For months, I’ve been arguing that the big reduction in the corporate tax rate is the most important part of Trump’s tax agenda.

But not because of politics or anything like that. Instead, my goal is to enable additional growth by shifting to a system that doesn’t do as much damage to investment and job creation.  A lower rate is consistent with good theory, and there’s also recent research from Australia and Germany to support my position.

A lower rate is consistent with good theory, and there’s also recent research from Australia and Germany to support my position.

Especially since the United States is falling behind the rest of the world. America now has the highest corporate tax rate in the developed world and arguably may have the highest rate in the entire world.

Needless to say, this is a self-inflicted wound on U.S. competitiveness.

But since the numbers I’ve been sharing are now a few year’s old, let’s now update some of this data.

Check out these four charts from a new OECD annual report on tax policy changes (the same one that I cited a few days ago when explaining that European-sized government means a suffocating tax burden on the poor and middle class).

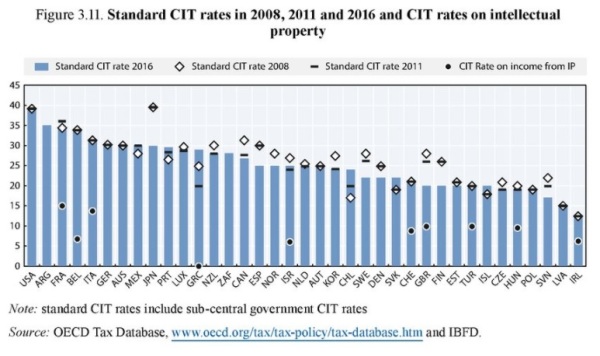

Here’s the grim data on the corporate income tax rate (the vertical blue bars). As you can see, the United wins the booby prize for having the highest rate.

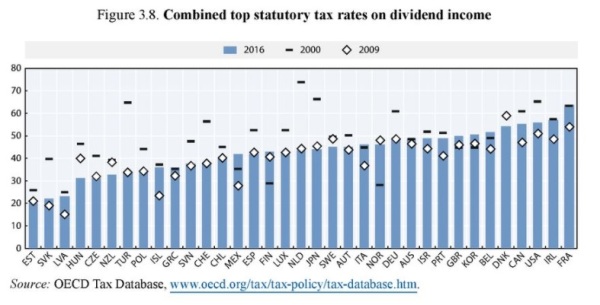

But here’s some “good news.” When you add in the second layer of tax on corporate income, the United States is “only” in third place, about where we were back in 2011.

France imposes the highest combined rate on corporate and dividend income (no surprise since the nation’s national sport is taxation), while Ireland is in second place (the corporate rate is very low, but personal rates are high and dividends receive no protection from double taxation).

For what it’s worth, I think it’s incredibly bad policy when governments are skimming 30 percent, 40 percent, 50 percent, and even 60 percent of the income being generated by business investment.

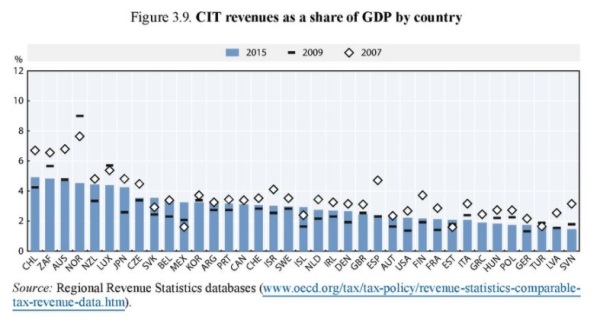

Particularly since high rates don’t translate into high revenue. Check out this third chart. You’ll notice that revenues are relatively low in the United States even though (or perhaps because) the tax rate is very high.

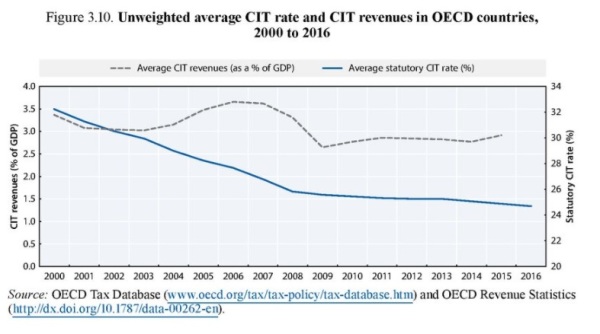

But our final chart provides the strongest evidence. Just like the IMF, the OECD is admitting that tax revenues have remained constant over time, even though (or because) corporate tax rates have plunged.

In other words, the Laffer Curve is alive and well.

Incidentally, the global shift to lower tax rates hasn’t stopped. I wrote back in May about plans for lower corporate tax burdens in Hungary and the United Kingdom and I noted last November that Croatia was lowering its corporate rate.

And, thanks to liberalizing effect of tax competition, more and more nations are hopping on the tax cut bandwagon.

Consider what’s happening in Sweden.

Sweden’s center-left minority government is proposing a corporate tax cut to 20 percent from 22 percent, Finance Minister Magdalena Andersson and Financial Markets Minister Per Bolund said on Monday… “With the proposals we want to strengthen competitiveness and create a more dynamic business climate,” they said… The proposed corporate tax cut would be…implemented on July 1, 2018.

Or what’s taking place in Belgium.

…government ministers finally reached agreement on a number of reforms to the Belgian tax and employment systems. …Belgium is to slash corporation tax from 34% to 29% next year. By 2020 corporation tax will have been cut to 25%. …Capital gains tax on the first 627 euros of dividends from shares disappears, a measure intended to encourage share ownership.

Or what’s looming in Germany.

Germany will likely need to make changes to its corporation tax system in coming years in response to growing tax competition from other countries, Finance Minister Wolfgang Schaeuble said on Wednesday… “I expect there will be a need to take action on corporation tax in coming years because in some countries, from the U.S. to Britain, but also on other continents, there are many considerations where we can’t simply say we’ll ignore them,” Schaeuble told a real estate conference.

This brings a smile to my face. Greedy politicians are being pressured to cut tax rates, even though they would prefer to do the opposite. Let’s hope the United States joins this “race to the bottom” before it’s too late.

———

Image credit: geralt | Pixabay License.