Because of his support for big government, I don’t like Donald Trump. Indeed, I have such disdain for him (as well as Hillary Clinton) that I’ve arranged to be out of the country when the election takes place.

The establishment media, by contrast, is excited about the election and many journalists are doing everything possible to aid the election of Hillary Clinton. In some cases, their bias leads to them to make silly pronouncements on public policy in hopes of undermining Trump. Which irks me since I’m then in the unwanted position of accidentally being on the same side as “The Donald.”

For instance, some of Trump’s private tax data was leaked to the New York Times, which breathlessly reported that he had a huge loss in 1995, and that he presumably used that “net operating loss” (NOL) to offset income in future years.

As I pointed out in this interview, Trump did nothing wrong based on the information we now have. Nothing morally wrong. Nothing legally wrong. Nothing economically wrong.

All that people really need to know is that NOLs exist in the tax code because businesses sometimes lose money (the worst thing that happens to individuals, by contrast, is that we get laid off and have zero income). With NOLs, companies basically get a version of “income averaging” so that they’re taxed on their long-run net income (i.e., total profits minus total losses).

In other words, this is not a controversy. Or it shouldn’t be.

But if you don’t believe me, let’s peruse the pages of The Flat Tax, which was written by Alvin Rabushka and Robert Hall at Stanford University’s Hoover Institution and is considered the Bible for tax reformers.

Here’s what it says about business losses in Chapter 5.

Remember that self-employed persons fill out the business tax form just as a large corporation does. Business losses can be carried forward without limit to offset future profits (assuming your bank or rich relatives will keep lending you money). There is no such thing as a tax loss under the individual wage tax. You can’t reduce your compensation tax by generating business losses. Well-paid individuals who farm as a hobby or engage in other dubious sidelines to shelter their wages from the IRS had better enjoy their costly hobbies; the IRS will not give them any break under the flat tax.

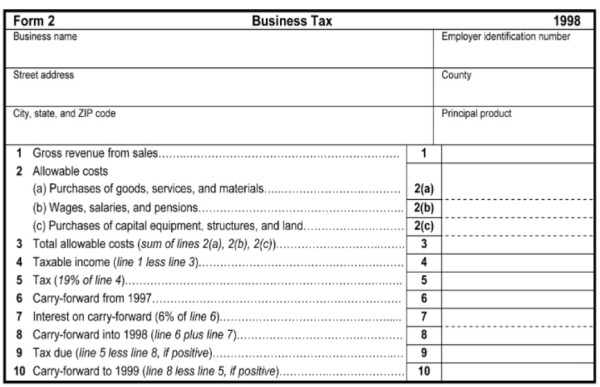

And here’s the business postcard for the flat tax. As you can see, it’s a very simple system based on the common-sense notion that profits equal total receipts minus total expenses.

And it allows “carry-forward” of losses, which is just another term for a company being able to use NOLs in one year to offset profits in a subsequent year.

But it’s not just advocates of the flat tax who hold this view.

A news report from the Wall Street Journal notes that NOLs are very normal in the business world for the simple reason that companies sometimes lose money.

The tax treatment of losses, bound to become a subject of national debate, is a typically uncontroversial feature of the income-tax system. The government doesn’t pay net refunds when business owners lose money, but it lets taxpayers use those losses to smooth their tax payments as they make money. That reflects the fact that “the natural business cycle of a taxpayer may exceed 12 months,” according to a congressional report.

Megan McArdle of Bloomberg also comments on this make-believe controversy.

At issue is the “net operating loss,” an accounting term that means basically what it sounds like: When you net out your expenses against the money you took in, it turns out that you lost a bunch of money. However, in tax law, this has a special meaning, because these NOLs can be offset against money earned in other years. …this struck many people as a nefarious bit of chicanery. And to be fair, they were probably helped along in this belief by the New York Times description of it, which made it sound like some arcane loophole wedged into our tax code at the behest of the United Association of Rich People and Their Lobbyists. …Every tax or financial professional I have heard from about the New York Times piece found this characterization rather bizarre. The Times could have just as truthfully written that the provision was “particularly prized by America’s small businesses, farmers and authors,” many of whom depend on the NOL to ensure that they do not end up paying extraordinary marginal tax rates — possibly exceeding 100 percent — on income that may not fit itself neatly into the regular rotation of the earth around the sun.

