It’s that time of year. Those of us who wait until the last minute are rushing to get tax returns filed (or extensions submitted).

So it’s also a good time to remind ourselves that there is a better way.

Economists look at the tax system and focus on the warts that undermine growth.

- High marginal tax rates on productive behavior.

- Pervasive double taxation on income that is saved and invested.

- Ubiquitous loopholes that lure people into inefficient choices.

- International rules that reduce competitiveness.

Other people focus on the immorality of the tax code.

- Special provisions for the politically powerful.

- Abusive and biased behavior by the IRS.

- Indecipherable complexity and corruption.

- Politicians using the tax code to extort campaign contributions.

Most of these problems have existed for decades and are familiar to people who have the misfortune of working for tax reform.

But every so often, policy wonks like me get surprised because we find out that things are even worse than we thought.

For instance, here are some excerpts from a very disturbing article in The Hill about the IRS’s we-don’t-care attitude about fraudulent use of Social Security numbers.

…illegal immigrants…use other people’s social security numbers (SSNs) to get jobs and then file their taxes with their IRS-issued Individual Taxpayer Identification Numbers (ITINs). Although the tax returns contain false W-2 information, the IRS continues to process them, and the agency does not notify the people whose SSNs were used. …Koskinen said that in such cases “it’s in everybody’s interest to have them pay the taxes they owe.” …Rep. Dave Brat (R-Va.)…told The Hill on Friday that he was “shocked” and “horrified” by Koskinen’s response. …House Freedom Caucus Chairman Jim Jordan (R-Ohio)…said Friday that Koskinen’s comments about illegal immigrants’ tax returns are “just one more example of why Koskinen is doing such a poor job and should be impeached.”

As a quick aside, I’d be very curious to get some confirmation about Commissioner Koskinen’s assertion that illegals are net taxpayers. I wouldn’t be surprised to learn instead that they are a net drain because of “earned income tax credit,” which is a form of redistribution that gets laundered through the tax code.

But setting that aside, it’s completely outrageous that the IRS doesn’t let taxpayers know that their Social Security numbers have been stolen.

Congressman Jordan (and George Will) are right. There should be consequences for a government official who treats taxpayers with contempt.

Though Koskinen does deserve some credit for honesty about tax reform, as reported by the Washington Free Beacon.

IRS Commissioner John Koskinen told lawmakers on Wednesday that implementing a flat tax would be simpler than the current tax system and would save the agency a lot of money. …Rep. Blaine Luetkemeyer (R., Mo.) asked Koskinen whether a flat tax policy would save the agency money. …”clearly if you had a two-page form or a one-page form where you got rid of all the deductions and everything else and people just paid…a flat tax…it would be simpler for taxpayers and it would be much simpler for us,” Koskinen said. …Luetkemeyer asked Koskinen for more specifics about how much of the IRS’ current budget of $11.2 billion could be saved if a flat tax were implemented. “…it would be a lot,” Koskinen said. “It’d clearly be a sea change, a difference in the way the place operates.”

To call the flat tax “a sea change” is an understatement. As explained in this video, research from the Tax Foundation shows that the compliance burden of the tax code would fall by more than 90 percent.

And the economy would grow much faster since a key principle of the flat tax is that revenue should be collected in the least-damaging manner.

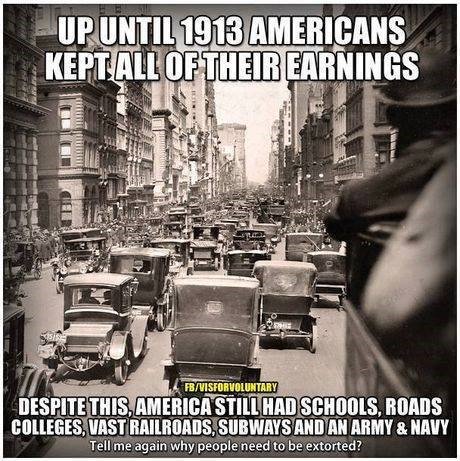

Though if you’re worried that a flat tax is too timid and you would prefer no broad-based tax for Washington, Mark Perry of the American Enterprise Institute shared this wonderful image.

Which is why October 3, 1913 may be the worst day in American history.

Some people claim that it would be impossible to have a modern society without an income tax.

Well, the Cayman Islands, Bermuda, and Monaco are very modern, and all those jurisdictions enjoy great prosperity in large part because there is no income tax.

And we could enjoy the same freedom and prosperity in the United States. But only if we reduced the size of the public sector.

- Shut down useless and counterproductive departments such as Housing and Urban Development, Energy, Education, Transportation, andAgriculture.

- Eliminate Washington-based redistribution and let state and local governments innovate and experiment to discover the best ways of reducing poverty.

- Reform old-age entitlements such as Social Security by shifting to personal retirement accounts based on real asset accumulation rather than political promises.

In other words, we could free ourselves of the income tax if we could somehow get rid of all the programs that were created once the income tax gave politicians a big new source of tax revenue.

The challenge is convincing politicians to give up their ability to buy votes with other people’s money.

Incidentally, this is why we should be stalwart in our opposition to the value-added tax. The experience with the income tax shows that politicians will expand the burden of government spending if they obtain any significant new source of revenue.

Let’s close with a somewhat amusing look at how tax compliance works in India. Here are some blurbs from a story in the Wall Street Journal.

For five years, real-estate developer Prahul Sawant ignored government orders to pay his taxes. Then the drummers showed up, beating their instruments and demanding he cough up the cash. Neighbors leaned out windows and gawked. Within hours, a red-faced Mr. Sawant had written a $945 check to settle his long-standing arrears. Shame is the name of the game as India’s local governments try new tools to collect taxes from reluctant citizens. …Thane’s municipal commissioner, Sanjeev Jaiswal, is resorting to public embarrassment of tax scofflaws. …Since the drummers started work early this year in this suburb of Indian commercial capital Mumbai, property-tax revenue has jumped 20%, said Mr. Jaiswal.

It’s also safer for the tax bureaucrats to rely on drummers.

Tax collectors in Vitawa-Kalwa are glad the drummers, and some security officers, are touring the neighborhood with them. “When the staff show up to collect tax alone, people get angry and beat them up,” said S.R. Patole, the assistant commissioner, who is responsible for revenue in the area.

And if drummers don’t work, the municipal commissioner has a back-up plan.

Mr. Jaiswal…plans to deploy groups of transgender women, known in India as hijras, to perform mocking dances to shame tax delinquents. Hijras are widely believed to be able to impose hexes.

I’ll have to add this story to my collection of “great moments in tax enforcement.”

For what it’s worth, I’m on the side of the taxpayers because of the Indian government’s legendary ability to waste money.