The International Monetary Fund is a left-leaning bureaucracy that was set up to monitor the fixed-exchange-rate monetary system created after World War II.

Unsurprisingly, when that system broke down and the world shifted to floating exchange rates, the IMF didn’t go away. Instead, it created a new role for itself as self-styled guardian of economic stability.

Which is a bit of a joke since the international bureaucracy is most infamous for its relentless advocacy of higher taxesin economically stressed nations. So much so that I’ve labeled the IMF the Dr. Kevorkian of the world economy.

Or if that reference is a bit outdated for younger readers, let’s just say the IMF is the dumpster fire of international economics. Heck, if I was in Beijing, I would consider the bureaucracy’s recommendations for China an act of war.

To get an idea of the IMF’s ideological bias, let’s review it’s new report designed to discredit economic liberty (a.k.a., “neoliberalism” in the European sense or “classical liberalism” to Americans).

Here’s their definition.

The neoliberal agenda—a label used more by critics than by the architects of the policies— rests on two main planks. The first is increased competition—achieved through deregulation and the opening up of domestic markets, including financial markets, to foreign competition. The second is a smaller role for the state, achieved through privatization and limits on the ability of governments to run fiscal deficits and accumulate debt.

The authors describe the first plank accurately, but they mischaracterize the second plank.

At the risk of nitpicking, I would say “neoliberals” such as myself are much more direct than they imply. We want to achieve “a smaller role for the state” byreducing the burden of government spending.

Sure, we want to privatize government-controlled assets, but that’s mostly for reasons of economic efficiency rather than budgetary savings. And because we care about what actually works, we’re fans of spending caps rather than balanced budget rules.

But let’s set all that aside and get back to the report.

The IMF authors point out that governments have been moving in the right direction in recent decades.

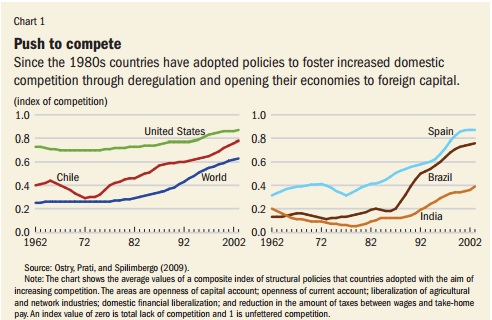

There has been a strong and widespread global trend toward neoliberalism since the 1980s.

That sounds like good news.

And the report even includes a couple of graphs to show the trend toward free markets and limited government.

And the bureaucrats even concede that free markets and small government generate some good results.

There is much to cheer in the neoliberal agenda. The expansion of global trade has rescued millions from abject poverty. Foreign direct investment has often been a way to transfer technology and know-how to developing economies. Privatization of state-owned enterprises has in many instances led to more efficient provision of services and lowered the fiscal burden on governments.

But then the authors get to their real point. They don’t like unfettered capital flows and they don’t like so-called austerity.

However, there are aspects of the neoliberal agenda that have not delivered as expected. …removing restrictions on the movement of capital across a country’s borders (so-called capital account liberalization); and fiscal consolidation, sometimes called “austerity,” which is shorthand for policies to reduce fiscal deficits and debt levels.

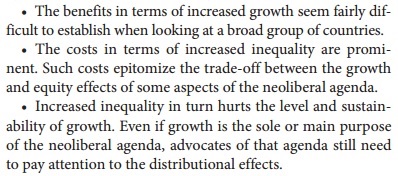

Looking at these two aspects of neoliberalism, the IMF proposes “three disquieting conclusions.”

I’m much more worried about stagnation and poverty than I am about inequality, so part of the IMF’s analysis can be dismissed.

Indeed, based on the sloppiness of previous IMF work on inequality, one might be tempted to dismiss the entire report.

But let’s look at whether the authors have a point. Are there negative economic consequences for nations that allow open capital flows and/or impose budgetary restraint?

They argue that passive financial flows (indirect investment) can be destabilizing.

