Like America’s Founders, I like constitutional constraints on government and dislike untrammeled majoritarianism.

So my gut instinct is to reject Swiss-style direct democracy as a governing system.

Yet I have to give credit to the Swiss people for being very sensible when asked to vote in national referendums. Here are some recent results.

- In 2010, nearly 60 percent of the electorate rejected a class-warfare income tax proposal.

- In 2014, Swiss voters overwhelmingly killed a minimum-wage mandate.

- Also in 2014, the voters of Switzerland rejected single-payer healthcare by a landslide margin.

- And in 2015, more than 70 percent of voters rejected a federal death tax.

And don’t forget they voted by a landslide margin in favor of a spending cap back in 2001.

Now they’ve done it again.

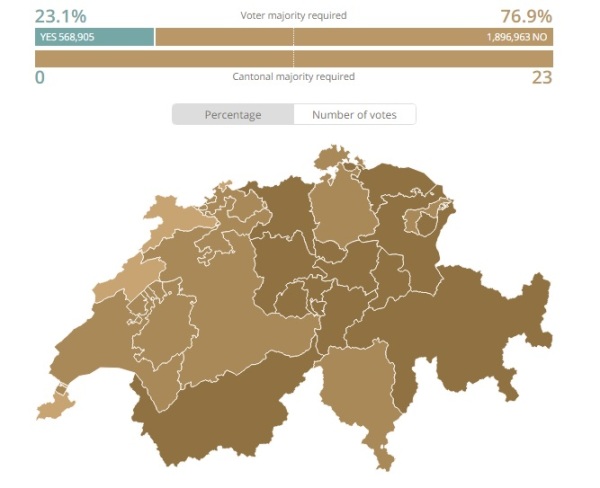

Voters were asked today to decide whether every adult should automatically receive more than $2,500 per month as part of a guaranteed basic income.

Sounds like a nice free lunch, right? That offer might be very attractive in a place like France, but Swiss voters apparently understand that government can’t give all that money to people without first taking that amount of money from people. They rejected Bernie-nomics by an overwhelming margin.

In Switzerland, there don’t appear to be left-wing blue states and right-wing red states. Instead, the entire nation favors limited government. Even the French-speaking parts of the country voted against the scheme.

I’d like to take credit for these results. I was in Switzerland early last month to discuss and debate this plan. Here’s what I said (click here to watch the entire panel discussion).

In reality, I’m sure my remarks didn’t have any impact on the outcome. Nonetheless, it’s nice to be on the winning side.

Though you may have noticed that I said some nice things about a guaranteed basic income in my presentation. That’s because, as I wrote back in 2013, these plans also would get rid of the current dysfunctional welfare state.

Writing in the Wall Street Journal a couple of days ago, Charles Murray of the American Enterprise Institute makes the best possible case for an automatic government-provided income.

The UBI has brought together odd bedfellows. Its advocates on the left see it as a move toward social justice; its libertarian supporters (like Friedman) see it as the least damaging way for the government to transfer wealth from some citizens to others. Either way, the UBI is an idea whose time has finally come… First, my big caveat: A UBI will do the good things I claim only if it replaces all other transfer payments and the bureaucracies that oversee them. If the guaranteed income is an add-on to the existing system, it will be as destructive as its critics fear.

Here are the highlights of Murray’s plan.

…the system has to be designed with certain key features. In my version, every American citizen age 21 and older would get a $13,000 annual grant deposited electronically into a bank account in monthly installments. …The UBI is to be financed by getting rid of Social Security, Medicare, Medicaid, food stamps, Supplemental Security Income, housing subsidies, welfare for single women and every other kind of welfare and social-services program, as well as agricultural subsidies and corporate welfare. As of 2014, the annual cost of a UBI would have been about $200 billion cheaper than the current system. By 2020, it would be nearly a trillion dollars cheaper. …Under my UBI plan, the entire bureaucratic apparatus of government social workers would disappear.

And while he acknowledges that some people will stop working and live off their handouts, he makes a reasonably persuasive argument that some people will be encouraged to enter the labor force.

Under the current system, taking a job makes you ineligible for many welfare benefits or makes them subject to extremely high marginal tax rates. Under my version of the UBI, taking a job is pure profit with no downside until you reach $30,000—at which point you’re bringing home way too much ($40,000 net) to be deterred from work by the imposition of a surtax. Some people who would otherwise work will surely drop out of the labor force under the UBI, but others who are now on welfare or disability will enter the labor force.

Sounds good, but then consider all the leftists who support a basic income scheme and imagine how such a system would work if they were in charge.

That’s what worries me. If Charles Murray was economic czar and there was never a risk of his plan being modified, I’d be sorely tempted to say yes.

But that’s not a plausible scenario. In the real world, a guaranteed basic income might start small and the current welfare state might be curtailed as part of the original deal, but I would be very worried about subsequent reforms that would expand the size of the handout (much as the EITC has been expanded in America) and reinstate misguided redistribution programs.

Perhaps this is why, in a column for the Financial Times, John Kay is not very sanguine about the numbers.

Bernie Sanders, a candidate for the Democratic presidential nomination, has expressed sympathy for basic income while stopping short of endorsement. Yanis Varoufakis, the former finance minister of Greece, is a proponent. …Yet simple arithmetic shows why these schemes cannot work. Decide what proportion of average income per head would be appropriate for basic income. Thirty per cent seems mean; perhaps 50 per cent is more reasonable? The figure you write down is the share of national income that would be absorbed by public expenditure on basic income. The Swiss government reckoned spending on social welfare would approximately double. To see the average tax rate implied, add the share of national income taken by other public sector activities — education, health, defence and transport. Either the basic income is impossibly low, or the expenditure on it is impossibly high.

Exactly.