In a column in today’s New York Times, Steven Rattner attacks Trump’s tax plan for being unrealistic. Since I also think the proposal isn’t very plausible, I’m not overly bothered by that message. However, Rattner tries to bolster his case by making very inaccurate and/or misleading claims about the Reagan tax cuts.

Given my admiration for the Gipper, those assertions cry out for correction. Starting with his straw man claim that the tax cuts were supposed to pay for themselves.

…four decades ago…the rollout of what proved to be among our country’s greatest economic follies — the alchemistic belief that huge tax cuts can pay for themselves by unleashing faster economic growth.

Neither Reagan nor his administration claimed that the tax cuts would be self-financing.

Instead, they simply pointed out that the economy would grow faster and that this would generate some level of revenue feedback.

Instead, they simply pointed out that the economy would grow faster and that this would generate some level of revenue feedback.

Which is exactly what happened. Heck, even leftists agree that there’s a Laffer Curve. The only disagreement is the point where tax receipts are maximized (and I don’t care which side is right on that issue since I don’t want to enable bigger government).

Anyhow, Rattner also wants us to believe the tax cuts hurt the economy.

…the plan immediately made a bad economy worse.

This is remarkable blindness and/or bias. The double dip recession of 1980-1982 was the result of economic distortions caused by bad monetary policy (by the way, Reagan deserves immense credit for having the moral courage to wean the country from easy-money policy).

But even if one wants to ignore the impact of monetary policy, how can you blame the second dip of the recession, which began in July 1981, on a tax cut that was signed into law in August 1981?!?

Moreover, while Reagan’s tax cut was adopted in 1981, it was phased in over several years. And because of previously legislated tax increases, as well as inflation-driven bracket creep (prior to 1985, households were pushed into higher tax brackets by inflation even though their real income did not rise), the economy did not enjoy a tax cut until 1983. Not coincidentally, that’s when the economy began to boom.

Rattner even wants us to believe the Reagan tax plan caused higher interest rates.

…the Reagan tax cut increased the budget deficit, helping elevate interest rates over 20 percent, which in turn contributed to the double-dip recession that ensued. The stock market fell by more than 20 percent.

The deficit jumped mostly because of the double-dip recession, just as red ink always climbs when there is an economic downturn.

And interest rates were high largely because inflation was so high (lenders don’t like to deliberately lose money).

But the most amazing part of the above excerpt is that Rattner wants us to believe the Reagan tax cuts caused the part of the double-dip recession that occurred in 1980, when Jimmy Carter was still president.

That’s sort of like Paul Krugman trying to imply that Estonia’s 2008 recession was caused by spending cuts that took place in 2009!

You also won’t be surprised to learn that Rattner selectively likes Keynesianism.

Big deficits can sometimes be advisable, as they were in aiding recovery from the 2009 recession.

I guess he wants us to applaud Obama’s so-called stimulus and be impressed by the very anemic recovery that followed.

But we’re supposed to overlook the booming economy of the Reagan years.

Last but not least, it’s noteworthy that Rattner – in spite of his bias – endorses part of the Trump tax plan.

I understand our need to lower the corporate tax rate to compete with other countries and adjust other provisions to keep companies and jobs here. Critics are correct that our business-tax structure encourages companies to ship jobs and even themselves overseas.

And when even folks like Rattner realize that the current corporate tax system is indefensible, that explains why I’m semi-hopeful that we’ll get a lower rate at some point in the near future.

Now let’s look at broader lessons from the Reagan tax cuts.

Lesson #1: Lower Tax Rates Can Boost Growth

We can draw some conclusions by looking at how low-tax economies such as Singapore and Hong Kong outperform the United States. Or we can compare growth in the United States with the economic stagnation in high-tax Europe.

We can also compare growth during the Reagan years with the economic malaise of the 1970s.

We can also compare growth during the Reagan years with the economic malaise of the 1970s.

Moreover, there’s lots of academic evidence showing that lower tax rates lead to better economic performance

The bottom line is that people respond to incentives. When tax rates climb, there’s more “deadweight loss” in the economy. So when tax rates fall, output increases.

Lesson #2: Some Tax Cuts “Pay for Themselves”

The key insight of the Laffer Curve is not that tax cuts are self-financing. Instead, the lesson is simply that certain tax cuts (i.e., lower marginal rates on productive behavior) lead to more economic activity. Which is another way of saying that certain tax cuts lead to more taxable income.

It’s then an empirical issue to assess the level of revenue feedback.

It’s then an empirical issue to assess the level of revenue feedback.

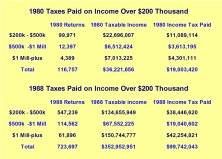

In the vast majority of the cases, the revenue feedback caused by more taxable income isn’t enough to offset the revenue loss associated with lower tax rates. However, we do have very strong evidencethat upper-income taxpayers actually paid more to the IRS because of the Reagan tax cuts.

This is presumably because wealthier taxpayers have much greater ability to control the timing, level, and composition of their income.

Lesson #3: Reagan Put the United States on a Path to Fiscal Balance

I already explained above why it is wrong to blame the Reagan tax cuts for the recession-driven deficits of the early 1980s. Indeed, I suspect most leftists privately agree with that assessment.

But there’s still a widespread belief that Reagan’s tax policy put the United States on an unsustainable fiscal path.

But there’s still a widespread belief that Reagan’s tax policy put the United States on an unsustainable fiscal path.

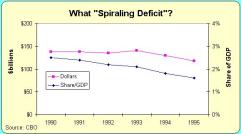

Yet the Congressional Budget Office, as Reagan left office in early 1989, projected that budget deficits, which had been consistently shrinking as a share of GDP, would continue to shrink if Reagan’s policies were left in place.

Moreover, the deficit was falling because government spending was projected to grow slower than the private sector, which is the key to good fiscal policy.

Lesson #4: Lower Tax Rates Are Just One Piece of a Larger Puzzle

Having just disgorged hundreds of words on the importance of lower tax rates, let’s close by noting that fiscal policy is just one of many factors that determine an economy’s performance.

Indeed, tax and budget issues only account for 20 percent of a nation’s economic performance according to Economic Freedom of the World.

Indeed, tax and budget issues only account for 20 percent of a nation’s economic performance according to Economic Freedom of the World.

So it’s quite possible for a nation to be relatively free even with a bad tax system, and it’s also possible for a country to be economically repressed if it has a good tax system.

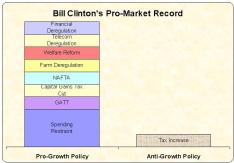

And this explains why economic freedom increased in America during the Clinton years, notwithstanding the 1993 tax hike. Simply stated, it’s the overall policy mix that matters.

I’ll conclude by noting that aggregate economic freedom in America increased during the Reagan years.

And the biggest reason for the increase was better fiscal policy.

And the biggest reason for the increase was better fiscal policy.

It’s possible that we may also get more economic freedom during the Trump years. Indeed, I gave him a decent score for his first 100 days.

But it takes a lot of political courage to consistently fight for economic liberty in a town that cheers statism. And even though there’s a strong case to be made that there are political benefits to good policy, I’m not overly optimistic that Trump will be another Reagan.