Let’s set aside the distasteful world of politics and contemplate U.S. competitiveness. Specifically, let’s examine America’s position in the latest edition of the World Economic Forum’s Global Competitiveness Report. This Report is partly a measure of policy (sort of like Economic Freedom of the World) and partly a measure of business efficiency and acumen.

The bad news is that we used to be ranked #1 and now we’re #3.

The good news is that being #3 is still pretty good, and it’s hard to beat Switzerland and Singapore because they have such good free-market policies. And that’s where America falls short.

Indeed, if you look at the top-10 nations and the three major measurements, you’ll notice that the United States ranks extremely high in “efficiency enhancers” and “innovation and sophistication factors,” both of which have a lot to do with the private sector’s competitiveness. But we have a mediocre (at least for developed nations) score for “basic requirements,” the area where government policy plays a big role.

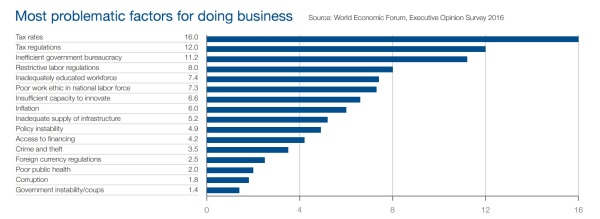

Moreover, if you look at the biggest obstacles to economic activity in the United States, the top 4 deal with bad government policy.

The tax treatment of companies is easily the main problem, as you might expect since we rank #94 out of 100 nations in a study of business tax policy.

Let’s now look at the indices where the United States scored especially low out of the 138 nations that were ranked.

America’s lowest scores were for exports (#130) and imports (#134), though I take issue with the Report‘s methodology, which is based on trade flows as a share of GDP. The problem with that approach is that the United States has a huge internal market, equal to about 22 percent of the world’s economic output. That’s why our trade flows aren’t very large relative to GDP. Being surrounded by two major oceans also probably has some dampening effect on cross-border trade flows. Yes, America is guilty of some protectionism, but I think our ranking for trade tariffs (#33) is the more appropriate and accurate measure of the degree to which there is a problem.

America also got a very bad score (#128) for government debt, though at least we beat Italy (#135), Greece (#137), and Japan (#138). In case you’re wondering, Hong Kong was #1, as you might expect from a well-run jurisdiction with small government and a flat tax. Though I must say that it is rather disappointing that the Report doesn’t include rankings for the overall burden of government spending. After all, government debt is basically a symptom of an underlying problem of a bloated public sector.

And there also was a very low score for the business cost of terrorism (#104), which is probably an unavoidable consequence of being the world’s leading superpower (and therefore a target for crazies). That being said, I imagine America’s score could be improved if we weren’t engaging in needless intervention – and thus generating needless animosity – in places such as Syria and Libya.

Here are two indices that deserve special attention. As you can see the United States gets a poor score for wasteful spending and a terrible score for the punitive taxation of profits.

With this information in mind, let’s now remind ourselves about last night’s debate. Did either candidate propose to control spending and reduce pork-barrel programs? Nope.

Did either candidate put forth a realistic plan to lower the corporate tax rate? Hillary’s plan certainly doesn’t qualify since she wants a bunch of class-warfare tax hikes. And while Trump’s plan includes a lower corporate rate, it’s not a serious proposal since he is too timid to put forth a plan to restrain government outlays.

And since neither candidate intends to address America’s looming fiscal crisis, it will probably be just a matter of time before America drops in the rankings.