to go for a more targeted tax cut, such as a big reduction in the corporate income tax (which would be a significant victory).

By the way, the Wall Street Journal editorialized favorably about the plan this morning, mostly because it reflects the sensible supply-side view that it is good to have lower tax rates on productive behavior.

While the details are sparse and will have to be filled in by Congress, President Trump’s outline resembles the supply-side principles he campaigned on and is an ambitious and necessary economic course correction that would help restore broad-based U.S. prosperity. …Faster growth of 3% a year or more is possible, but it will take better policies, and tax reform is an indispensable lever. Mr. Trump’s modernization would be a huge improvement on the current tax code that would give the economy a big lift, especially on the corporate side. …The Trump principles show the President has made growth his highest priority, and they are a rebuke to the Washington consensus that 1% or 2% growth is the best America can do.

But the WSJ shares my assessment that the plan will not survive in its current form.

…the blueprint is being assailed from both the left and the balanced-budget right. The Trump economic team acknowledges that their plan would mean less federal revenue than current law… Mr. Trump’s plan is an opening bid to frame negotiations in Congress, and there are plenty of bargaining chips. Perhaps the corporate rate will rise to 20%… Budget rules and Democratic opposition could force Republicans to limit the reform to 10 years.

For what it’s worth, if the final result is a 15 percent or 20 percent corporate tax rate, I’ll actually be quite pleased. That reform would be very good for the economy and national competitiveness. And regardless of what JCT projects, there would be substantial revenue feedback.