Every so often, I mock the New York Times for biased or sloppy analysis.

- Claiming Medicaid cuts in a piece that shows rising outlays for the program.

- Asserting that government schools are “starved of funding” when taxpayer subsidies actually have skyrocketed.

- Claiming that budget-cutting austerity nations are doing worse than “stimulus” nations, but getting the numbers backward.

- Writing that the sequester will mean “deep automatic spending cuts” when the budget actually will climb by $2.4 trillion.

- Claiming that Italy is more prosperous than the United States and that there is less poverty.

- Asserting that U.S. multinationals pay little tax on foreign-source income, but forgetting to include the taxes paid to foreign governments.

Now there’s a new column by David Leonhardt that cries out for correction.

He’s very upset that upper-income people are enjoying higher incomes over time.

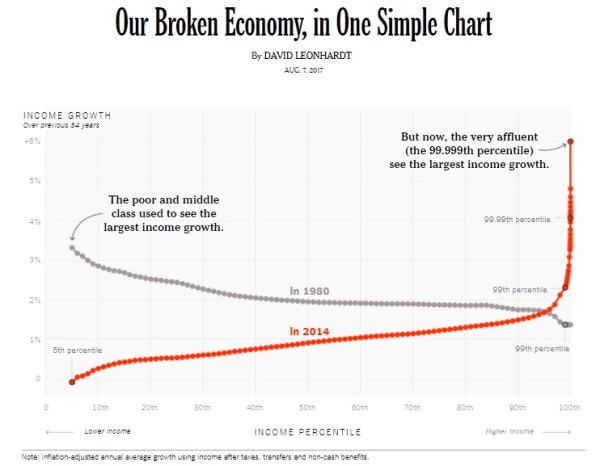

A…team of inequality researchers…has been getting some attention recently for a chart… It shows the change in income between 1980 and 2014 for every point on the distribution, and it neatly summarizes the recent soaring of inequality. …the very affluent, and only the very affluent, have received significant raises in recent decades. This line captures the rise in inequality better than any other chart or simple summary that I’ve seen. …only very affluent families — those in roughly the top 1/40th of the income distribution — have received…large raises. …The basic problem is that most families used to receive something approaching their fair share of economic growth, and they don’t anymore.

And here’s the chart that ostensibly shows that the economy is broken.

And what is the solution for this alleged problem? Class-warfare taxation and bigger government, of course.

…there is nothing natural about the distribution of today’s growth — the fact that our economic bounty flows overwhelmingly to a small share of the population. Different policies could produce a different outcome. My list would start with a tax code that does less to favor the affluent, a better-functioning education system, more bargaining power for workers and less tolerance for corporate consolidation.

Whenever I see this type of data, I’m automatically suspicious for two reasons.

- The people at various income levels in 1980 aren’t the same as the people at those income levels in 2014. In other words, there is considerable income mobility, with some high-income people falling to the middle of the pack, or even below, and some low-income people climbing the middle of the income distribution, or even higher. At the very least, this type of chart exaggerates the degree to which “the rich are getting richer.”

- Moreover, rich people getting rich doesn’t imply that poor people are losing income. This chart shows that all income percentiles generally enjoy more income with each passing year, so it isn’t grossly misleading like the charts that incorrectly imply income gains for the rich are at the expense of the poor. Nonetheless, a reader won’t have any way of knowing that more inequality and poverty reduction can go hand in hand.

But I think this chart from the New York Times inadvertently shows something very interesting.

As shown in the excerpt above, Mr. Leonhardt wants us to look at this data and support bigger government and class warfare.

Yet look at the annual data. The chart above has the numbers for 1980 and 2014. To the right, I’ve put together the numbers for 1987, 1996, and 2004.

Yet look at the annual data. The chart above has the numbers for 1980 and 2014. To the right, I’ve put together the numbers for 1987, 1996, and 2004.

One obvious conclusion is that prosperity (as shown by rising income levels) was much more broadly and equally shared in the 1980s and 1990s, back when the economy was moving in the direction of free markets and smaller government under both Reagan and Clinton.

But look at what happened last decade, and what’s been happening this decade. Government has been expanding (as measured by falling scores from Economic Freedom of the World).

And that’s the period, thanks to Bush-Obama statism, when lower-income people began to lag and income gains were mostly concentrated at the top of the income redistribution.

As the very least, this certainly suggests that Leonhardt’s policy agenda is misguided. Assuming, of course, the goal is to enable more prosperity for the less fortunate.

I’ll add another point. I suspect that big income gains for the rich in recent years are the result of easy-money policies from the Federal Reserve, which have – at least in part – pushed up the value of financial assets.

The bottom line is that Leonhardt seems motivated by ideology, so he bends the data in hopes of justifying his leftist agenda.

What makes this sad is that the New York Times used to be far more sensible.

Back in 1982, shortly after the Professors Hall and Rabushka unveiled their plan for a flat tax, here’s what the New York Times opined.

