As part of yesterday’s column about the comparatively tiny – and temporary – tax cut in the Republican tax reform plan, I quoted a leftist columnist for US News & World Report, who argued that there should be a big tax increase (including a big tax hike on middle-income taxpayers) and that such a tax hike would not hurt the economy.

Today, I want to address the latter argument about taxes and economic growth. When this topic arises, I normally cite both public-finance theory and empirical research to make the case that taxes do impact economic performance, and I try to always stress that not all taxes are created equal.

Today, I want to address the latter argument about taxes and economic growth. When this topic arises, I normally cite both public-finance theory and empirical research to make the case that taxes do impact economic performance, and I try to always stress that not all taxes are created equal.

And if the focus is corporate taxation, I usually share my primer on the issue, and then link to research from Australia, Canada, Germany, and the United Kingdom.

But maybe it will be more persuasive to look at some new academic evidence from a study on U.S. corporate taxes by Professor Eric Ohrn (forthcoming in the American Economic Journal).

If you don’t want to dwell on the details, the paper’s abstract tells you the highlights. Simply stated, a lower corporate rate translates into more investment and less debt.

I exploit quasi-experimental variation created by the Domestic Production Activities Deduction, a corporate tax expenditure created in 2005. A one percentage point reduction in tax rates increases investment by 4.7 percent of installed capital, increases payouts by 0.3 percent of sales, and decreases debt by 5.3 percent of total assets. These estimates suggest that lower corporate tax rates and faster accelerated depreciation each stimulate a similar increase in investment, per dollar in lost revenue.

But hopefully there will be interest in some of the details from the study.

Here’s the problem Professor Ohrn identified.

…relatively little empirical work has been able to directly estimate the effects of a reduction in the corporate income tax rate on business activity. This study provides new evidence on these effects.

His evidence is based on the fact lawmakers created a lower tax rate for America-based manufacturing (a.k.a., the domestic production activities deduction, or DPAD).

In 2005, when the DPAD was implemented, firms could deduct 3 percent of manufacturing income. This rate was scaled to 6 percent in 2007 and 9 percent in 2010, where it remains today. As a result of the policy, after 2010, firms that derive all of their income from domestic manufacturing activities and face the top statutory corporate income tax rate have a 3.15 (= 0.09 × 35 percent) percentage point lower effective tax rate than firms with no domestic manufacturing activities. …I use data provided by the IRS Statistics of Income (SOI) Division. The SOI publishes the aggregate annual dollar values of the DPAD and Net Taxable Income for corporations in 75 unique industries and all businesses in 12 asset-classes (firm size bins).

And what did he find as he looked at the difference between firms with lower tax rates and higher tax rates?

It turns out that even modest differences in tax rates can have a big impact.

I find that the DPAD has a large effect on corporate behavior. A one percentage point reduction in the effective corporate income tax rate via the DPAD increases investment by 4.7 percent of installed capital, increases payouts by 0.3 percent of revenues, and decreases debt usage by 5.3 percent of total assets. …corporations respond strongly to the DPAD, and corporate income tax rate cuts more generally, by increasing investment and payouts and decreasing debt usage. The average firm does not report more taxable income per dollar of asset, suggesting that any increases in revenue generated by corporate tax rate reductions are the product of real effects such as investment but not decreased avoidance activity.

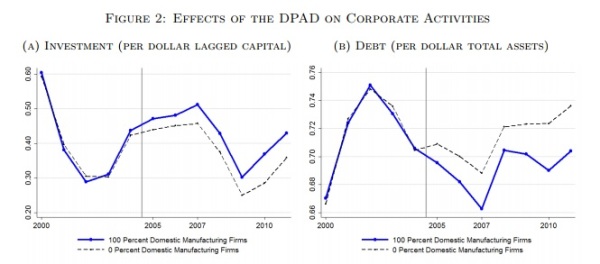

Here are a couple of charts from the study. The dark blue line represents companies with lower tax rates and the dashed line represents the ones with higher tax rates.

And since it’s good to have more investment and good to have less debt, both these findings are very positive.

Interestingly, the benefits of fixing depreciation laws (by moving in the direction of expensing) are quite similar to the benefits of lowering the corporate tax rates.

…a dollar spent by the government stimulates virtually the same amount of investment whether it is used to reduce corporate tax rates or accelerate depreciation expenses.

I hate to digress, but I can’t resist pointing out that I’m irked by the language about “a dollar spent by the government.” Professor Ohrn certainly seems to be a rigorous and capable economist, but he has a bit of a moral blind spot. If the federal government adopts a policy that allows a business to keep more of the money it earns, that is not “a dollar spent” by government.

Unless you have the bizarre mindset of some statists who think all output belongs to the state.

Anyhow, back to regularly scheduled programming.

We’re now at a critical point in the battle for tax reform. The House passed its version and now the Senate has passed its version. The good news is that there’s strong agreement on Capitol Hill to slash the corporate tax rate.

This latest study underscores why that reform will boost investment. And remember, when investment increases, that translates into higher wages for workers.