For data-loving policy wonks, the World Bank’s Doing Business report is a fascinating look at the degree to which nations have a policy and governance environment that is conducive to economic activity.

Unlike Economic Freedom of the World, it’s not designed to measure whether a jurisdiction has small government. Doing Business is probably best described as measuring the quality of governance and whether a nation has sensible business policy.

That being said, there’s a lot of overlap between the rankings of the two publications. Indeed, you’ll notice many free-market countries in the top 20 of Doing Business, led by the “unsung success story” of New Zealand, followed by the capitalist haven of Singapore.

The United States is ranked #8, and you’ll notice most of the Nordic nations with very good scores, along with two of the Baltic nations.

Here’s some of the report’s analysis, including the unsurprising observation that countries with market-friendly policies tend to have high incomes (a lesson one wishes Hillary Clinton was capable of absorbing).

OECD high-income economies have on average the most business-friendly regulatory systems, followed by Europe and Central Asia. There is, however, a large variation within those two regions. New Zealand has a ranking of 1 while Greece has a ranking of 61; FYR Macedonia stands at 10 while Tajikistan is at 128. The Sub-Saharan Africa region continues to be home to the economies with the least business-friendly regulations on average.

If you’re wondering where the rest of world’s nations rank, click on the table in the excerpt. One thing that stands out is that Venezuela – finally! – isn’t in last place. Though being 187 out of 190 is not exactly something to brag about.

While it’s good to give favorable attention to the nations with the highest scores, it’s also worthwhile to see which countries are moving in the right direction at the fastest pace.

Ten economies are highlighted this year for making the biggest improvements in their business regulations—Brunei Darussalam, Kazakhstan, Kenya, Belarus, Indonesia, Serbia, Georgia, Pakistan, the United Arab Emirates and Bahrain.

Kudos to Georgia (the one wedged between Turkey and Russia on the Black Sea, not the one that is home to my beloved – but underperforming – Bulldogs). It’s the only country that is both in the overall top 20 and among the 10 nations that delivered the most positive reforms.

Here’s the table from the report showing why these 10 nations enjoyed a lot of improvement.

The report observes that a more sensible regulatory approach is associated with higher levels of prosperity.

A considerable body of evidence confirms that cross-country differences in the quality of business regulation are strongly correlated with differences in income per capita across economies.

But here’s the part that should open a few eyes among our leftist friends.

A more market-friendly regulatory environment also is linked to lower levels of inequality.

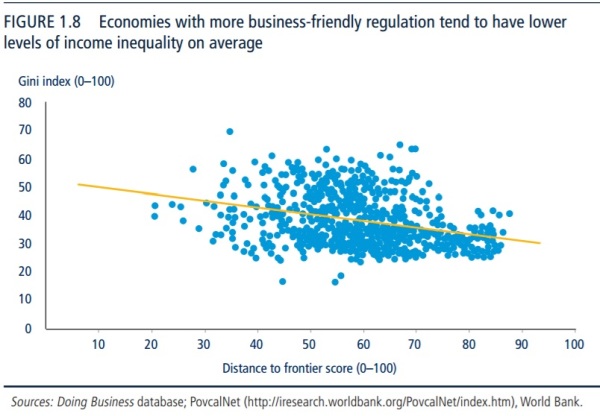

There is a negative association between the Gini index, which measures income inequality within an economy, and the distance to frontier score, which measures the quality and efficiency of business regulation when the data are compared over time (figure 1.8). Data across multiple years and economies show that as economies improve business regulation, income inequality tends to decrease in parallel.

As I’ve said many times tomorrow, I don’t care about differences in income. I simply want economic liberty so everybody has a chance to earn more income.

Nonetheless, it’s good to have some evidence for statists who fixate on how the pie is sliced. Here’s the relevant chart from the report.

