What’s the worst loophole (properly defined) in the cluttered internal revenue code?

I think the deduction for state and local taxes is very bad policy since it enables higher tax burdens in states such as California, New Jersey, and Illinois. The exemption for municipal bond interest is another misguided provision since it makes it easier for states to finance spending with debt.

Special favors in the tax code for ethanol also deserve scorn and disdain, and I’m also not a fan of the charitable deductionor the ways in which housing gets preferential treatment.

But if I had to pick just one tax preference to repeal, it would be the so-called healthcare exclusion. This is the policy that enables employers to deduct the cost of health insurance policies they buy for their employees.

You may think that deduction is reasonable. After all, employers also can deduct the wages and salaries they pay their employees. But here’s the catch. Employees pay tax on their wages and salaries, but they don’t have to pay tax on the value of their health insurance, even though such policies obviously are a form of compensation.

Moreover, since this type of compensation is shielded from both income taxes and payroll taxes, the playing field is therefore very tilted, which generates some very perverse results.

First, some background. As part of a broader analysis of the non-taxation of fringe benefits, Scott Greenberg of the Tax Foundation explains how government has created a big incentive to take income in the form of fringe benefits rather than wages and salaries.

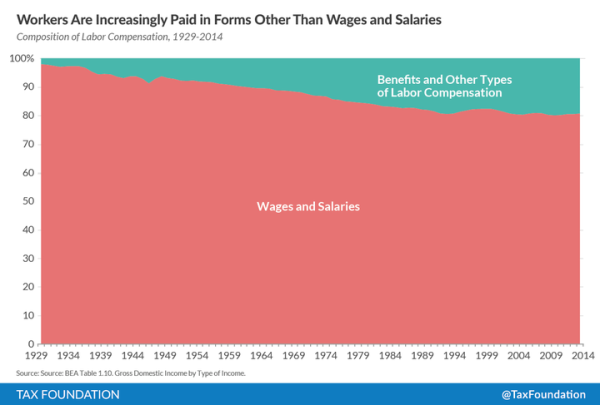

…eighty years ago, it was relatively uncommon to offer workers compensation other than their regular wages and salaries. In 1929, only 1.9 percent of employee pay took the form of fringe benefits. By 2014, fringe benefits had risen to 19.2 percent of worker compensation.

Here’s a chart looking at the historical data.

Greenberg says this distortion in the tax code is unfair.

…the growing trend of unreported fringe benefits is “inequitable and inefficient.” This claim is spot on. For an illustration, imagine two employees, one of whom makes a salary of $100,000, and one of whom makes a salary of $80,000 and benefits worth $20,000, which largely go unreported. Although both workers receive the same overall compensation, the first employee is subject to a significantly higher tax burden than the second, which seems plainly unfair.

Moreover, the distortion lures people into making economically foolish choices.

Furthermore, this arrangement incentivizes companies to shift more compensation towards benefits, to help employees avoid taxes. This leads to an inefficient allocation of resources, towards services that employers might not have been willing to pay for in the absence of tax incentives.

He’s correct

Writing for the Weekly Standards, Ike Brannon looks specifically at the biggest tax-free fringe benefit.

…allowing employers to provide health insurance tax-free to their workers is terrible policy, a truism that any honest economist—whether liberal, conservative, or otherwise—would agree with. …First, workers end up with more health insurance than they would ever purchase on their own (since tax-free health insurance is worth more than income that’s taxed at 30%-50%), which gives people less take-home pay to spend as they see fit. Second, more generous health insurance entails lower co-pays as well as other provisions that insulate the worker from the actual cost of their health care. As a result, people become less sensitive to prices when seeking health care, and they consume more of it—most of which does nothing to improve health outcomes, numerous studies have shown.

For further details on this unfortunate tax preference, A. Barton Hinkle looks at the evolution of the health exclusion in a column for Reason.

…the original sin of the American health-care marketplace…was committed back in World War 2, when inflation led workers to demand higher wages – which many employers could not afford to pay because of price controls. …With wages frozen, employers needed another way to compete for labor made scarce by the draft. So some began offering health coverage. The practice took root, spread, and outlasted the war. In 1949 the National Labor Relations Board ruled that health benefits counted as wages for the purpose of union negotiations. Five years later, the IRS ruled that health coverage was not taxable income. The result was a double incentive for employers to offer fatter health benefits in lieu of fatter paychecks. …The result: a skyrocketing, ultimately unsustainable increase in national outlays for health care. …In short, for decades the federal government has encouraged employers to provide gold-plated health-care plans.

