Left-wing columnists at the Washington Post have hit upon a theme. In late October, Ruth Marcus wrote a column asserting that tax cuts are “dangerous.”

I explained why her argument was nonsensical, but that clearly didn’t have any impact since Robert Rubin has a new column in the same paper with the same theme. He claims to have identified five “dangers” in the Republican tax plan.

I explained why her argument was nonsensical, but that clearly didn’t have any impact since Robert Rubin has a new column in the same paper with the same theme. He claims to have identified five “dangers” in the Republican tax plan.

It’s a remarkably weak list, but I guess it merits a response, both because Rubin served as Bill Clinton’s Treasury Secretary and because I feel compelled to once again slap down the claim that tax cuts are dangerous.

I debunk each one of Rubin’s points below, but you’ll also notice that I first restate (fairly, I think) what he’s really trying to say since his writing style is so bureaucratically obtuse.

Rubin Claim #1:

…business confidence would likely be negatively affected by creating uncertainty about future policy and heightening concern about our political system’s ability to meet our economic policy challenges.

What he’s really saying: We don’t know what will happen in the future (“uncertainty”) and it would be good if taxes were higher so politicians could spend more (“ability to meet…challenges”).

Why he’s wrong: Since it’s very difficult for today’s politicians to restrict the behavior of future politicians, it is true that there will be policy uncertainty. But that’s just as true if we leave the corporate tax rate at 35 percent as it will be if the rate is reduced the 20 percent. I’m also unimpressed by his desire for government to have more cash to meet challenges since it’s far more likely that government is the cause of problems rather than the solution.

Rubin Claim #2:

…our country’s resilience to deal with inevitable future economic and geopolitical emergencies, including the effects of climate change, would continue to decline.

What he’s really saying: If there’s a tax cut, politicians will have less money, which means it will be harder (a “decline” in “resilience”) to spend money in the future.

Why he’s wrong: Once again, I feel compelled to point out that very few problems can be solved with more government spending. Indeed, that’s usually a recipe for making a problem worse (the welfare state, for example). But the most glaring flaw with Rubin’s argument about “future…emergencies” is that there’s no long-run tax cut. The GOP tax plan is revenue-neutral after 10 years. So how can a plan that doesn’t lower the long-run revenue baseline impact the government’s ability to do anything?

Rubin Claim #3:

…funds available for public investment, national security and defense spending…would continue to decline as debt rises, because of rising interest costs and the increased risk of borrowing to fund government activities.

What he’s really saying: Less tax money going to Washington could mean higher interest payments (“increased risk of borrowing”), which would displace other forms of spending.

Why he’s wrong: There’s actually some truth to this argument, at least in the first 10 years when there actually is a tax cut. If I was being snarky, I could ask why Rubin wasn’t making the same argument when the faux stimulus was being debated. Or when the Obamacare boondoggle was being discussed. Why does he think deficits are only bad when tax cuts are on the agenda (just like CBO), but deficits are “stimulus” when spending goes up? I may sue for whiplash since folks on the other side keep changing their minds on red ink.

Rubin Claim #4:

Treasury bond interest rates would be highly likely to increase over time because of increased demand for the supply of savings and increased concern about future imbalances.

What he’s really saying: A tax cut will lead to higher deficits, which will lead to higher interest rates (“increased demand for the supply of savings”).

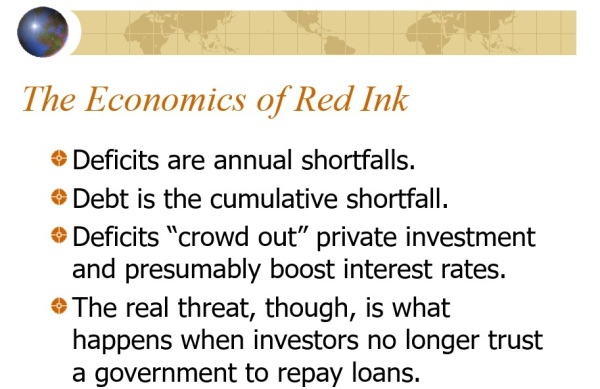

Why he’s wrong: I believe in supply-and-demand curves, so it’s theoretically true that interest rates should increase when government competes against private borrowers. That being said, even big shifts in U.S. deficits are just a drop in the bucket in a world where global capital markets amount to tens of trillions of dollars. Here’s a slide from a speech I gave to the Leadership Program of the Rockies earlier this month in Denver. If I had space, I would have added “but in reality the impact is minimal” to the third sentence.

Rubin Claim #5:

…at some unpredictable point, fiscal conditions…would likely be seen as sufficiently serious to cause severe market and economic destabilization.

What he’s really saying: Tax cuts will mean more red ink, which could ultimately lead to a Greek-style fiscal crisis (“severe..destabilization”).

Why he’s wrong: It’s certainly true that America faces very worrisome long-run fiscal problems, but those challenges are entirely due to a rising burden of government spending. And since the GOP plan is only a tax cut in the first 10 years, it’s absurd to say the GOP plan will have any meaningful impact on that dismal outlook. If Rubin really was concerned about America’s fiscal situation, he would be aggressively arguing for genuine entitlement reform.

I could have shortened that entire section by collapsing his five “dangers” into one teenager-type rant: “OMG, the economy will be in danger with tax cuts and the government won’t be able to spend on good things.”

To which I could have replied: “LOL.”

To be fair, there actually is a semi-serious section in Rubin’s column. He summarizes the left’s economic argument against lower tax rates.

…tax cuts will not increase growth and, given their fiscal effects, would likely have a significant and increasingly negative impact. The nonpartisan Tax Policy Center’s latest report estimated that, over 10 years,

the average increase in our growth rate would be roughly zero, counting the crowding out of private investment by increasing deficits but not counting other adverse effects of worsening our fiscal outlook. The Penn Wharton Budget Model, using the same approach, estimates virtually no increase in long-term growth. …These estimates reflect three underlying views held by mainstream economists. First, individual tax cuts will not materially induce people to work more. Second, corporate tax cuts will likely have limited effect on investment or decisions about where to locate business activity, given the many other variables at play. Third, deficit-funded tax cuts will have little short-term effect on growth, except perhaps for some temporary overheating, because we are at roughly full employment.

Now allow me to translate: It is quite possible to generate bad numbers if you build models that, 1) assume lower tax rates have very little impact on incentives to engage in productive behavior, and 2) assume larger deficits cause interest rates to increase significantly and therefore measurably reduce investment.

The real question is whether those theoretical models are correct given so much of the empirical evidence on the other side. After all, what are you going to believe, the models or your lying eyes?

———

Image credit: Max Pixel | CC0 Public Domain.