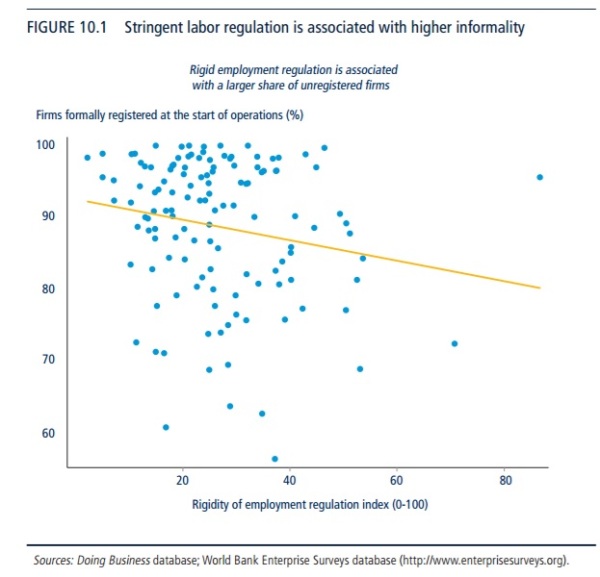

And here’s another chart showing that lots of regulation and red tape in labor markets (inevitably imposed for the ostensible goal of “protecting” workers) are correlated with a bigger underground economy.

Reminds me of the research showing how “labor protection” laws actually hurt workers.

Let’s now turn to the tax component, which predictably the part that grabbed my interest.

The score for this component is based on both the tax burden and the cost of tax compliance.

While the size of the tax cost imposed on businesses has implications for their ability to invest and grow, the efficiency of the tax administration system is also critical for businesses. A low cost of tax compliance and efficient tax-related procedures are advantageous for firms. Overly complicated tax systems are associated with high levels of tax evasion, large informal sectors, more corruption and less investment.

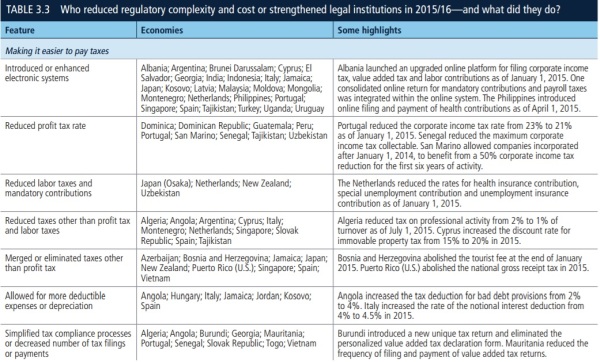

Here’s a table from the report showing some of the good reforms that have happened in various nations.

Sadly, America did not make any improvements in tax policy, so we don’t show up on any of the lists.

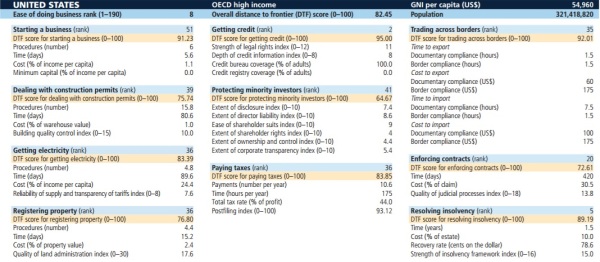

But since we’re on that topic, let’s now take a closer look at the United States. As already noted, America is ranked #8, which obviously is a reasonably good score.

But if you look at the various components, you sort of get the same story that we saw with the World Economic Forum’s Global Competitiveness Report, namely that there are some sub-par government policies that are hampering an otherwise very efficient private economy.

I’m particularly displeased that the U.S. scores so poorly (#51) in “starting a business.” And just imagine how much the score will drop if statists succeed in forcing states like Delaware, Wyoming, and Nevada to alter their business-friendly incorporation laws.

And I’m also unhappy that we rank #8 when the United States started at #3 in the World Bank’s inaugural 2006 edition of Doing Business. Thanks, Bush! Thanks, Obama!