If you follow the contest between Hillary Clinton and Bernie Sanders, most of the tax discussion is about who has the best plan to squeeze the rich with ever-higher tax rates.

For those motivated by spite and envy, Bernie Sanders “wins” that debate since he wants bigger increases in the tax rates on investors, entrepreneurs, business owners, and other upper-income taxpayers.

For those of us who don’t earn enough to be affected by changes in the top tax rates, this may not seem to be a relevant discussion. Some of us like the idea of higher tax rates on our well-to-do neighbors because we expect to get a slice of the loot and we think it’s morally okay to use government to take other people’s money. Others of us don’t like those higher rates because we don’t resent success and we also worry about the likely impact on incentives to create jobs and wealth.

But all of us are making a mistake if we think that the policy proposals from Bernie and Hillary won’t mean higher taxes on ordinary Americans.

Here are three basic proposition to help explain why lower-income and middle-income taxpayers are the ones who face the biggest threat.

- Hillary and Bernie want government to be much bigger, because of both built-in expansions of entitlements and a plethora of new handouts and subsidies.

- There’s not much ability to squeeze more money from the “rich” and America already has the developed world’s most “progressive” tax system.

- The only practical way to finance bigger government is with big tax hikes on the middle class, both with higher income taxes and a value-added tax.

There’s not really any controversy about the first proposition. We know the two Democratic candidates are opposed to genuine entitlement reform, so that means the burden of government spending automatically will climb in coming decades. And we also know that Hillary and Bernie also want to create new programs and additional spending commitments, with the only real difference being that Bernie wants government to expand at a faster rate.

So let’s look at my second proposition, which may strike some people as implausible, particularly the assertion that America has the most “progressive” tax system. After all, don’t European nations impose higher tax rates on the “rich” than the United States?

Yes and no, but first let’s deal with the issue of whether the rich are a never-ending spigot of tax revenue. The most important thing to understand is that there’s a huge difference between tax rates and tax revenue. If you don’t believe me, simply look at the IRS data from the 1980s, which shows that upper-income taxpayers paid far more to Uncle Sam at a 28 percent tax rate in 1988 than they paid at a 70 percent tax rate in 1980.

And keep in mind that there are incredibly simple – and totally legal – steps that well-to-do taxpayers can take to dramatically lower their tax exposure.

The bottom line is that high tax rates penalize productive behavior and encourage inefficient tax planning, the net effect being that higher tax rates won’t translate into higher revenue.

Moreover, as shown by a different set of IRS data, the American tax system already is heavily biased against the so-called rich. Even when compared with other countries. There are some nations that impose higher top tax rates than America, to be sure, but that’s only part of the story. The “progressivity” of a tax system is based on what share of the burden is paid by the rich.

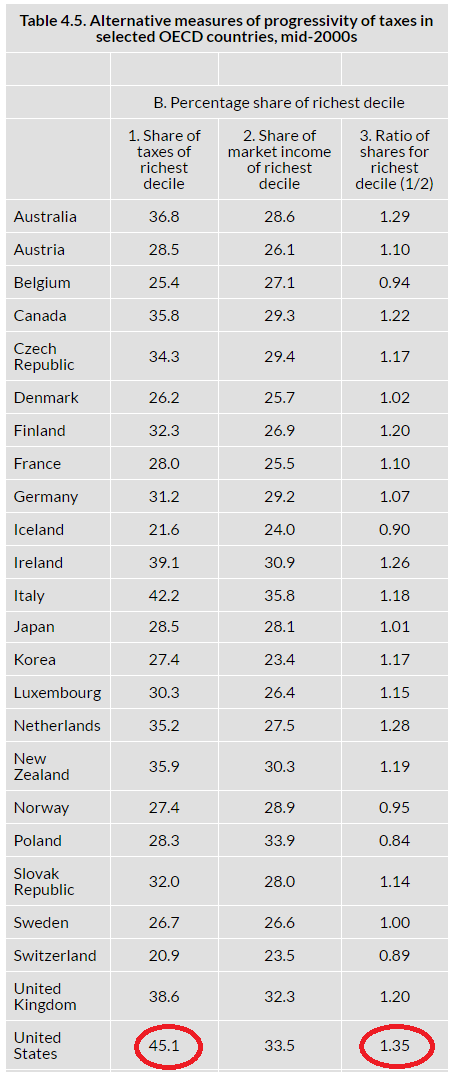

And if you look at this data from the Tax Foundation, particularly the two measures of progressivity in columns 1 and 3, you can see that the United States gets a greater share of taxes from the rich than any other developed nation.