Some capital inflows, such as foreign direct investment—which may include a transfer of technology or human capital—do seem to boost long-term growth. But the impact of other flows—such as portfolio investment and banking and especially hot, or speculative, debt inflows—seem neither to boost growth nor allow the country to better share risks with its trading partners… Although growth benefits are uncertain, costs in terms of increased economic volatility and crisis frequency seem more evident. Since 1980, there have been about 150 episodes of surges in capital inflows in more than 50 emerging market economies…about 20 percent of the time, these episodes end in a financial crisis, and many of these crises are associated with large output declines… In addition to raising the odds of a crash, financial openness has distributional effects, appreciably raising inequality. …there is increased acceptance of controls to limit short-term debt flows that are viewed as likely to lead to—or compound—a financial crisis. While not the only tool available—exchange rate and financial policies can also help—capital controls are a viable, and sometimes the only, option when the source of an unsustainable credit boom is direct borrowing from abroad.

I certainly agree that there have been various crises in different nations, but I’m wondering whether the IMF is focusing on the symptoms rather than the underlying diseases.

What happened in the various nations, for instance, to trigger sudden capital flight? That seems to be a much more important question.

In some cases, such as Greece, the problem obviously isn’t capital flight. It’s the reckless spending by Greek politicians that created a fiscal crisis.

In other cases, such as Estonia, there was a bubble because of an overheated property market, and there’s no question the economy took a hit when that bubble popped.

In other cases, such as Estonia, there was a bubble because of an overheated property market, and there’s no question the economy took a hit when that bubble popped.

But there’s a very strong case that Estonia’s open economy has generated plenty of strong growth over the years to compensate for that blip.

And it’s worth noting that criticisms of Estonia’s market-oriented policies often are based on grotesque inaccuracies, as was the case when Paul Krugman tried to blame the 2008 recession on spending cuts that occurred in 2009.

So I’m very skeptical of the IMF’s claim that capital controls are warranted. That’s the type of policy designed to insulate governments from the consequences of bad policy.

Now let’s shift to the fiscal policy issue. The IMF report correctly states that “Curbing the size of the state is another aspect of the neoliberal agenda.”

But the authors make a big (perhaps deliberate) mistake by then blaming neoliberals for adverse consequences associated with the “austerity” imposed by various governments.

Austerity policies not only generate substantial welfare costs due to supply-side channels, they also hurt demand—and thus worsen employment and unemployment. …in practice, episodes of fiscal consolidation have been followed, on average, by drops rather than by expansions in output. On average, a consolidation of 1 percent of GDP increases the long-term unemployment rate by 0.6 percentage point.

The problem with this analysis is that it doesn’t differentiate between tax increases and spending cuts.

And since much of the “austerity” is the former variety rather than the latter, especially in Europe, it borders on malicious for the IMF to blame neoliberals (who want less spending) for the economic consequences of IMF-endorsed policies (mostly higher taxes).

Especially since research from the European Central Bank and International Monetary Fund (!) show that spending restraint is the pro-growth way of dealing with a fiscal crisis.

Let’s now look at what the IMF authors suggest for future policy. More taxes and spending!

…policymakers should be more open to redistribution than they are. …And fiscal consolidation strategies—when they are needed—could be designed to minimize the adverse impact on low-income groups. But in some cases, the untoward distributional consequences will have to be remedied after they occur by using taxes and government spending to redistribute income. Fortunately, the fear that such policies will themselves necessarily hurt growth is unfounded.

Wow, the last couple of sentences are remarkable. The bureaucrats want readers to believe that a bigger fiscal burden of government want have any adverse consequences.

That’s a spectacular level of anti-empiricism. I guess they want us to believe that nations such as France are economically stronger economy than places such as Hong Kong.

Wow.

Last but not least, here’s a final excerpt that’s worth sharing just because of these two sentences.

IMF Managing Director Christine Lagarde said the institution believed that the U.S. Congress was right to raise the country’s debt ceiling “because the point is not to contract the economy by slashing spending brutally now as recovery is picking up.” …Policymakers, and institutions like the IMF that advise them, must be guided not by faith, but by evidence of what has worked.

We’re supposed to believe the IMF is guided by evidence when the chief bureaucrat relies on Keynesian theory to make a dishonest argument. I wish that “slashing spending” was one of the options on the table when the debt limit was raised, but the fight was at the margins over how rapidly the burden of spending should climb.

But if Lagarde can make that argument with a straight face, I guess she deserves her massive tax-free compensation package.

———

Image credit: MEDEF | CC BY-SA 2.0.