I like how she zings the NYT for its biased treatment of the issue.

She also explains why the law allows NOLs and why businesses (including, presumably, Trump’s companies) would prefer to never be in a position to utilize them.

“If someone has a $20 million gain in one year and a $10 million loss in the second year, that person should be treated the same as someone who had $5 million in each of the two years,” says Alan Viard, a tax specialist at the American Enterprise Institute, who like all the other experts, seemed somewhat surprised that this was not obvious. “There are definitely tax provisions narrowly targeted to various industries that you could take issue with,” says Ron Kovacev, a tax partner at Steptoe and Johnson. “The NOL is not one of them.” …Losing $900 million dollars may save you $315 million or so on future or past taxes. But astute readers will have noticed that it is not actually smart financial strategy to lose $900 million in order to get out of paying $315 million to the IRS. Most of us would rather have the other $585 million than a tax bill of $0. …If Trump managed to pay no taxes for years, the most likely way he did this was by losing sums much vaster than the unpaid taxes. This is fair, it is right, it is good tax policy.

In other words, Trump used NOLs, but he would have greatly preferred to avoid the big $916 million loss in the first place.

Ryan Ellis, writing for Forbes, doesn’t suffer fools gladly on this issue.

…political reporters don’t know a damned thing about taxes. …That ignorance was on display in vivid colors over the weekend. We were told that this tricky NOL was some sort of “loophole” that only super-rich bad guys like Donald Trump got to use. We were told that this relieved him of having to pay taxes for 18 years, a laughably arbitrary, made up number that is the tautological output of simple arithmetic and wild assumptions. …It’s not difficult to see how political reporters got played like a fiddle here. Most of them have never actually run a business, much less learned about the tax rules surrounding them.

I especially like that Ryan also nails the NYT for bias, in this case, because the reporters used a made-up number to imply that he didn’t pay tax for almost two decades.

And Ryan also notes that NOLs are very common (and were even used in 2015 by Trump’s opponent).

…a net operating loss is very common in businesses. As Alan Cole of the Tax Foundation pointed out this morning, about 1 million taxpayers had an NOL in 1995. It results from business deductions exceeding business income in a particular year. …Trump’s not the only presidential candidate this year who once had a big loss on his taxes. In 2015, the Clintons realized a capital loss of nearly $700,000. That will be available in perpetuity to offset capital gains they might incur. Unlike an NOL, a capital loss can slowly be used to offset other income, albeit at a slow $3000 per year net of any other gains offset.

Now that we’ve established that there’s nothing remotely scandalous about NOLs, let’s see whether there are any lessons we can from this kerfuffle.

Let’s return to the Wall Street Journal story cited earlier in this column.

Real-estate developers can generate losses more easily than other taxpayers. …Unlike investors in other businesses, they can use those losses to offset other income. …Bryan Skarlatos, a tax lawyer at Kostelanetz & Fink LLP, said…“Trump appears to have a perfect storm of allowable real-estate losses that can be offset against streams of income from salaries from his companies and royalty fees from the use of his name,” Mr. Skarlatos said. “Most taxpayers who have large real-estate losses don’t have such large steady streams of other ordinary income; they just have losses that may turn into profits in the future when they sell the real estate.”

This doesn’t tell us whether Trump actually did use his NOLs to offset other income, though I’m guessing the answer is yes. And as I speculated in the above interview, I wonder whether the losses were real losses or paper losses.

And others have suggested that Trump actually lost other people’s money and he was able to use their losses to offset some of his income.

I have no idea if that’s even possible, just as I have no idea whether his losses were real.

But I do know that a flat tax would put an end to any possible gamesmanship since it is a cash-flow system (which means it is based on actual transactions that take place, not whether companies use currency).

In a world with a flat tax, Trump would be allowed to “carry forward” losses, but only if they are real. And as explained above, he wouldn’t be able to use those losses to offset income that gets reported on the individual postcard.

So as I argued in the interview, let’s rip up the corrupt and destructive internal revenue code and copy the simple and fair flat tax that is used by Hong Kong.

———

Image credit: Gage Skidmore | CC BY-SA 2.0.