By the way, the data is from the middle of last decade, so the numbers are probably different today. But since we’ve taken more people off the tax rolls in the past 10 years in America while also increasing tax rates on upper-income households, I would be shocked if the United States didn’t still have the most “progressive” tax code.

In any event, the most important takeaway from the Tax Foundation data is that America has the most “progressive” tax system not because we impose the highest tax rates on the rich, but rather for the simple reason that the tax burden on lower-income and middle-income taxpayers is comparatively mild.

In other words, the tax burden on the rich in America is not particularly unusual. Some nations impose higher tax rates and some countries impose lower tax rates. But because other taxpayers in the U.S. pay very low effective tax rates, that’s why the overall tax code in the United States is so tilted against the rich.

Which brings us to the third proposition about the middle class being the main target of Hillary and Bernie.

Simply stated, the only practical way of financing bigger government is by raising the tax burden on lower-income and middle-income Americans. As already explained, there’s not much leeway to generate more tax revenue from the “rich.”

In other words, the rest of us have a bulls-eye painted on our backs. Our tax burden is relatively low by world standards and there are simple and effective ways that politicians could grab more of our income.

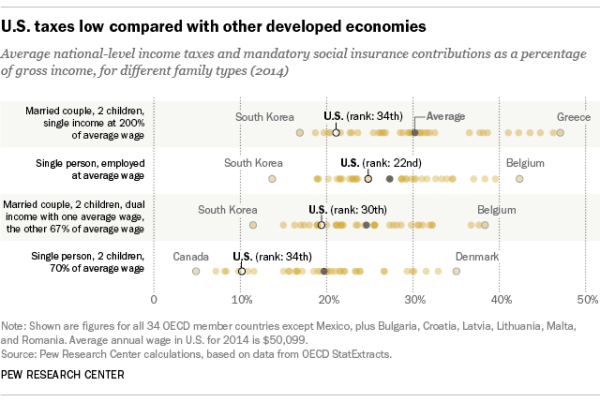

Let’s look at some of the details. The folks at the Pew Research Group crunched the data for 39 developed nations to compare tax burdens for various types of middle-income households. As you can see, taxpayers in the United States are relatively fortunate, particularly if they have kids.

Here are some excerpts from the article.

…most research has concluded that, at least among developed nations, the U.S. is on the low end of the range. We looked at 2014 data from the Organization for Economic Cooperation and Development’s database of benefits, taxes and wages, which has standardized data from 39 countries going back to 2001 and allows comparisons across different family types. …We calculated this for four different family types: a single employed person with no children; two married couples with two children, one with both parents working and the other with one worker; and a single working parent. In all cases, the U.S. was below the 39-nation average – in some cases, well below. …Much of the difference in relative tax burdens among different countries is due to the taxes that fund social-insurance programs, such as Social Security and Medicare in the U.S. These taxes tend to be higher in other developed nations than they are in the U.S.

And here’s the most shocking part of the article. The aforementioned data only considers income taxes and payroll taxes.

…the OECD data don’t include…other national taxes, such as…value-added taxes.

This is a huge omission. The average VAT in Europe is now 21 percent, so the actual tax burden on taxpayers in other nations is actually much higher than shown in the chart prepared by Pew.

Let’s look at the scorecard.

- Non-rich Europeans pay higher income tax rates.

- Non-rich Europeans pay higher payroll taxes.

- Non-rich Europeans pay the value-added tax.

And because all these taxes on lower-income and middle-income people are the only effective and realistic way to finance European-sized government, this is the future Hillary and Bernie want for America. Even though they won’t admit it.

P.S. I can’t resist pointing out that the countries most admired by Bernie Sanders, Denmark and Sweden, both have tax systems that are far less “progressive” than the United States according to the Tax Foundation data. And the reason for that relative lack of progressivity is because of a giant fiscal burden on lower-income and middle-income taxpayers. And that’s what will happen in the United States if entitlements aren’t reformed.

P.P.S. Since I’m a fan of the flat tax, does that mean I like the countries with lower scores in column 3 of the Tax Foundation table? Yes and no. A lower score obviously means that a nation’s tax code isn’t biased against successful taxpayers, but it’s also important to look at the overall size of the public sector. Sweden’s tax system isn’t very progressive, for instance, but everyone pays a lot because of a bloated government. It’s far better to be in Switzerland, which has the right combination of a modest-sized government and a non-discriminatory tax regime.