Since it is the single-largest government program, not only in the United States but also the entire world, it’s remarkable that Social Security isn’t getting much attention from fiscal policy wonks.

Sure, Obamacare is a more newsworthy issue because of the repeal/replace fight. And yes, it’s true that Medicare and Medicaid are growing faster and eventually will consume a larger share of the economy.

But those aren’t reasons to turn a blind eye toward a program that will soon have an annual budget of $1 trillion. Especially since the tax-and-spend crowd in Washington is actually arguing that the program should be expanded. I’m not kidding.

If nothing else, the just-released Trustees Report from the Social Security Administration demands attention. As I do every year, I immediately looked at Table VI.G9, which shows the annual inflation-adjusted budgetary impact of the program.

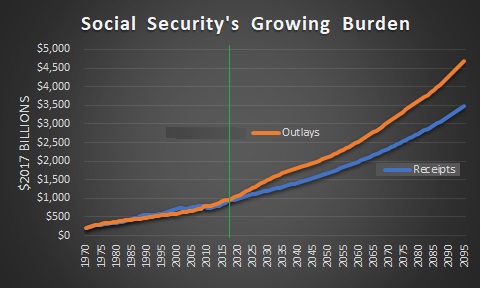

Here’s a chart showing how the program has grown since 1970 and what is expected in the future. Remember, these are inflation-adjusted numbers, so the sharp increase in outlays over the next several decades starkly illustrates that Social Security will be grabbing ever-larger amounts of money from the economy’s productive sector.

It’s also worth noting that the program already is in the red. Social Security outlays began to exceed revenues back in 2010.

And the numbers will get more out of balance over time.

By the way, some people say that the program is in decent shape since the “Trust Fund” isn’t projected to run out of money until 2034. That’s technically true, but utterly meaningless since it is nothing but a pile of IOUs.

You don’t have to believe me. A few years ago, I quoted this passage from one of Bill Clinton’s budgets.

These balances are available to finance future benefit payments and other trust fund expenditures–but only in a bookkeeping sense. …They do not consist of real economic assets that can be drawn down in the future to fund benefits. Instead, they are claims on the Treasury, that, when redeemed, will have to be financed by raising taxes, borrowing from the public, or reducing benefits or other expenditures.

Amen.

This is why annual cash flow into and out of the program is what matters, at least if we care about the Social Security’s economic impact.

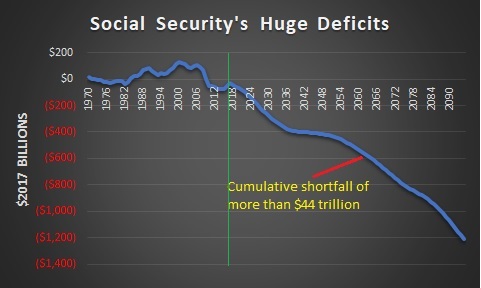

And for those who want to know about the gap between the inflow and outflow, here’s a chart showing how deficits are going to explode in coming decades. Again, keep in mind these are inflation-adjusted numbers.

That’s not a typo in the chart. The total shortfall between now and 2095 is a staggering $44.2 trillion. Yes, trillion.

Remarkably, there’s an even bigger long-run problem with Medicare and Medicaid. Which helps to explain I relentlessly push for genuine entitlement reform.

But let’s focus today on Social Security. The answer to this looming fiscal nightmare is to copy one of the many nations that have shifted to “funded” retirement systems based on real savings. I’m a big fan of the Australian approach. Chile also has a great system, and Switzerland and the Netherlands are good role models as well. Hong Kong and Singapore also rely on private savings for retirement, and both jurisdictions demonstrate that aging populations and falling birth rates aren’t necessarily a fiscal death sentence. Heck, even the Faroe Islands and Sweden have jumped on the bandwagon of private retirement accounts.

———

Image credit: Pedro Ribeiro Simões | CC BY 2.0.