Joe Antos of the American Enterprise Institute explains how the “healthcare exclusion” is bad fiscal policy, bad health policy, and bad economic policy.

If we hope to move to an efficient healthcare system that is fair to everyone, Congress will have to take on the largest subsidy in the tax code. …Premiums paid for employment-based health insurance are excluded from federal income and payroll taxes.

When describing provisions that allow people to keep more of their own money, I would prefer to say largest distortion rather than largest subsidy, but I realize I’m being pedantic. Regardless of word choice, the net effect of this preference is negative.

The tax exclusion…fuels the rapid growth of health spending, contributes to stagnating wage growth, and disadvantages low-wage workers. Because there is no limit on how much can be excluded from taxes, workers are encouraged to buy more expensive coverage than they would otherwise…makes consumers less sensitive to prices and promotes the use of medical services, including services that may not provide much value to the patient.

Let’s take a closer look at some of the problems associated with the exclusion.

The exclusion has caused a shift in compensation from taxable cash wages to greater health benefits which are not taxed. Between 1999 and 2015, the average employer contribution for family coverage nearly tripled while wage rates increased by only about half.

By the way, our leftists friends should oppose the exclusion for class-warfare reasons.

…workers in higher tax brackets benefit the most from the exclusion. The Joint Committee on Taxation found that the average savings for tax filers with incomes less than $30,000 was about $1,650 compared to about $4,580 for those with incomes over $200,000.

To deal with these negative effects, Antos proposes a modified version of the “Cadillac tax” from Obamacare combined with tax credits for consumers who purchase their own health insurance.

That’s better than the status quo, but the ideal solution is a flat tax, which would eliminate the deduction provided to employers for compensation in the form of fringe benefits.

In their book on tax reform, Professors Hall and Rabushka explain the obvious beneficial consequence of a level playing field for all forms of compensation.

The flat tax eliminates the distortion toward fringe benefits created by the fact that employers can deduct them, thereby receiving a subsidy that can be passed on to their employees. The best alternative, and one we expect your employer to select, is to offer you higher pay in exchange for lower fringes. You can then use the extra cash to buy whatever combination of benefits you desire.

This will make the healthcare marketplace much more efficient.

Here’s what I wrote about the healthcare exclusion way back in 2009, as part of a column on government-created inefficiency in the health sector.

…social engineering in the tax code created this mess. Specifically, most of us get some of our compensation in the form of health insurance policies from our employers. And because that type of income is exempt from taxation, this encourages so-called Cadillac health plans. …our gold-plated health plans now mean we use insurance for routine medical costs. This means, of course, we have the paperwork issues discussed above, but that’s just a small part of the problem. Even more problematic, our pre-paid health care system is somewhat akin to going to an all-you-can-eat restaurant. We have an incentive to over-consume since we’ve already paid. Except this analogy is insufficient. When we go to all-you-can-eat restaurants, at least we know we’re paying a certain amount of money for an unlimited amount of food. Many Americans, by contrast, have no idea how much of their compensation is being diverted to purchase health plans. …this messed-up approach causes inefficiency and higher costs. We consumers don’t feel any need to be careful shoppers since we perceive that our health care is being paid by someone else. Should we be surprised, then, that normal market forces don’t seem to be working? (though it is worth noting that costs keep falling and quality keeps rising in the few areas – such as laser-eye surgery and cosmetic surgery – that are not covered by insurance) Imagine if auto insurance worked this way? Or homeowner’s insurance? Would it make sense to file insurance forms to get an oil change? Or to buy a new couch? That sounds crazy. The system would be needlessly bureaucratic, and costs would rise because we would act like we were spending other people’s money. But that’s what would probably happen if government intervened in the same way it does in the health-care sector.

By the way, to make sure politicians don’t get a windfall of new revenue, the healthcare exclusion should only be repealed as part of a reform that also lowers tax rates.

Here’s a CF&P video that highlights how the healthcare exclusion is a major cause of the third-party payer problem.

And if you like videos, I strongly recommend this Reason TV explanation of how simple and affordable healthcare can be in the absence of government-created third-party payer.

———

Image credit: http://401kcalculator.org | CC BY-SA 2.0.