While the political world is consumed by the various scandals and baggage of the two main presidential candidates, let’s play a game of make-believe.  Let’s pretend that politicians aren’t crooks and clowns and instead actually want to make America’s economy more vibrant and productive so the American people can enjoy higher living standards.

Let’s pretend that politicians aren’t crooks and clowns and instead actually want to make America’s economy more vibrant and productive so the American people can enjoy higher living standards.

What would they do? What should they do?

Those are very big questions with lots of answers, so let’s focus just on the issue of tax policy. If the goal is more growth and prosperity, there are two obvious choices.

- To the maximum extent possible, reduce marginal tax rates on productive behavior.

- To the maximum extent possible, reduce the tax bias against saving and investment.

And if these two policies are desirable, there are three ways to make them happen.

- Pass a stand-alone tax cut.

- Finance a tax cut with concomitant reductions in federal spending (i.e., a spending-reducing and deficit-neutral tax cut).

- Finance a tax cut by eliminating special tax preferences (i.e., a revenue-neutral, spending-neutral, and deficit-neutral tax reform).

Needless to say, a combination of the three also is possible.

My preference is for a spending-reducing/deficit-neutral tax cut for the simple reason that lower spending and better tax policy is a win-win situation that would make us more like Hong Kong. And I certainly don’t mind going with a pure, stand-alone tax cut since it’s generally a good idea to “starve the beast.”

In the current political environment, however, I suspect the final choice may be the most practical option. That’s because reasonable leftists may be willing to go along with better tax policy so long as they can be convinced that the burden of government spending won’t be reduced. And self-styled deficit hawks may be willing to go along with better tax policy so long as they can be convinced that red ink won’t increase.

But this also can be a win-win situation since there are many distortionary preferences in the tax code that lure people into making economically inefficient decisions solely because of tax considerations. So if those provisions are repealed and all the money is used to finance lower tax rates and less double taxation, we’ll have a tax system that is much less punitive.

But this also can be a win-win situation since there are many distortionary preferences in the tax code that lure people into making economically inefficient decisions solely because of tax considerations. So if those provisions are repealed and all the money is used to finance lower tax rates and less double taxation, we’ll have a tax system that is much less punitive.

Heck, this is the premise of the flat tax. Wipe out the 70,000-plus pages of the tax code and replace it with a simple and fair system that taxes income only one time at one low rate.

This means getting rid of preferences such as the healthcare exclusion, the municipal bond exemption, the charitable contributions deduction, and the state and local tax deduction.

Some people say eliminating tax preferences is too politically risky, however, akin to “touching the third rail.”

And it’s certainly true that the interest groups benefiting from a tilted playing field will fight to preserve their special preferences. But I’m not sure they would be able to scare voters into supporting their position.

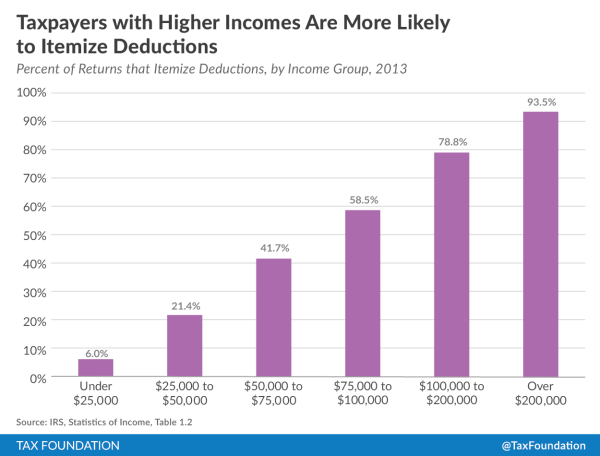

The first thing to understand is that only 30.1 percent of taxpayers utilize itemized deductions. And those that do itemize on their tax returns tend to have higher-than-average incomes. And remember that these are the same people who will directly benefit from lower tax rates and less double taxation.

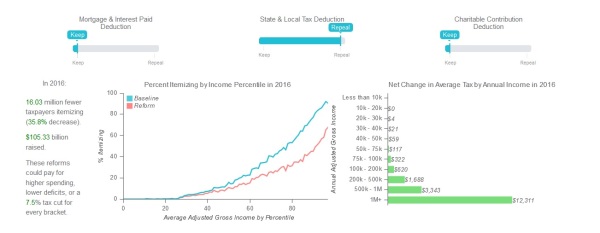

Interestingly, the Open Source Policy Center has an interactive site where you can see what happens to people in various income classes if selected itemized deductions are repealed.

Here are the results from repealing the state and local tax deduction. As you can see, rich people are the only ones who take a meaningful hit.

Yet are these upper-income taxpayers going to fight to preserve that deduction if they are offered a trade for lower tax rates and less double taxation?

I suppose it depends on the specific circumstances of each taxpayer, but I’m guessing a majority of them would prefer a friendlier and simpler tax code that didn’t punish wealth creation.

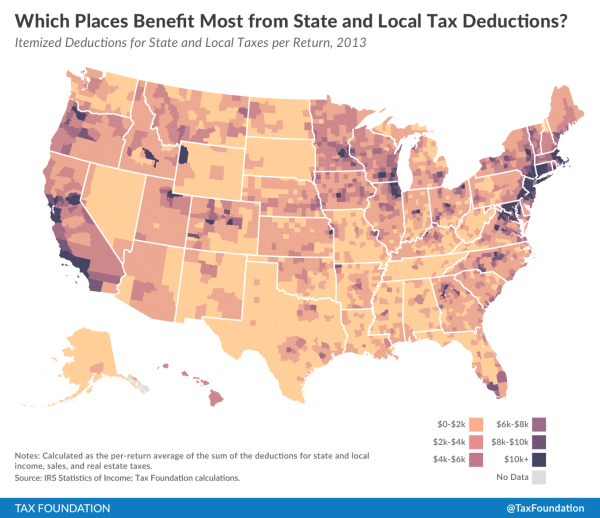

Moreover, if you look at where these people live, you find that they are highly concentrated in just a handful of states along with a few urban areas elsewhere in the country.

This suggests that policy makers from most states shouldn’t even care about itemized deductions. So there shouldn’t be any reason for them to oppose a tax reform plan that produces lower tax rates and less double taxation.

P.S. The hard-core left will not go along with revenue-neutral tax reform. They have such antipathy to success that some of them openly urge punitive taxes even if the economic damage is so severe that the government doesn’t collect any revenue.

P.P.S. With regards to the reasonable leftists and the deficit hawks, one can point out that good tax policy will generate better economic performance and therefore more taxable income (i.e., the Laffer Curve). But it’s only in rare (albeit sometimes very noteworthy) cases that the increase in taxable income is sufficiently large to offset the impact of lower tax rates, so revenues will still fall. And since these people don’t like tax cuts, even smaller-than-expected ones, they will still be opposed to pro-growth tax policy unless it is revenue-neutral.

P.P.P.S. The mortgage interest deduction is misguided, but isn’t technically a loophole since one of the goals of tax reform is to give business investment the same tax-income-only-one-time treatment now reserved for residential real estate.