What’s the best measure of the tax burden on the U.S. economy?

Is it the amount of money that we’re forced to surrender to the knaves in Washington (i.e., the difference between our pre-tax income and post-tax consumption)?

Or is it the loss of economic output caused by high tax rates, distorting preferences, and pervasive double taxation (i.e., policies that reduce our pre-tax income)?

The answer is both.

But even that’s not sufficient. There’s another very big part of the tax burden, which is the complexity caused by a 75,000-page tax code that imposes very high compliance costs on taxpayers. In other words, the tax (as measured by time, resources, and energy) we pay for the ostensible privilege of paying taxes.

And this compliance tax is enormous according to new research from the Tax Foundation. The report starts with some very sobering numbers.

…In 1955, the Internal Revenue Code stood at 409,000 words. Since then, it has grown to a total of 2.4 million words: almost six times as long as it was in 1955 and almost twice as long as in 1985. However, the tax statutes passed by Congress are only the tip of the iceberg when it comes to tax complexity. There are roughly 7.7 million words of tax regulations, promulgated by the IRS over the last century, which clarify how the U.S. tax statutes work in practice. On top of that, there are almost 60,000 pages of tax-related case law, which are indispensable for accountants and tax lawyers trying to figure out how much their clients actually owe.

It then measures the burden of this convoluted system for taxpayers.

According to the latest estimates from the Office of Information and Regulatory Affairs, Americans will spend more than 8.9 billion hours complying with IRS tax filing requirements in 2016. This is equal to nearly 4.3 million full-time workers doing nothing but tax return paperwork. …in dollar terms, the 8.9 billion hours needed to comply with the tax code computes to $409 billion each year in lost productivity, or greater than the gross product of 36 states… The cost of complying with U.S. business income taxes accounts for 36 percent of the total cost of the entire tax code, at $147 billion. Complying with the individual income tax costs another $99 billion annually.

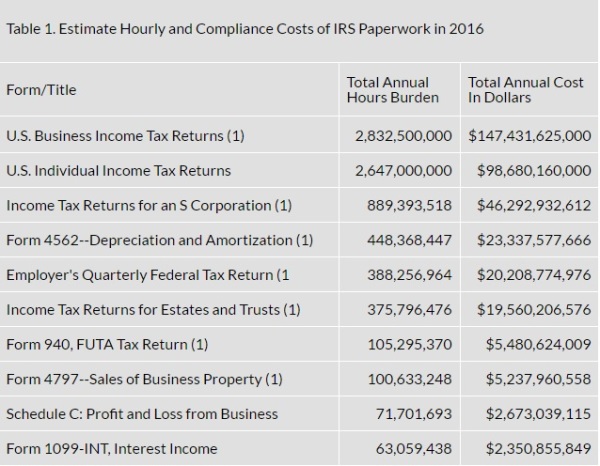

The report provides data for 50 provisions of the tax code. In the interest of brevity, here are the 10-most expensive features of the internal revenue code.

The overall $147 billion compliance cost for businesses is enormous, particularly when you consider that corporate tax revenue for Uncle Sam this year is estimated to be $329 billion. So companies have a double-whammy of enduring the developed world’s highest corporate tax rate, and they have to spend lots of money for the pleasure of that punitive system.

Another part that grabbed my attention is “Form 4562” dealing with depreciation. If you care about good policy and stronger growth, businesses shouldn’t even have to depreciate. Instead, we should have a policy of “expensing,” which is simply the common-sense approach of recognizing costs in the year they occur. So firms are paying a $23 billion-plus tax for the privilege of a policy that already punishes them for investing. Amazing.

And don’t forget the death tax, which also makes the top-10 list. The Tax Foundation points out that the compliance cost basically doubles the burden of that horrible and unfair levy.

The estate and gift tax, which will only collect approximately $20 billion in federal revenues this year, has a compliance cost of $19.6 billion.

What a mess.

So what’s the answer?

Simply stated, we should rip up the entire internal revenue code and replace it with a simple and fair flat tax.

———

Image credit: LaurMG | CC BY-SA 3.0.