I wrote recently about the Pfizer-Allergan merger and made the case that it was a very sensible way to protect the interests of workers, consumers, and shareholders.

That’s the good news.

Why? Because companies should be allowed to engage in a do-it-yourself form of territorial taxation to minimize the damage caused by bad tax policy coming out of Washington.

The bad news is that the White House, with its characteristic disregard of the rule of law, promulgated a regulation that retroactively changed existing tax law and derailed the merger.

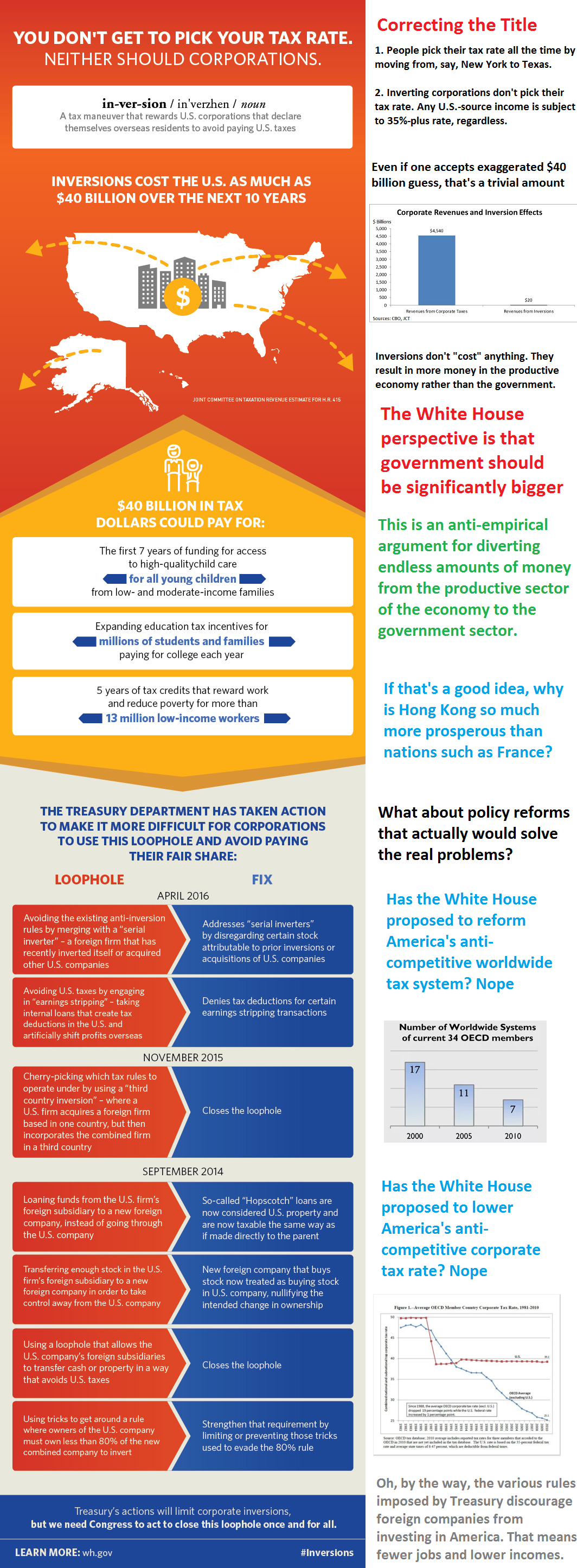

Now the White House has produced an infographic designed to bolster its case against inversions. You can click on this link to see the full-sized version, but I thought the best approach would be to provide a “corrected” version.

So if you look below, you’ll find my version, featuring the original White House document on the left and my editorial commentary on the right.

But if you don’t want to read the document and my corrections, all you need to know is that the Obama Administration makes several dodgy assumptions and engages in several sins of omission. Here are the two biggest problems.

- No acknowledgement that the U.S. corporate tax regime drives inversions because of high rates and worldwide taxation.

- A bizarre and anti-empirical assertion that money is spent more productively by governments compared to the private sector.

And here’s the entire “corrected” infographic.

The bottom line is there aren’t any “loopholes” being exploited by inverting companies.

Instead, there’s a very anti-growth American tax system that makes it very difficult for American-domiciled firms to compete in global markets.

The solution is a simple, low rate flat tax.