Here’s a simple and fundamental question: What is economic growth?

And here’s a simple answer: It’s when there’s more national income.

That seems like a trivial tautology, but let’s explore some implications. When you dig into the numbers, it turns out that increases in national income (usually measured by gross domestic product, though I prefer gross domestic income) are driven by two factors.

- More people.

- More output per hour, also known as increased productivity.

This is why people sometimes say that GDP growth is a function of population growth plus productivity growth.

And what really matters, at least if we want higher living standards, is to have more output per hour. As a result, we should be very concerned that productivity growth seems to be lagging in the United States.

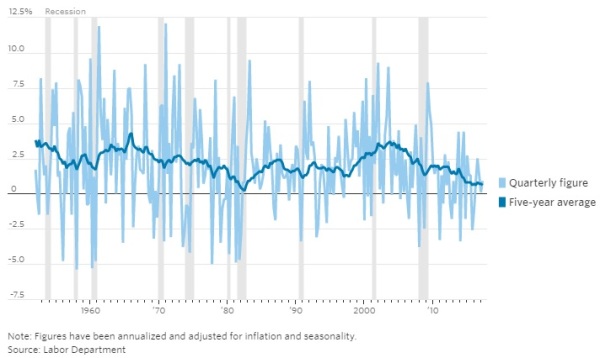

Here’s a chart that was created by the Wall Street Journal, showing data from the Labor Department on productivity all the way back to the 1950s.

And here’s what I wrote about these numbers in a column for the Hill, starting with the observation that productivity growth is very important for long-run prosperity.

…one thing that presumably unites economists is that we all recognize higher productivity is a good thing. It’s what enables higher wages for workers, higher earnings for companies and higher living standards for the nation.

I then point out that we have a problem.

…when we see weak productivity numbers, that’s not good news. …there is a very worrisome trend this century. Productivity is increasing, but at ever-lower rates, which helps to explain why the overall rate of economic growth this century has lagged compared to the post-World War II average.

But I also share suggestions for policy reforms that would lead to higher productivity.

…tax reform could be…beneficial. …a lower corporate tax rate…a key reason…is that investors will have a bigger incentive to finance new projects that will boost productivity and thus boost wages. …to replace “depreciation” with “expensing” would be particularly helpful since the current approach imposes an unwarranted tax on new investments.

The column explains why it’s foolish to impose tax penalties on income that is saved and invested.  Policies such as the capital gains tax and death tax punish capital formation and thus reduce productivity growth.

Policies such as the capital gains tax and death tax punish capital formation and thus reduce productivity growth.

Politicians impose these levies to go after “the rich,” but it’s the rest of us who suffer because of slower growth.

But my column doesn’t just focus on investments in “physical capital.” I also argue that our current education system does a very poor job of boosting “human capital.”

The United States spends more on education — on a per-pupil basis — than other nations. Yet, international test scores show that we get very mediocre results. We see a similar pattern inside the country, with high levels of spending associated with more bureaucracy rather than better outcomes. …it’s time to unleash the power of markets by allowing greater school choice. There’s certainly plenty of evidence that this approach will be more effective.

I closed the column by noting that productivity growth increased under both Ronald Reagan and Bill Clinton when the United States was moving in the direction of free markets. Conversely, I also noted that productivity growth has declined under the government-centric policies of George W. Bush and Barack Obama.

Seems like the lesson should be obvious.

P.S. I looked at this same issue back in 2012 when writing about the recipe for increased prosperity. I pointed out that capital and labor are the two factors of production and explained that a bigger economy is a function of more labor, more capital, and/or the more efficient use of labor and capital. Well, another way of saying “more efficient use” is to say “higher productivity.”

After all, it’s much better to have a bigger economy because we’re more productive rather than because we all take a second job on the weekends.

P.P.S. For those who want to get deeper in the economic weeds, this column on China includes a discussion of potential production and this column on Hong Kong includes two great videos on growth from Marginal Revolution University.