Based on what she’s been saying during the campaign, Hillary Clinton is a big fan of class warfare. She has put forth a series of “soak-the-rich” tax hikes designed to finance bigger government.

Her official plan includes provisions such as an increase (“surcharge”) in the top tax rate, the imposition of the so-called Buffett Rule, an increase in the tax burden on capital gains (including carried interest), and a more onerous death tax.

The Tax Foundation explains that this plan won’t be good for the economy or the budget.

Hillary Clinton’s tax plan would reduce the economy’s size by 1 percent in the long run. The plan would lead to 0.8 percent lower wages, a 2.8 percent smaller capital stock, and 311,000 fewer full-time equivalent jobs. …If we account for the economic impact of the plan, it would end up raising $191 billion over the next decade.

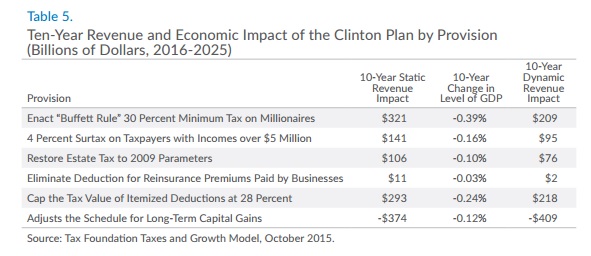

Here’s a table showing the static revenue impact for the various provisions, followed by the estimated economic impact, which then allows the Tax Foundation to calculate the real-world, dynamic revenue impact.

So what does all this mean?

Well, the Congressional Budget Office estimates that tax revenue over the next 10 years will be $41,658 billion based on current law. Hillary’s plan will add $191 billion to that total, an increase of 0.46 percent.

Which means that she’s willing to lower our incomes by 0.80 percent to increase the government’s take by 0.46 percent. A good deal for her and her cronies, but bad for America.

But it gets worse. Hillary’s official tax plan doesn’t include her biggest proposed tax hike. As I’ve warned before, and as Andrew Biggs of the American Enterprise explains in a new article, she has explicitly stated her support for huge tax hikes to bail out Social Security.

…she has endorsed both of the main tax increases included in Sanders’ Social Security plan: imposing the Social Security tax on earnings above the current $118,500 cap and applying Social Security taxes to investment income in addition to wages.

Andrew warns that busting the wage-base cap may boost payroll tax receipts, but such a policy will lead to lower revenues from other sources.

Eliminating the payroll tax ceiling would require workers and employers to each pay an additional 6.2% tax on all earnings above the ceiling, currently $118,500. Both the SSA actuaries and the Congressional Budget Office assume that when employers are hit with an additional payroll tax they will over time reduce employees’ wages to cover the increased cost, consistent with economists’ view that employees ultimately “pay” for employer-provided benefits through lower wages. Those lost wages would then no longer be subject to federal income taxes, Medicare payroll taxes or state government income taxes. If the average marginal tax rate on earnings above the current payroll tax ceiling is 48% – say, the top earned income tax rate of 39.6%, plus the 3.8% top Medicare payroll tax rate, plus a roughly 5% state income tax – then federal and state tax revenues would fall by 26 cents for each additional dollar of Social Security taxes collected.

And this estimate is based solely on the reduction in taxable income that occurs as businesses give their employees less take-home buy because of the higher payroll tax.

To be accurate, you also have to consider how workers will react (and rest assured that upper-income taxpayers have plenty of ability to alter the timing, level, and composition of their income). Andrew looks at the potential impact.

…revenue losses occur even if individual earners themselves make no adjustments to their earnings in response to higher tax rates. They’re purely a function of employers adjusting wages to compensate for their payroll tax bills. But if affected earners react to higher tax rates by reducing their earnings, either though less work or by tax avoidance strategies, then net revenue losses would be even higher. A 2010 literature survey by economists Emmanuel Saez, Joel Slemrod, and Seth Giertz found that high earners reduce their earnings by between 0.12% and 0.40% for each 1% increase in their taxes. These estimates imply that total revenues gained by eliminating the Social Security tax max would fall one-third to one-half below the static assumptions that Social Security reforms rely upon. Other credible academic studies find even higher sensitivities of taxable income to tax rates.

For more information, here’s a CF&P video I narrated on the issue.

Let’s close on a grim note. If Hillary Clinton goes forward with her plan to bust the wage base cap and change Social Security from an actuarially bankrupt social insurance program into a conventional tax-and-spend redistribution program, she won’t collect very much tax revenue because of the way workers and employers will react.

But from Hillary’s perspective, she won’t care. Under the budget rules governing Washington, she’ll still be able to increase spending (i.e., buy votes) based on how much revenue the Joint Committee on Taxation inaccurately predicts will materialize based on primitive “static scoring” estimates.

In other words, the Laffer Curve will prevail, but – other than the ability to say “I told you so” – proponents of good policy won’t have any reason to be happy.

And when, in the real world, the long-run fiscal and economic outlook weakens because of her misguided policies, Mrs. Clinton will just propose additional tax hikes to deal with the “unexpected” shortfalls. Lather, rinse, repeat, until we become Greece.