Who can defend a tax code so complicated that even the most educated family needs a professional to decide how much it owes? …President Reagan’s tax package will eventually roll back rates to the level of the late 1970’s, but it will not simplify the code or rid it of provisions that penalize hard work and reward unproductive investment. …the income base that is taxed has been so eroded by exceptions and preferences that the rates on what is left to tax must be kept high. Thus, the tax on an extra dollar of income for a typical family earning $20,000 is 28 percent and progressively higher for the more affluent. …The most dramatic fresh start, without changing the total amount collected, would be a flat-rate tax levied on a greatly broadened income base. Senator Helms of North Carolina would rid the law of virtually every tax preference and tax all income at about 12 percent. Representative Panetta of Cali-fornia would retain a few preferences and tax at a flat 19 percent. Either approach would greatly improve the efficiency of the system, simplifying calculations and increasing the incentive to earn.

And here’s what the editors wrote about Governor Jerry Brown’s modified flat tax in 199s. They started by praising the core principles of the flat tax.

Taking Jerry Brown seriously means taking his flat tax proposal seriously. Needlessly, he’s made that hard to do. By being careless, the former California Governor has bent a good idea out of shape. …Mr. Brown’s basic idea — creating a simplified code that encourages saving — is exactly right. …The present tax code is riddled with wasteful contradictions and complexity. For example, profit from corporate investment is taxed twice — when earned by the corporation and again when distributed to shareholders. That powerfully discourages savings and investment — the exact opposite of what the economy needs to grow. The remedy is, in a word, integration, meshing personal and corporate codes so that the brunt of taxes falls on consumption, not saving. …there is a reform that achieves all these objectives. Robert Hall and Alvin Rabushka, economists at the Hoover Institution, have proposed an integrated code that applies a single rate to both personal and corporate income. Their plan wipes away most deductions and exemptions, permitting a low tax rate of 19 percent. …Under the Hall-Rabushka plan, individuals would pay taxes on earnings and corporations would pay tax on interest, dividends and profits. That way, every dollar of income would be taxed once and only once.

And they rightly criticized Governor Brown for violating those principles.

Jerry Brown borrowed some of the elements of Hall-Rabushka. He too would eliminate wasteful exemptions, adopt a single rate and favor saving by exempting corporate investment. But at that point, he turns glib. He would impose on corporations a value-added tax, similar to a national sales tax. That eliminates the elegant symmetry of Hall-Rabushka. Indirectly, Mr. Brown’s variation would tax some income twice — which is why his supposed 13 percent rate would collect revenue equal to about 20 percent of total income.

Wow, this isn’t what I would write, but it’s within shouting distance.

The editors back then understood the importance of low marginal tax rates and they recognized that double taxation is a bad thing.

Now check out what the New York Times believes today about tax reform.

First and foremost, the editors want more money taken from the productive economy to expand the D.C. swamp.

Real reform would honestly confront the fact that in the next decade we will need roughly $4.5 trillion more revenue than currently projected to meet our existing commitment…. Even more would be needed if the government were to make greater investments.

And even though class-warfare taxation is unlikely to generate much revenue, the editors want both higher tax rates and more double taxation.

…it would make sense to increase the top rates on them and eliminate a break on income from investments. …the richest 1 percent pay 33 percent of their total income in taxes; if rates were changed so they paid 40 percent, it would generate $170 billion of revenue in the first year.

The editors want to take one of the most anti-competitive features of the current system and make it even worse.

It would also be a good idea to scale back accelerated depreciation allowances that let businesses write off investments faster than assets actually wear out. Speedy write-offs for luxuries like corporate jets could be eliminated altogether.

They also want to further undermine the ability of U.S. companies to compete on a level playing field in foreign markets.

…they should agree to close…the ability of corporations to defer tax on profits earned abroad.

In a display of knee-jerk statism, the editors also want new tax burdens to finance an ever-larger burden of government. Such as an energy tax.

New forms of taxation are also needed. Even prominent Republicans like James Baker III, George Shultz and Henry Paulson Jr. support a carbon tax imposed on emissions to reduce greenhouse gases. …revenue generated by carbon taxes could be used for other purposes as well, including investments in renewable energy and public transportation.

And a tax on financial transactions.

Revenue can also be raised by imposing a tax on the trading of stocks, bonds and derivatives. …Estimates show that a financial transaction tax of even 0.01 percent per trade ($10 on a $100,000 trade) could raise $185 billion over 10 years, enough to finance prekindergarten for 3- and 4-year olds, with money left over.

But the granddaddy of new taxes would be the value-added tax, a money machine for bigger government.

A value-added tax would be akin to a national sales tax, but harder to evade than traditional sales taxes and thus an efficient revenue raiser.

I’m genuinely curious whether there is any type of tax increase the NYT wouldn’t support.

But that’s not really the point of this column. The real lesson is that it’s sad that the editors have gone from being rationally left to being ideologically left.

P.S. I confess that I especially enjoy when the New York Times inadvertently publishes pieces that show the benefits of free markets and personal liberty.

- Accidentally showing the superiority of funded private retirement systems.

- Revealing how feminist policies backfire against women.

- Unintentionally showing the folly of gun control.

Which is sort of what happened with Leonhardt’s data, which shows more broadly shared prosperity when economic liberty was increasing.