Back in 2009, I shared the results of a very helpful study by Pierre Bessard of Switzerland’s Liberal Institute (by the way, “liberal” in Europe means pro-market or “classical liberal“).

Pierre ranked the then-30 member nations of the Organization for Economic Cooperation and Development based on their tax burdens, their quality of governance, and their protection of financial privacy.

Switzerland was the top-ranked nation, followed by Luxembourg, Austria, and Canada.

Italy and Turkey were tied for last place, followed by Poland, Mexico, and Germany.

The United States, I’m ashamed to say, was in the bottom half. Our tax burden was (and still is) generally lower than Europe, but there’s nothing special about our quality of governance compared to other developed nations, and we definitely don’t allow privacy for our citizens (though we’re a good haven for foreigners).

Pierre’s publication was so helpful that I’ve asked him several times to release an updated version.

I don’t know if it’s because of my nagging, but the good news is that he’s in the final stages of putting together a new Tax Oppression Index. He just presented his findings at a conference in Panama.

But before divulging the new rankings, I want to share this slide from Pierre’s presentation. He correctly observes that the OECD’s statist agenda against tax competition is contrary to academic research in general, and also contrary to the Paris-based bureaucracy’s own research!

But before divulging the new rankings, I want to share this slide from Pierre’s presentation. He correctly observes that the OECD’s statist agenda against tax competition is contrary to academic research in general, and also contrary to the Paris-based bureaucracy’s own research!

Yet the political hacks who run the OECD are pushing bad policies because Europe’s uncompetitive governments want to prop up their decrepit welfare states. And what’s especially irksome is that the bureaucrats at the OECD get tax-free salaries while pushing for higher fiscal burdens elsewhere in the world.

But I’m digressing. Let’s look at Pierre’s new rankings.

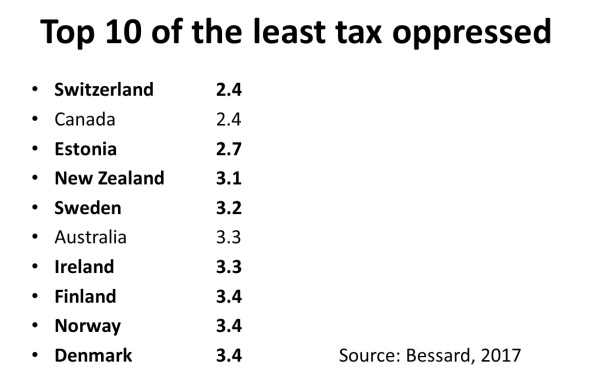

As you can see, Switzerland is still at the top, though now it’s tied with Canada. Estonia (which wasn’t part of the OECD back in 2009) is in third place, and New Zealand and Sweden also get very high scores.

At the very bottom, with the most oppressive tax systems, are Greece and Mexico (gee, what a surprise), followed by Israel and Turkey.

The good news, relatively speaking, is that the United States is tied with several other nations for 11th place with a score of 3.5.

So instead of being in the bottom half, as was the case with the 2009 Tax Oppression Index, the U.S. is now in the top half.

But that’s not because we’ve improved policy. It’s more because the OECD advocates of statism have been successful in destroying financial privacy in other nations. Even Switzerland’s human rights laws on privacy no longer protect foreign investors.

As such, Pierre’s new index basically removes financial privacy as a variable and augments the quality of governance variable with additional data about property rights and the rule of law.

P.S. When measuring the tax burden, the reason that America ranks above most European nations is not because they impose heavier taxes on rich people and businesses (indeed, the U.S. has a much higher corporate tax rate). Instead, we rank above Europe because they impose very heavy taxes on poor and middle-income taxpayers (mostly because of the value-added tax, which helps to explain why I am so unalterably opposed to that destructive levy).

P.P.S. Also in 2009, Pierre Bessard authored a great defense of tax havens for the New York Times.